Ouster to Combine With Colonnade Acquisition Corp

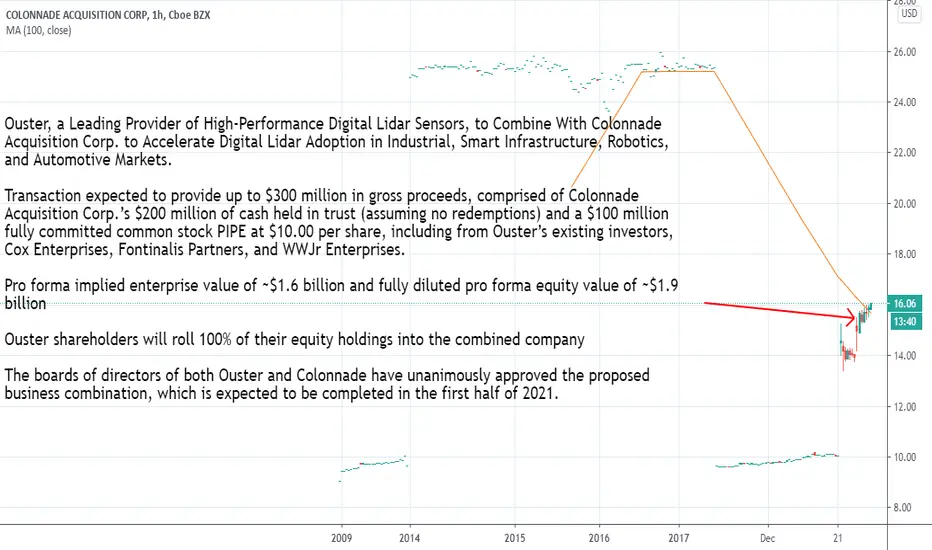

Ouster, a Leading Provider of High-Performance Digital Lidar Sensors, to Combine With Colonnade Acquisition Corp. to Accelerate Digital Lidar Adoption in Industrial, Smart Infrastructure, Robotics, and Automotive Markets.

Transaction expected to provide up to $300 million in gross proceeds, comprised of Colonnade Acquisition Corp.’s $200 million of cash held in trust (assuming no redemptions) and a $100 million fully committed common stock PIPE at $10.00 per share, including from Ouster’s existing investors, Cox Enterprises, Fontinalis Partners, and WWJr Enterprises.

Pro forma implied enterprise value of ~$1.6 billion and fully diluted pro forma equity value of ~$1.9 billion

Ouster shareholders will roll 100% of their equity holdings into the combined company

The boards of directors of both Ouster and Colonnade have unanimously approved the proposed business combination, which is expected to be completed in the first half of 2021, subject to, among other things, the approval by Colonnade's shareholders and Ouster’s shareholders, satisfaction of the minimum cash condition, which is equal to the $100 million committed common stock PIPE investment at $10.00 per share obtained in connection with the entry into the Merger Agreement, and certain other customary closing conditions stated in the Merger Agreement.

businesswire.com/news/home/20201222005187/en/Ouster-a-Leading-Provider-of-High-Performance-Digital-Lidar-Sensors-to-Combine-With-Colonnade-Acquisition-Corp.-to-Accelerate-Digital-Lidar-Adoption-in-Industrial-Smart-Infrastructure-Robotics-and-Automotive-Markets

Transaction expected to provide up to $300 million in gross proceeds, comprised of Colonnade Acquisition Corp.’s $200 million of cash held in trust (assuming no redemptions) and a $100 million fully committed common stock PIPE at $10.00 per share, including from Ouster’s existing investors, Cox Enterprises, Fontinalis Partners, and WWJr Enterprises.

Pro forma implied enterprise value of ~$1.6 billion and fully diluted pro forma equity value of ~$1.9 billion

Ouster shareholders will roll 100% of their equity holdings into the combined company

The boards of directors of both Ouster and Colonnade have unanimously approved the proposed business combination, which is expected to be completed in the first half of 2021, subject to, among other things, the approval by Colonnade's shareholders and Ouster’s shareholders, satisfaction of the minimum cash condition, which is equal to the $100 million committed common stock PIPE investment at $10.00 per share obtained in connection with the entry into the Merger Agreement, and certain other customary closing conditions stated in the Merger Agreement.

businesswire.com/news/home/20201222005187/en/Ouster-a-Leading-Provider-of-High-Performance-Digital-Lidar-Sensors-to-Combine-With-Colonnade-Acquisition-Corp.-to-Accelerate-Digital-Lidar-Adoption-in-Industrial-Smart-Infrastructure-Robotics-and-Automotive-Markets

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.