To any who are not convinced of the bearish case for Ethereum, I defer you to these articles:

realinvestmentadvice.com/an-earnings-reversion-is-coming/

Simply put, most of the economic activity conducted on Ethereum has been a result of:

1) Millenial / Gen Z Speculators

2) Venture Capital Funds

Without a constant supply of fresh liquidity from the Fed, most ERC-20 tokens will leak value alongside ETH's ticker price.

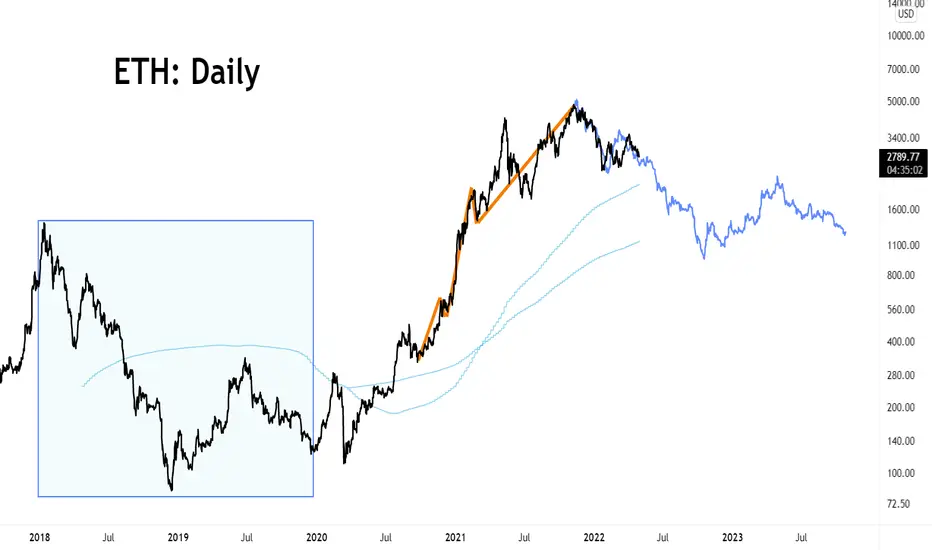

According to a fractal taken after Ethereum's 2017 blow-off top, ETH should reach <$1000 by OCTOBER. Such a steep decline would represent a GENERATIONAL BUYING OPPORTUNITY, as Ethereum's long-term growth potential is still unbelievably bullish (we are just early).

realinvestmentadvice.com/an-earnings-reversion-is-coming/

Simply put, most of the economic activity conducted on Ethereum has been a result of:

1) Millenial / Gen Z Speculators

2) Venture Capital Funds

Without a constant supply of fresh liquidity from the Fed, most ERC-20 tokens will leak value alongside ETH's ticker price.

According to a fractal taken after Ethereum's 2017 blow-off top, ETH should reach <$1000 by OCTOBER. Such a steep decline would represent a GENERATIONAL BUYING OPPORTUNITY, as Ethereum's long-term growth potential is still unbelievably bullish (we are just early).

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.