🚨 Ethereum’s $10K Breakout Is in Sight — BlackRock’s Staking ETF Could Trigger a Historic Supply Squeeze

All eyes are on the SEC’s pending decision regarding BlackRock’s Ethereum Staking ETF, and if approval lands in July 2025, it could trigger one of the most powerful supply-side shocks in Ethereum’s history.

This isn’t just about price speculation. It’s about structural demand meeting vanishing supply.

🟢 Why This ETF Is a Game-Changer

BlackRock isn’t just filing for an Ethereum ETF—it’s filing for a staking-enabled ETF. That’s a huge distinction. This means:

ETH held in the ETF will be staked, earning real yield

Staked ETH is locked and removed from circulation

Institutional capital gains exposure to yield + price upside

Ethereum becomes a yield-bearing digital commodity

It’s no longer just “digital oil.” It’s now digitized yield, and institutions are hungry for real yield in a low-rate environment.

📈 Technical Setup Is Bullish

ETH is coiling under its former ATH of ~$4,800

RSI shows no major bearish divergence

ETH/BTC ratio shows signs of breakout after long consolidation

Bitcoin dominance is peaking → altseason rotation imminent

Add a major ETF approval catalyst to this technical structure, and ETH could move explosively.

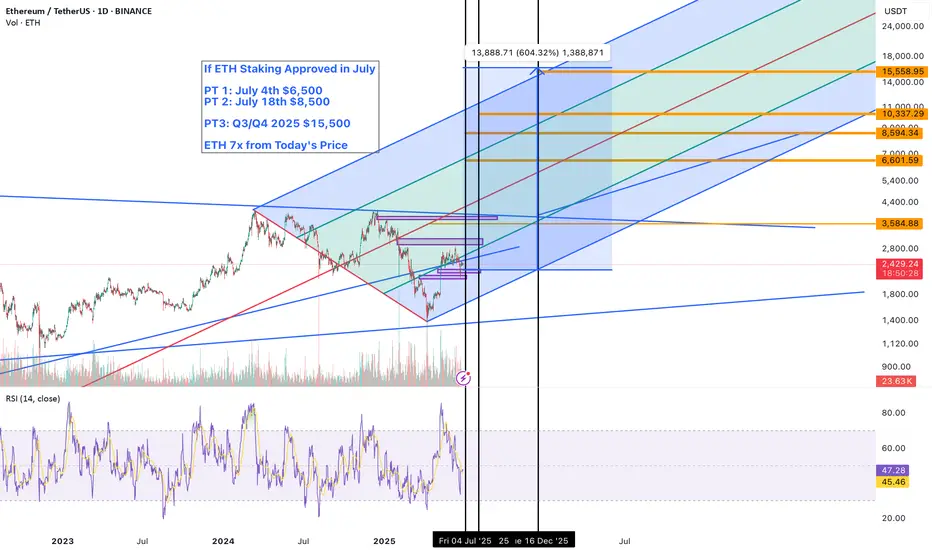

🔮 Ethereum Price Forecasts Post-Approval

Scenario Price Target Timeframe

Conservative $6,000–$7,000 2–4 weeks post-approval

Upside / Momentum $9,000–$10,000 Q3 2025

Supercycle Case $12K–$15K Q4 2025–Q1 2026

Why $10K ETH is Realistic:

Bitcoin’s ETF sparked $15B+ in inflows in <6 months

ETH has smaller market cap, so similar flows have outsized impact

Staking ETF removes ETH from float, making price reflexively bullish

TradFi gets exposure to yield + deflationary asset in one product

🔥 This Could Be Ethereum’s “GBTC Moment”

Remember how Grayscale’s GBTC product in 2020 created a reflexive premium and drove massive BTC inflows?

This is version 2.0, with yield attached. And instead of retail FOMO, we now have pension funds, RIAs, and endowments allocating via regulated ETF rails.

That’s not hype. That’s capital rotation—on-chain.

🛑 Risks to Watch

SEC delays or waters down staking component

Macro headwinds (rate volatility, geopolitical shock)

ETF approval gets front-run and sells the news

But even with these risks, the ETH supply structure is fundamentally stronger than during prior cycles. The burn is active. The float is tightening. And now TradFi wants in.

✅ Conclusion: July Could Be Ethereum’s Tipping Point

With a BlackRock staking ETF on deck, a macro environment ripe for a Fed rate cut, and Ethereum sitting under its ATH with rising momentum…

$10K ETH isn’t a moonshot—it’s the logical next leg.

If approved in July, Ethereum may never trade below $5,000 again.

🔔 Follow for updates on ETH ETF flows, ETH/BTC ratio breakouts, and altseason timing models.

📊 Comment below—what’s your Ethereum price target if the ETF is approved?

#Ethereum #ETHUSD #CryptoETF #BlackRock #Altseason #ETHAnalysis #CryptoNews #TradingView

All eyes are on the SEC’s pending decision regarding BlackRock’s Ethereum Staking ETF, and if approval lands in July 2025, it could trigger one of the most powerful supply-side shocks in Ethereum’s history.

This isn’t just about price speculation. It’s about structural demand meeting vanishing supply.

🟢 Why This ETF Is a Game-Changer

BlackRock isn’t just filing for an Ethereum ETF—it’s filing for a staking-enabled ETF. That’s a huge distinction. This means:

ETH held in the ETF will be staked, earning real yield

Staked ETH is locked and removed from circulation

Institutional capital gains exposure to yield + price upside

Ethereum becomes a yield-bearing digital commodity

It’s no longer just “digital oil.” It’s now digitized yield, and institutions are hungry for real yield in a low-rate environment.

📈 Technical Setup Is Bullish

ETH is coiling under its former ATH of ~$4,800

RSI shows no major bearish divergence

ETH/BTC ratio shows signs of breakout after long consolidation

Bitcoin dominance is peaking → altseason rotation imminent

Add a major ETF approval catalyst to this technical structure, and ETH could move explosively.

🔮 Ethereum Price Forecasts Post-Approval

Scenario Price Target Timeframe

Conservative $6,000–$7,000 2–4 weeks post-approval

Upside / Momentum $9,000–$10,000 Q3 2025

Supercycle Case $12K–$15K Q4 2025–Q1 2026

Why $10K ETH is Realistic:

Bitcoin’s ETF sparked $15B+ in inflows in <6 months

ETH has smaller market cap, so similar flows have outsized impact

Staking ETF removes ETH from float, making price reflexively bullish

TradFi gets exposure to yield + deflationary asset in one product

🔥 This Could Be Ethereum’s “GBTC Moment”

Remember how Grayscale’s GBTC product in 2020 created a reflexive premium and drove massive BTC inflows?

This is version 2.0, with yield attached. And instead of retail FOMO, we now have pension funds, RIAs, and endowments allocating via regulated ETF rails.

That’s not hype. That’s capital rotation—on-chain.

🛑 Risks to Watch

SEC delays or waters down staking component

Macro headwinds (rate volatility, geopolitical shock)

ETF approval gets front-run and sells the news

But even with these risks, the ETH supply structure is fundamentally stronger than during prior cycles. The burn is active. The float is tightening. And now TradFi wants in.

✅ Conclusion: July Could Be Ethereum’s Tipping Point

With a BlackRock staking ETF on deck, a macro environment ripe for a Fed rate cut, and Ethereum sitting under its ATH with rising momentum…

$10K ETH isn’t a moonshot—it’s the logical next leg.

If approved in July, Ethereum may never trade below $5,000 again.

🔔 Follow for updates on ETH ETF flows, ETH/BTC ratio breakouts, and altseason timing models.

📊 Comment below—what’s your Ethereum price target if the ETF is approved?

#Ethereum #ETHUSD #CryptoETF #BlackRock #Altseason #ETHAnalysis #CryptoNews #TradingView

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.