🔍 ICT (Inner Circle Trader) is a trading methodology developed by Michael J. Huddleston. It focuses on market structure, smart money concepts (SMC), and how institutions manipulate liquidity to trap retail traders.

📚 It's not about indicators or over-complication — it's about reading the price action like a pro, understanding where liquidity is, and trading with the banks, not against them.

📐 1. Market Structure

Understand Highs & Lows: Identify break of structure (BOS) and change of character (CHOCH)

Follow the macro to micro flow: D1 > H4 > M15 for precision entries

🧱 2. Order Blocks (OBs)

An order block is the last bullish or bearish candle before a major price move.

Banks and institutions place large orders here.

Smart traders look for price to return to these areas (mitigation), then enter with tight stop losses.

👉 Think of OBs as institutional footprints on the chart.

💧 3. Liquidity Zones

Equal highs/lows, trendline touches, support/resistance — these are liquidity traps.

ICT teaches that price often hunts liquidity before reversing. That’s why many retail traders get stopped out.

Learn to trade into liquidity, not off it.

🔄 4. Fair Value Gaps (FVGs)

Also called imbalances — when price moves too fast and leaves gaps.

Price often retraces to "fill the gap" — a key entry point for ICT traders.

🥇 ICT for Gold & Forex in 2025

💰 Why It Works for XAUUSD & Majors:

Gold is a highly manipulated asset, perfect for ICT-style trading.

It responds beautifully to liquidity grabs, order blocks, and Asian–London–New York session transitions.

Forex majors (EUR/USD, GBP/USD, etc.) are also ideal since they’re heavily influenced by institutional flow and news-driven liquidity hunts.

🕐 Timing Is Everything

Trade Killzones:

📍 London Killzone: 2AM–5AM EST

📍 New York Killzone: 7AM–10AM EST

These are high-volume sessions where institutions make their moves.

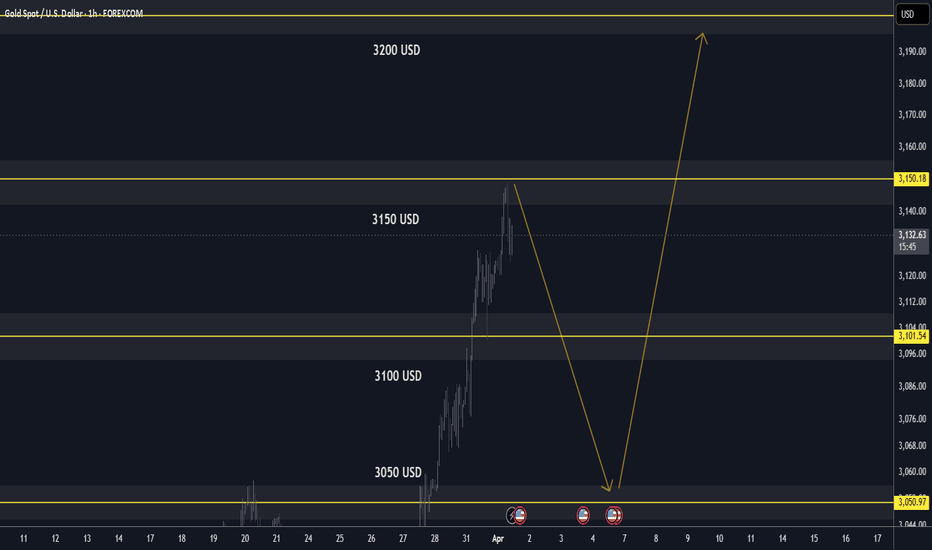

📈 Typical ICT Setup

▪️Spot liquidity zone above or below recent price

▪️Wait for liquidity sweep (stop hunt)

▪️Identify nearby order block or FVG

▪️Enter on a pullback into OB/FVG

▪️Set tight SL just past the recent swing

Target internal range, opposing OB, or next liquidity level

👨💻 Why FX/GOLD Traders Love ICT

✅ It’s clean, no indicators, and highly logical

✅ Great for part-time trading — 1 or 2 trades a day

✅ Feels like "leveling up" your understanding of the market

✅ Perfect for backtesting and journaling on platforms like TradingView or SmartCharts

✅ Easy to integrate into algo-based systems or EAs for semi-automation

If you’re tired of indicators and guessing, and want to trade like the institutions, ICT is a game changer. In 2025, more prop firms and traders are applying ICT concepts to dominate markets like gold, forex, and even crypto.

🧭 Master the method. Understand the logic. Ride with the smart money.

🔥 Welcome to the next level of trading.

📚 It's not about indicators or over-complication — it's about reading the price action like a pro, understanding where liquidity is, and trading with the banks, not against them.

📐 1. Market Structure

Understand Highs & Lows: Identify break of structure (BOS) and change of character (CHOCH)

Follow the macro to micro flow: D1 > H4 > M15 for precision entries

🧱 2. Order Blocks (OBs)

An order block is the last bullish or bearish candle before a major price move.

Banks and institutions place large orders here.

Smart traders look for price to return to these areas (mitigation), then enter with tight stop losses.

👉 Think of OBs as institutional footprints on the chart.

💧 3. Liquidity Zones

Equal highs/lows, trendline touches, support/resistance — these are liquidity traps.

ICT teaches that price often hunts liquidity before reversing. That’s why many retail traders get stopped out.

Learn to trade into liquidity, not off it.

🔄 4. Fair Value Gaps (FVGs)

Also called imbalances — when price moves too fast and leaves gaps.

Price often retraces to "fill the gap" — a key entry point for ICT traders.

🥇 ICT for Gold & Forex in 2025

💰 Why It Works for XAUUSD & Majors:

Gold is a highly manipulated asset, perfect for ICT-style trading.

It responds beautifully to liquidity grabs, order blocks, and Asian–London–New York session transitions.

Forex majors (EUR/USD, GBP/USD, etc.) are also ideal since they’re heavily influenced by institutional flow and news-driven liquidity hunts.

🕐 Timing Is Everything

Trade Killzones:

📍 London Killzone: 2AM–5AM EST

📍 New York Killzone: 7AM–10AM EST

These are high-volume sessions where institutions make their moves.

📈 Typical ICT Setup

▪️Spot liquidity zone above or below recent price

▪️Wait for liquidity sweep (stop hunt)

▪️Identify nearby order block or FVG

▪️Enter on a pullback into OB/FVG

▪️Set tight SL just past the recent swing

Target internal range, opposing OB, or next liquidity level

👨💻 Why FX/GOLD Traders Love ICT

✅ It’s clean, no indicators, and highly logical

✅ Great for part-time trading — 1 or 2 trades a day

✅ Feels like "leveling up" your understanding of the market

✅ Perfect for backtesting and journaling on platforms like TradingView or SmartCharts

✅ Easy to integrate into algo-based systems or EAs for semi-automation

If you’re tired of indicators and guessing, and want to trade like the institutions, ICT is a game changer. In 2025, more prop firms and traders are applying ICT concepts to dominate markets like gold, forex, and even crypto.

🧭 Master the method. Understand the logic. Ride with the smart money.

🔥 Welcome to the next level of trading.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

taplink.cc/black001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

🔱Syndicate Black MT4/MT5

⚡️Gold/FX Auto-Trading bot

🔱100%/week max DD <10%

📕verified 500%+ gains

🏧GOLD EA target 100%+ gains/week

🚀supercharge your trading

💎75% win rate gold signals

t.me/syndicategold001

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.