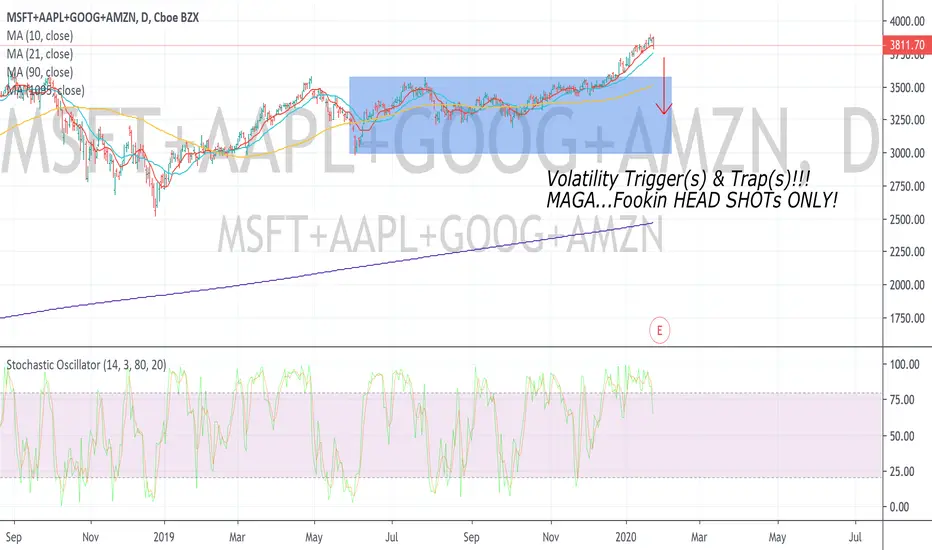

Be careful out there....let the dust settle...Nothing is as it seems...TBD!!! Is it Happy Hour Yet?

What is an Options Gamma Trap?

An options gamma trap is when options dealers are positioned “short gamma” and cause large swings in the stock market. To hedge a short gamma position you sell stock when the market is dropping and buy stock when the market is going up. Therefore any move in the market could be compounded because dealers must hedge in the same direction as the market.

It becomes a trap when the selling leads to more put buying – which puts dealers short more puts and hence having to sell more futures. Typically these scenarios also lead to higher implied volatility levels (eg VIX) which increases put values, leading to more dealer selling. spotgamma.com/options-gamma-trap/

What is an Options Gamma Trap?

An options gamma trap is when options dealers are positioned “short gamma” and cause large swings in the stock market. To hedge a short gamma position you sell stock when the market is dropping and buy stock when the market is going up. Therefore any move in the market could be compounded because dealers must hedge in the same direction as the market.

It becomes a trap when the selling leads to more put buying – which puts dealers short more puts and hence having to sell more futures. Typically these scenarios also lead to higher implied volatility levels (eg VIX) which increases put values, leading to more dealer selling. spotgamma.com/options-gamma-trap/

Nota

Long Gamma: 3275Zero G: 3237

WATCH THE VIX (Lo VIX = Market Rally)

Resistance at 3275....Below 3240 Look Out (Gamma Trap)

Call Wall 3300

Nota

• Options Activity: Options volume was high at ~1.8 million on Friday. After several days of traders accumulating protective puts, • Dark pools remained buyers.

• Volatility: The spread between the first and third months in VIX futures is rapidly shrinking. Realized volatility exceeded implied vol. VVIX https://increased.https://nextsignals.com/2020/01/26/premarket-report-for-monday-january-27-2020/

Nota

That isn’t what you want to see. It suggests we could witness the type of selling-begets-selling dynamic that’s defined so many of the harrowing routs witnessed over the past several years.“Our Dealer Gamma analysis actually shows that the Dealer Gamma position has now pivoted NEGATIVE on the move in futures below 3263”, McElligott says. “The lower we go from here, Dealers have to (perversely) ‘short more’ into the down-move to dynamically hedge”.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.