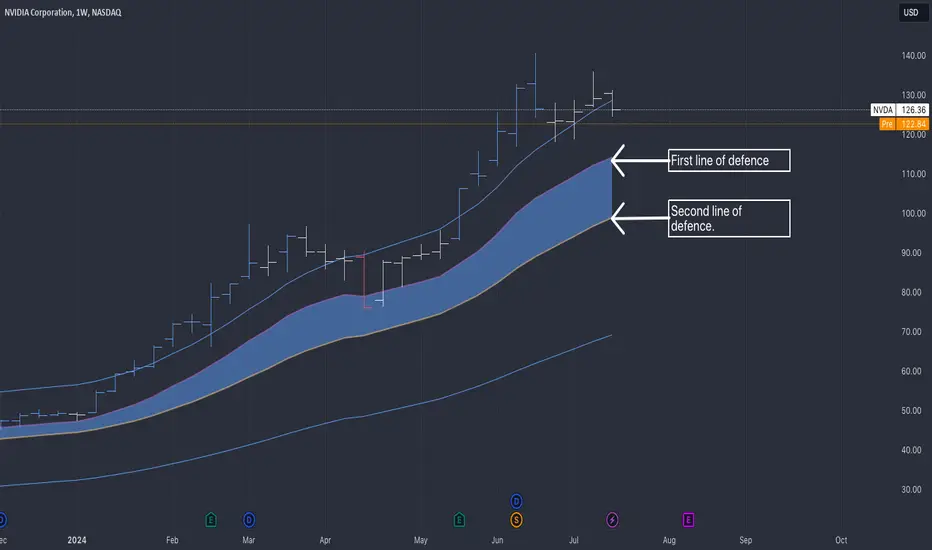

The chart does seem overextended, but I view it as a return to normality rather than panic selling.

In fact, the entire market appears to be a "return to the mean" kind of market. What used to work, the Magnificent 7, has decreased slightly, but all the other 493 stocks are up.

It's an overdue correction of an extended market.

Notice the change in colour on my graph from blue to white a few weeks ago, which warned us about the decrease in bulls' power.

Key points to watch for

The first line of defence - $114

The second line of defence -$98

If you break the second level you are entitled to panic, until then look for other opportunities in the market. They seemed to be plenty now.

If you want the indicator described, send me a message.

In fact, the entire market appears to be a "return to the mean" kind of market. What used to work, the Magnificent 7, has decreased slightly, but all the other 493 stocks are up.

It's an overdue correction of an extended market.

Notice the change in colour on my graph from blue to white a few weeks ago, which warned us about the decrease in bulls' power.

Key points to watch for

The first line of defence - $114

The second line of defence -$98

If you break the second level you are entitled to panic, until then look for other opportunities in the market. They seemed to be plenty now.

If you want the indicator described, send me a message.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.