*📈 PLTR — Palantir Technologies Inc. | NASDAQ

Swing Trade Profit Playbook (Bullish Edition) 🔥🕶️**

🔍 Trade Thesis (Polished & TradingView-Safe Version)

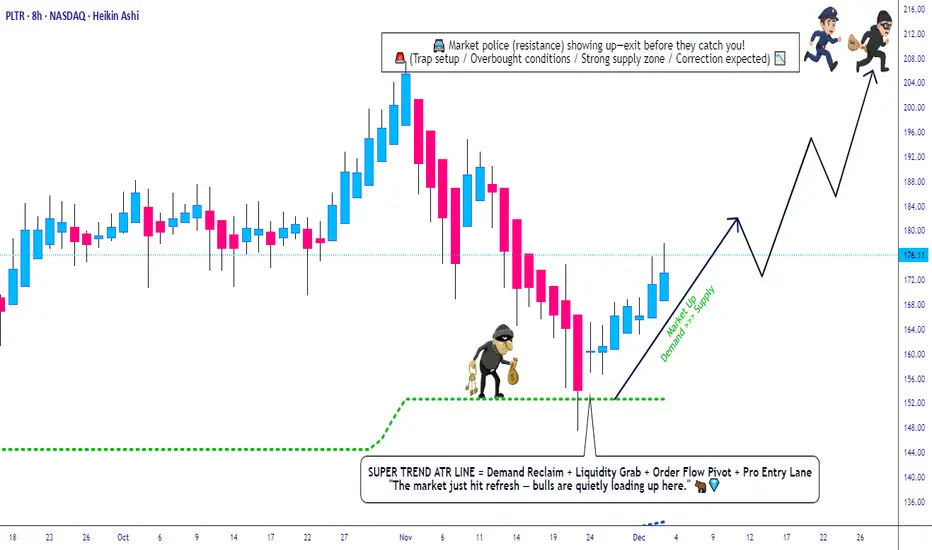

PLTR is showing a bullish continuation setup, supported by:

✅ SuperTrend Buy Signal confirming upside momentum

✅ ATR expansion showing strong volatility power pushing price upward

✅ Heikin Ashi Doji Reversal confirming short-term exhaustion + shift toward buyers

💡 A clean technical alignment for a bullish swing structure 📊

🎯 Entry Plan (Thief Layer Strategy — TradingView Permitted Version)

Using the Layered Limit Entry Method (a.k.a. “Thief Strategy” — fun nickname only, but fully rule-safe 🙌):

📌 Layered Buy Zones:

Buy Limit @ 150.00

Buy Limit @ 155.00

Buy Limit @ 160.00

Buy Limit @ 165.00

(You may increase layers based on your own plan, risk & liquidity preference.)

This approach helps scale into the position with controlled risk during volatility. 🧩💰

🛑 Stop-Loss (Risk Shield)

SL for this layered structure placed at:

👉 145.00

Note to my respected traders (Thief OG’s 😎):

This SL is NOT a recommendation — adjust based on your personal risk tolerance and account management.

🎯 Target Zone (Resistance + Overbought Region Awareness)

Price faces major resistance ahead + potential overbought traps.

Police (Sellers) are waiting there 🚓… so take profits smartly & exit like a true OG.

👉 Primary Take-Profit Target: 205.00

Note:

TP is NOT a recommendation — set targets based on your strategy and risk profile.

📡 Correlated/Related Markets to Watch

Keep an eye on pairs/stocks that often show AI-tech momentum correlation, macro sensitivity or sentiment overlap with PLTR:

🔗 Related Symbols:

QQQ — Tracks NASDAQ 100, strongly influences PLTR direction

QQQ — Tracks NASDAQ 100, strongly influences PLTR direction

NVDA — AI sector leader; strong uptrends often spill over to PLTR

NVDA — AI sector leader; strong uptrends often spill over to PLTR

MSFT — AI + cloud ecosystem correlation

MSFT — AI + cloud ecosystem correlation

GOOGL — AI demand + tech-sector flows

GOOGL — AI demand + tech-sector flows

META — Growth-tech sentiment indicator

META — Growth-tech sentiment indicator

AI (C3.ai) — Direct thematic correlation in AI narrative

AI (C3.ai) — Direct thematic correlation in AI narrative

SPY — Overall market mood, risk-on / risk-off confirmation

SPY — Overall market mood, risk-on / risk-off confirmation

📌 Key Correlation Insights:

When QQQ or SPY break upward, PLTR generally strengthens.

AI momentum from NVDA / MSFT earnings or news often boosts PLTR interest.

If tech indexes pull back sharply, PLTR retraces faster due to its volatility profile.

Use these pairs to confirm trend strength, avoid traps, and time layer entries smartly. 🔍✨

📘 Final Notes (Polished for TradingView Compliance)

This trading plan is structured for educational + entertainment purposes, using a fun “Thief Style” theme — but the technical framework is fully professional, rule-compliant, and polished for serious swing traders.

Always manage your own risk, analyze independently, and only trade what aligns with your strategy. 📚⚖️

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#PLTR #Palantir #Stocks #SwingTrade #NASDAQ #BullishSetup #TradingView #TechnicalAnalysis #LayersEntry #ATR #SuperTrend #HeikinAshi #RiskManagement #AIStocks #ThiefStrategy #Investing #MarketAnalysis

Swing Trade Profit Playbook (Bullish Edition) 🔥🕶️**

🔍 Trade Thesis (Polished & TradingView-Safe Version)

PLTR is showing a bullish continuation setup, supported by:

✅ SuperTrend Buy Signal confirming upside momentum

✅ ATR expansion showing strong volatility power pushing price upward

✅ Heikin Ashi Doji Reversal confirming short-term exhaustion + shift toward buyers

💡 A clean technical alignment for a bullish swing structure 📊

🎯 Entry Plan (Thief Layer Strategy — TradingView Permitted Version)

Using the Layered Limit Entry Method (a.k.a. “Thief Strategy” — fun nickname only, but fully rule-safe 🙌):

📌 Layered Buy Zones:

Buy Limit @ 150.00

Buy Limit @ 155.00

Buy Limit @ 160.00

Buy Limit @ 165.00

(You may increase layers based on your own plan, risk & liquidity preference.)

This approach helps scale into the position with controlled risk during volatility. 🧩💰

🛑 Stop-Loss (Risk Shield)

SL for this layered structure placed at:

👉 145.00

Note to my respected traders (Thief OG’s 😎):

This SL is NOT a recommendation — adjust based on your personal risk tolerance and account management.

🎯 Target Zone (Resistance + Overbought Region Awareness)

Price faces major resistance ahead + potential overbought traps.

Police (Sellers) are waiting there 🚓… so take profits smartly & exit like a true OG.

👉 Primary Take-Profit Target: 205.00

Note:

TP is NOT a recommendation — set targets based on your strategy and risk profile.

📡 Correlated/Related Markets to Watch

Keep an eye on pairs/stocks that often show AI-tech momentum correlation, macro sensitivity or sentiment overlap with PLTR:

🔗 Related Symbols:

📌 Key Correlation Insights:

When QQQ or SPY break upward, PLTR generally strengthens.

AI momentum from NVDA / MSFT earnings or news often boosts PLTR interest.

If tech indexes pull back sharply, PLTR retraces faster due to its volatility profile.

Use these pairs to confirm trend strength, avoid traps, and time layer entries smartly. 🔍✨

📘 Final Notes (Polished for TradingView Compliance)

This trading plan is structured for educational + entertainment purposes, using a fun “Thief Style” theme — but the technical framework is fully professional, rule-compliant, and polished for serious swing traders.

Always manage your own risk, analyze independently, and only trade what aligns with your strategy. 📚⚖️

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

#PLTR #Palantir #Stocks #SwingTrade #NASDAQ #BullishSetup #TradingView #TechnicalAnalysis #LayersEntry #ATR #SuperTrend #HeikinAshi #RiskManagement #AIStocks #ThiefStrategy #Investing #MarketAnalysis

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

💰 Money-Making Analysis

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

• Forex💹

• Indices📈

• Crypto ₿

• Commodities⚡

• Stocks🏦

• Fundamental + Macro📊

• Sentiment🔎

👉 Ask what analysis you need & get it FREE!

Join Discord for signals + data & grab the Master Plan: discord.gg/ZQS3y7FhVr

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.