🔥

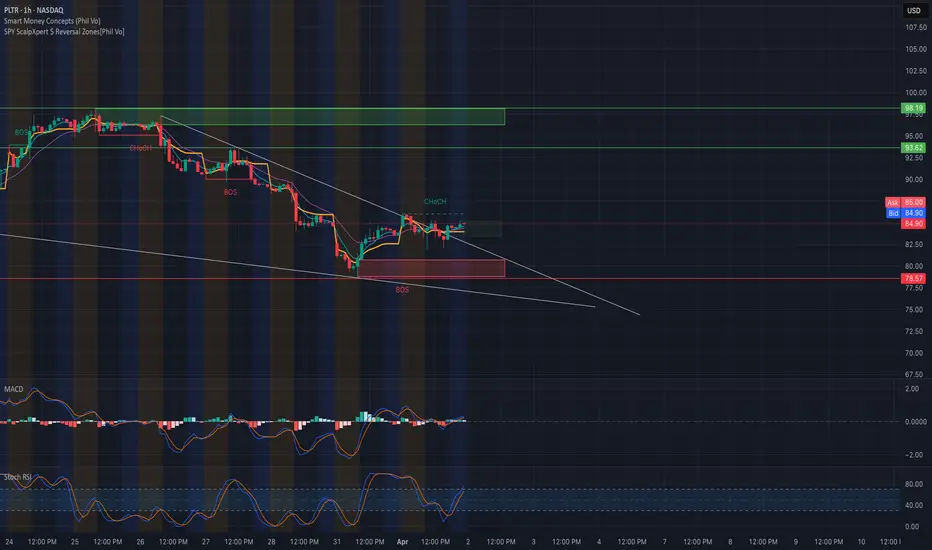

1. Market Structure & Price Action PLTR is compressing inside a descending wedge while forming a small CHoCH near $85, attempting to flip structure. We saw a BOS from the $80 region, pushing toward the $85 liquidity zone. Price is consolidating under a key resistance band around $86, just below the GEX HVL level.

2. SMC & Supply/Demand Zones

* Demand Zone: $78–$80 range acted as a BOS origin with high buyer reaction.

* Supply Zone: $85–$86 now tested multiple times.

* Downward trendline resistance is holding; a break above could invite a run toward the $90 zone.

3. Indicators Analysis

* MACD: Slightly bullish crossover, histogram fading — suggesting early momentum but caution.

* Stoch RSI: Rebounding from oversold, trending upward toward 80 — suggests bullish follow-through if resistance breaks.

4. Options Sentiment & GEX

* GEX Chart shows a thick CALL Resistance / Gamma Wall at $90, aligned with the second call wall (29.31%).

* HVL at $86: Major short-term magnet — breakout above could initiate a gamma squeeze.

* Put support: Strongest level sits at $80, where downside is well-hedged.

* Options Oscillator:

* IVR: 72.4

* IVx Avg: 85.2

* Call$: 26.1%

* GEX Sentiment: 🟢🟢🔴 — still slightly conflicted, but flipping green.

5. Bullish Scenario 🟢

* Entry: Break and retest of $86 with volume

* Target 1: $90 (Gamma Wall)

* Target 2: $93.5–$95

* Stop-loss: Below $83

6. Bearish Scenario 🔴

* Entry: Rejection from $86 + drop under $83

* Target 1: $80

* Target 2: $78–$77 PUT wall

* Stop-loss: Above $86.5

Conclusion PLTR is sitting at a critical inflection point. Compression inside a wedge, early CHoCH + GEX alignment suggests breakout potential, but the $86 HVL must be cleared first. Watch volume and MACD confirmation for the next move.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk.

1. Market Structure & Price Action PLTR is compressing inside a descending wedge while forming a small CHoCH near $85, attempting to flip structure. We saw a BOS from the $80 region, pushing toward the $85 liquidity zone. Price is consolidating under a key resistance band around $86, just below the GEX HVL level.

2. SMC & Supply/Demand Zones

* Demand Zone: $78–$80 range acted as a BOS origin with high buyer reaction.

* Supply Zone: $85–$86 now tested multiple times.

* Downward trendline resistance is holding; a break above could invite a run toward the $90 zone.

3. Indicators Analysis

* MACD: Slightly bullish crossover, histogram fading — suggesting early momentum but caution.

* Stoch RSI: Rebounding from oversold, trending upward toward 80 — suggests bullish follow-through if resistance breaks.

4. Options Sentiment & GEX

* GEX Chart shows a thick CALL Resistance / Gamma Wall at $90, aligned with the second call wall (29.31%).

* HVL at $86: Major short-term magnet — breakout above could initiate a gamma squeeze.

* Put support: Strongest level sits at $80, where downside is well-hedged.

* Options Oscillator:

* IVR: 72.4

* IVx Avg: 85.2

* Call$: 26.1%

* GEX Sentiment: 🟢🟢🔴 — still slightly conflicted, but flipping green.

5. Bullish Scenario 🟢

* Entry: Break and retest of $86 with volume

* Target 1: $90 (Gamma Wall)

* Target 2: $93.5–$95

* Stop-loss: Below $83

6. Bearish Scenario 🔴

* Entry: Rejection from $86 + drop under $83

* Target 1: $80

* Target 2: $78–$77 PUT wall

* Stop-loss: Above $86.5

Conclusion PLTR is sitting at a critical inflection point. Compression inside a wedge, early CHoCH + GEX alignment suggests breakout potential, but the $86 HVL must be cleared first. Watch volume and MACD confirmation for the next move.

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.