Panjang

RDSA - Room for More?

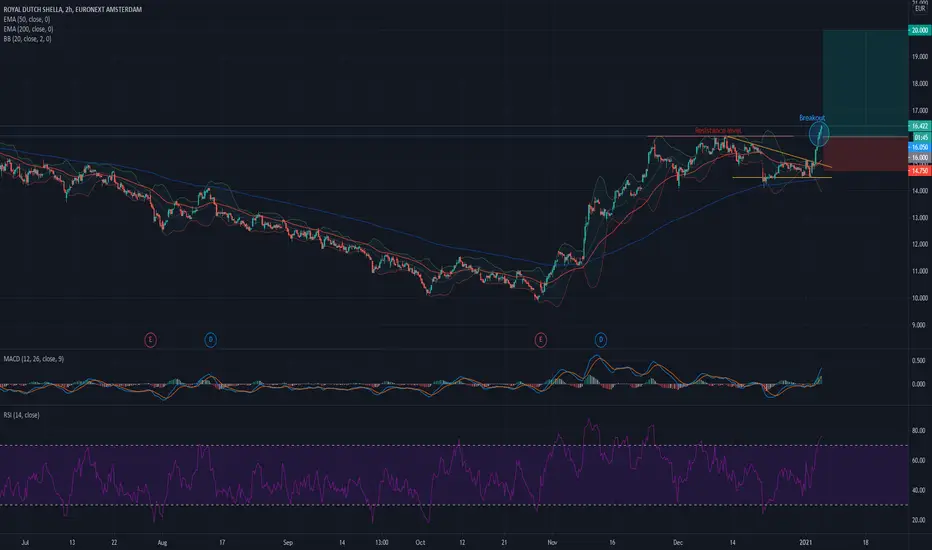

RDSA has shown an impressive performance since hitting its lows in October 2020. Since then the stock is up almost 65%. So the question that arises is, has the train left the station?

I have always liked the stock as a dividend producing block in my portfolio, however since RDSA slashed it's dividends in Q1 this year and oil prices went on the slide, I sold out. However I am increasingly warming to the prospects of the company and how radically they changed things around throughout 2020. The recent jump in share prices seem to support my thinking. RDSA seem to have understood the signs early and radically cut operating expenses, cut payouts to build a war chest for harsher times and is adapting to more sustainable energy sources.

The stock looks attractive to me on a fundamental basis and also because i currently re-allocate my portfolio more towards Value stocks, away from the crowded Growth trade.

Looking to go long for about 5% of my portfolio at 15.50 - with a long-term horizon far into 2021.

Personal price target around 20.00 (Avg. Analyst Est. 24.00)

Major support around 15.00, recent resistance before breakout

SL at 14.75

EURONEXT:RDSA

I have always liked the stock as a dividend producing block in my portfolio, however since RDSA slashed it's dividends in Q1 this year and oil prices went on the slide, I sold out. However I am increasingly warming to the prospects of the company and how radically they changed things around throughout 2020. The recent jump in share prices seem to support my thinking. RDSA seem to have understood the signs early and radically cut operating expenses, cut payouts to build a war chest for harsher times and is adapting to more sustainable energy sources.

The stock looks attractive to me on a fundamental basis and also because i currently re-allocate my portfolio more towards Value stocks, away from the crowded Growth trade.

Looking to go long for about 5% of my portfolio at 15.50 - with a long-term horizon far into 2021.

Personal price target around 20.00 (Avg. Analyst Est. 24.00)

Major support around 15.00, recent resistance before breakout

SL at 14.75

EURONEXT:RDSA

Dagangan aktif

Sold JAN 22 16 PUTNota

Consolidation between 16.50 / 17.00 with thin support at 16.40 ahead of former resistance @ 16.00I remain longterm bullish on the stock and still looking for an entry around current levels.

Despite being an Oil Major the move towards clean energy is a longterm play and RDSA has some significant lead over its competitors.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.