🔮  SPY /

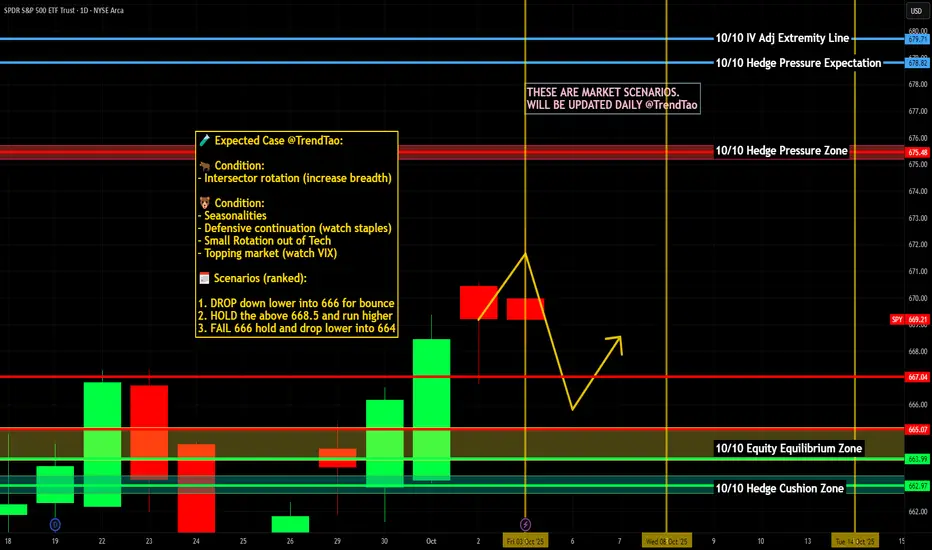

SPY /  SPX Scenarios — Week of Oct 6 → Oct 10, 2025 🔮

SPX Scenarios — Week of Oct 6 → Oct 10, 2025 🔮

🌍 Market-Moving Headlines

🚩 Shutdown overhang: Some data (Trade, Jobless Claims, Budget) remain at risk of delay; markets lean on Fed tone instead.

📉 Fed-heavy week: Nearly every regional president and governor is on deck — tone from Powell (Thu) + FOMC Minutes (Wed) = the core catalyst.

💻 Earnings prep: Q3 pre-announcements begin — AAPL

AAPL  MSFT

MSFT  NVDA remain leadership barometers.

NVDA remain leadership barometers.

💵 Rates & positioning: 10Y yields and USD remain key drivers into mid-month CPI/PPI stretch.

📊 Key Data & Events (ET)

Mon 10/6

⏰ 5:00 PM — Jeff Schmid (Kansas City Fed) speech

Tue 10/7

⏰ 🚩 8:30 AM — U.S. Trade Deficit (Aug) [subject to delay]

⏰ 3:00 PM — Consumer Credit (Aug)

🗣️ Fed Speakers — Bostic (10:00), Bowman (10:05, 8:35, 8:45), Miran (10:45, 4:05), Kashkari (11:30)

Wed 10/8

⏰ 🚩 2:00 PM — FOMC Minutes (September Meeting)

🗣️ Fed Speakers — Musalem (9:20), Barr (9:30, 5:45), Kashkari (3:15), Goolsbee (7:15)

Thu 10/9

⏰ 🚩 8:30 AM — Initial Jobless Claims (Oct 4) [subject to delay]

⏰ 🚩 8:30 AM — Fed Chair Powell remarks (opening keynote)

⏰ 10:00 AM — Wholesale Inventories (Aug)

🗣️ Fed Speakers — Bowman (8:35, 8:45, 3:45), Kashkari + Barr (12:45), Daly (4:10, 9:40 PM)

Fri 10/10

⏰ 🚩 10:00 AM — Consumer Sentiment (Prelim, Oct)

⏰ 2:00 PM — U.S. Federal Budget (Sept) [subject to delay]

🗣️ Fed Speakers — Goolsbee (9:45)

⚠️ Disclaimer: Educational/informational only — not financial advice.

📌 #trading #stockmarket #SPY #SPX #Powell #FOMC #Fed #joblessclaims #tradebalance #consumerconfidence #shutdown #bonds #Dollar #megacaps #economy

🌍 Market-Moving Headlines

🚩 Shutdown overhang: Some data (Trade, Jobless Claims, Budget) remain at risk of delay; markets lean on Fed tone instead.

📉 Fed-heavy week: Nearly every regional president and governor is on deck — tone from Powell (Thu) + FOMC Minutes (Wed) = the core catalyst.

💻 Earnings prep: Q3 pre-announcements begin —

💵 Rates & positioning: 10Y yields and USD remain key drivers into mid-month CPI/PPI stretch.

📊 Key Data & Events (ET)

Mon 10/6

⏰ 5:00 PM — Jeff Schmid (Kansas City Fed) speech

Tue 10/7

⏰ 🚩 8:30 AM — U.S. Trade Deficit (Aug) [subject to delay]

⏰ 3:00 PM — Consumer Credit (Aug)

🗣️ Fed Speakers — Bostic (10:00), Bowman (10:05, 8:35, 8:45), Miran (10:45, 4:05), Kashkari (11:30)

Wed 10/8

⏰ 🚩 2:00 PM — FOMC Minutes (September Meeting)

🗣️ Fed Speakers — Musalem (9:20), Barr (9:30, 5:45), Kashkari (3:15), Goolsbee (7:15)

Thu 10/9

⏰ 🚩 8:30 AM — Initial Jobless Claims (Oct 4) [subject to delay]

⏰ 🚩 8:30 AM — Fed Chair Powell remarks (opening keynote)

⏰ 10:00 AM — Wholesale Inventories (Aug)

🗣️ Fed Speakers — Bowman (8:35, 8:45, 3:45), Kashkari + Barr (12:45), Daly (4:10, 9:40 PM)

Fri 10/10

⏰ 🚩 10:00 AM — Consumer Sentiment (Prelim, Oct)

⏰ 2:00 PM — U.S. Federal Budget (Sept) [subject to delay]

🗣️ Fed Speakers — Goolsbee (9:45)

⚠️ Disclaimer: Educational/informational only — not financial advice.

📌 #trading #stockmarket #SPY #SPX #Powell #FOMC #Fed #joblessclaims #tradebalance #consumerconfidence #shutdown #bonds #Dollar #megacaps #economy

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penerbitan berkaitan

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.