Daily Chart View

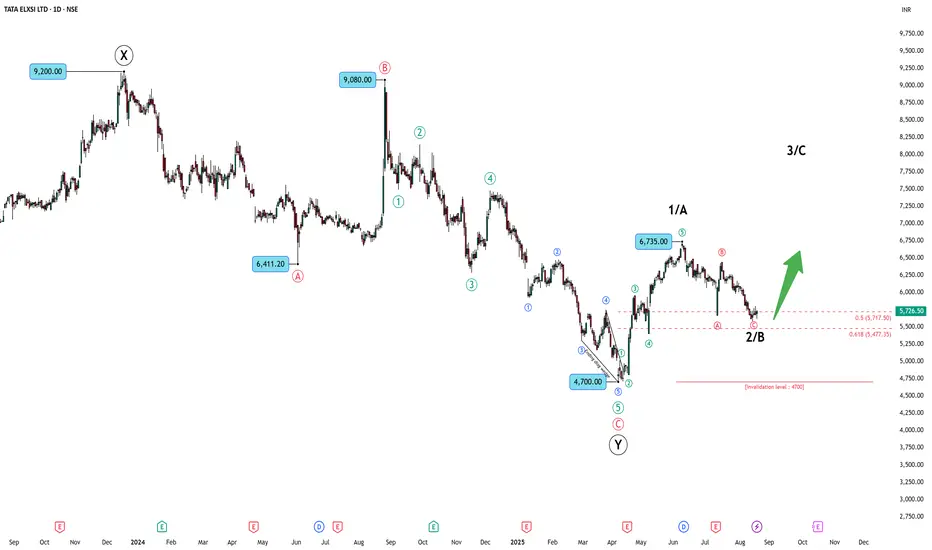

Price action from the 9,080 peak into the 4,700 low unfolded as a complete 5-wave decline, ending with an ending diagonal. From that low, we can count a new 5-wave sequence beginning:

This sets up 4,700 as the line in the sand(Invalidation level) — a break below would invalidate the bullish impulse count.

Weekly Chart View

Looking at the bigger picture, the fall from 10,760 ATH into 4,700 can be read as a W–X–Y correction. If true, then the low at 4,700 completed the corrective cycle.

From there, the current up-move could be interpreted as:

Either way, the bias is higher unless 4,700 breaks. A sustained move above 6,735 will strengthen the bullish scenario.

Summary

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Always do your own research (DYOR) before making trading decisions.

Price action from the 9,080 peak into the 4,700 low unfolded as a complete 5-wave decline, ending with an ending diagonal. From that low, we can count a new 5-wave sequence beginning:

- Wave 1 up into 6,735

- Wave 2 pullback now testing the 0.5–0.618 retracement zone

- A possible Wave 3 launchpad if the structure holds

This sets up 4,700 as the line in the sand(Invalidation level) — a break below would invalidate the bullish impulse count.

Weekly Chart View

Looking at the bigger picture, the fall from 10,760 ATH into 4,700 can be read as a W–X–Y correction. If true, then the low at 4,700 completed the corrective cycle.

From there, the current up-move could be interpreted as:

- Either 1–2–3 of a new bullish cycle

- Or an A–B–C corrective rally

Either way, the bias is higher unless 4,700 breaks. A sustained move above 6,735 will strengthen the bullish scenario.

Summary

- Primary View: New bullish sequence started from 4,700

- Alternate: If 4,700 is breached, bearish continuation resumes

- Confirmation: Above 6,735, momentum tilts firmly bullish

Disclaimer: This analysis is for educational purposes only and does not constitute investment advice. Always do your own research (DYOR) before making trading decisions.

WaveXplorer | Elliott Wave insights

📊 X profile: @veerappa89

📊 X profile: @veerappa89

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.

WaveXplorer | Elliott Wave insights

📊 X profile: @veerappa89

📊 X profile: @veerappa89

Penafian

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by TradingView. Read more in the Terms of Use.