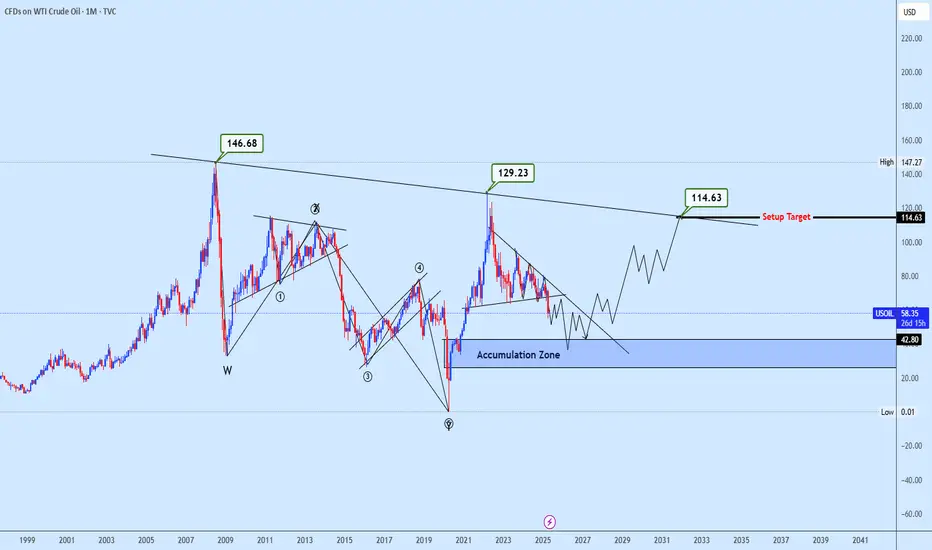

WTI Crude Oil has completed a prolonged complex correction from its historical high of $146.68, forming a structurally mature accumulation base between the $33.06–$42.80 demand zone. This zone aligns with multi-year support and marks the potential terminal point of a corrective macro structure positioning the asset for a major impulsive phase within either Wave 3 or Wave 5 of the broader cycle.

Recent price behavior near $33.06 reflects a critical inflection, signaling strong institutional absorption and suggesting exhaustion of the long-term bearish momentum. The projected bullish scenario envisions a reversal targeting $114.63 as the primary technical pivot, corresponding with significant resistance and the neckline of the long-term structural setup. A confirmed breakout above this level would unlock higher targets toward $129.23 and potentially a full retracement to the $146.68 high, contingent on macroeconomic alignment.

Fundamentally, this scenario is underpinned by key catalysts including OPEC+ production adjustments, U.S. inventory dynamics, geopolitical instability across major oil-exporting nations, and global macro data such as GDP trends, inflation prints, and energy demand forecasts. These elements are poised to fuel volatility but also support a sustained recovery phase, provided demand fundamentals remain intact.

Recent price behavior near $33.06 reflects a critical inflection, signaling strong institutional absorption and suggesting exhaustion of the long-term bearish momentum. The projected bullish scenario envisions a reversal targeting $114.63 as the primary technical pivot, corresponding with significant resistance and the neckline of the long-term structural setup. A confirmed breakout above this level would unlock higher targets toward $129.23 and potentially a full retracement to the $146.68 high, contingent on macroeconomic alignment.

Fundamentally, this scenario is underpinned by key catalysts including OPEC+ production adjustments, U.S. inventory dynamics, geopolitical instability across major oil-exporting nations, and global macro data such as GDP trends, inflation prints, and energy demand forecasts. These elements are poised to fuel volatility but also support a sustained recovery phase, provided demand fundamentals remain intact.

📢Follow the official links only! Trade smart, stay safe! 🎯

Telegram: t.me/+m0IACMn0ul03OTFk

Forex zone: t.me/+piiPgrNtrulkNDk0

💎 Premium details: t.me/wcsepayment

📩 Promotion/Partnership: t.me/WESLAD

Telegram: t.me/+m0IACMn0ul03OTFk

Forex zone: t.me/+piiPgrNtrulkNDk0

💎 Premium details: t.me/wcsepayment

📩 Promotion/Partnership: t.me/WESLAD

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

📢Follow the official links only! Trade smart, stay safe! 🎯

Telegram: t.me/+m0IACMn0ul03OTFk

Forex zone: t.me/+piiPgrNtrulkNDk0

💎 Premium details: t.me/wcsepayment

📩 Promotion/Partnership: t.me/WESLAD

Telegram: t.me/+m0IACMn0ul03OTFk

Forex zone: t.me/+piiPgrNtrulkNDk0

💎 Premium details: t.me/wcsepayment

📩 Promotion/Partnership: t.me/WESLAD

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.