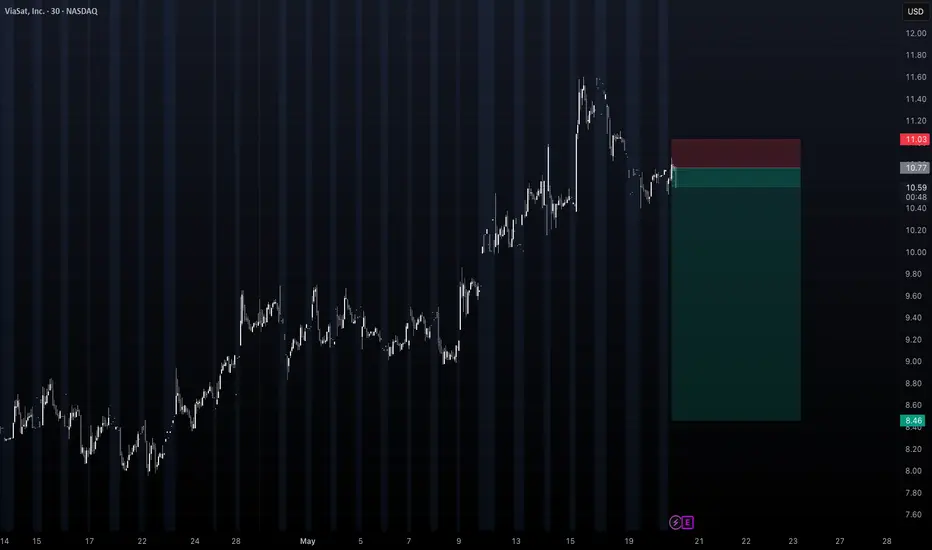

continued uncertainty around its core satellite operations, particularly the delayed and still-unproven ViaSat-3 EMEA launch. The company is coming off a major impairment from the failed Americas satellite, is burdened by high debt, and remains unprofitable with little room for upside surprise in the near term. With weak consumer broadband growth, intense competition from Starlink, and limited near-term catalysts, there's a strong chance that earnings will disappoint or guidance will remain cautious—potentially triggering downside pressure on the stock. other Sat defense systems will take over their niche, im short

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.