GOLD MARKET ANALYSIS AND COMMENTARY - WEEK 27 - 2024

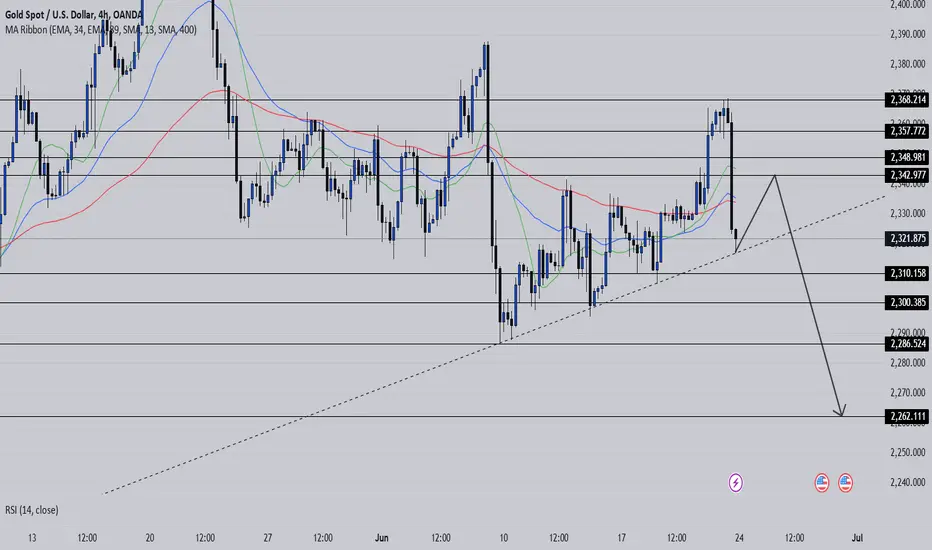

This week, after opening at 2,331 USD/oz, gold prices went sideways in the first sessions of the week, then skyrocketed to 2,368 USD/oz. However, gold prices could not maintain this high level so they quickly dropped to 2,317 USD/oz and closed the week at 2,322 USD/oz.

During the summer months, trading in the gold market is often quite gloomy, investors often take profits whenever gold prices increase. Therefore, liquidity in the market is often much lower than other times of the year, making it difficult for gold prices to have a strong breakthrough.

Support: 2310 - 2300 - 2286 - 2262

Resistance: 2343 - 2349 -2358 -2369

🔴SELL ZONE 2342 - 2344 stoploss 2347

🟢BUY ZONE 2318 - 2316 stoploss 2313

Scalping strategies will be taken until the resistance - support zones above have an entry signal.‼️

Note: TP, SL are full to be safe and win the market

During the summer months, trading in the gold market is often quite gloomy, investors often take profits whenever gold prices increase. Therefore, liquidity in the market is often much lower than other times of the year, making it difficult for gold prices to have a strong breakthrough.

Support: 2310 - 2300 - 2286 - 2262

Resistance: 2343 - 2349 -2358 -2369

🔴SELL ZONE 2342 - 2344 stoploss 2347

🟢BUY ZONE 2318 - 2316 stoploss 2313

Scalping strategies will be taken until the resistance - support zones above have an entry signal.‼️

Note: TP, SL are full to be safe and win the market

Nota

BUY ZONE 2318 - 2316 +100pips runningNota

BUY ZONE 2318 - 2316 +180pipsPenafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.