OPEN-SOURCE SCRIPT

Telah dikemas kini Machine Learning Support and Resistance [AlgoAlpha]

🚀 Elevate Your Trading with Machine Learning Dynamic Support and Resistance!

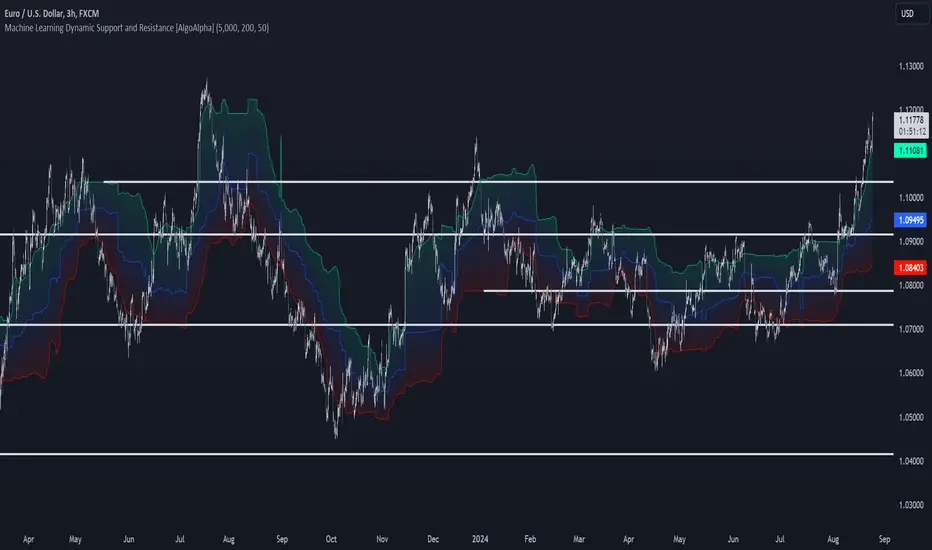

The Machine Learning Dynamic Support and Resistance by AlgoAlpha leverages advanced machine learning techniques to identify dynamic support and resistance levels on your chart. This tool is designed to help traders spot key price levels where the market might reverse or stall, enhancing your trading strategy with precise, data-driven insights.

Key Features:

Quick Guide to Using the Machine Learning Dynamic Support and Resistance Indicator

Maximize your trading with this powerful indicator by following these streamlined steps! 🚀✨

How It Works

This indicator employs a K-means clustering algorithm to dynamically identify key price levels based on the historical price data within a specified lookback window. It starts by initializing three centroids based on the highest, lowest, and an average between the highest and lowest price over the lookback period. The algorithm then iterates through the price data to cluster the prices around these centroids, dynamically adjusting them until they stabilize, representing potential support and resistance levels. These levels are further confirmed based on a separate confirmation length parameter to identify "fixed" levels, which are then drawn as horizontal lines on the chart. The script continuously updates these levels as new data comes in, while also removing older levels to keep the chart clean and relevant, offering traders a clear and adaptive view of market structure.

The Machine Learning Dynamic Support and Resistance by AlgoAlpha leverages advanced machine learning techniques to identify dynamic support and resistance levels on your chart. This tool is designed to help traders spot key price levels where the market might reverse or stall, enhancing your trading strategy with precise, data-driven insights.

Key Features:

- 🎯 Dynamic Levels: Continuously adjusts support and resistance levels based on real-time price data using a K-means clustering algorithm.

- 🧠 Machine Learning: Utilizes clustering methods to optimize the identification of significant price zones.

- ⏳ Configurable Lookback Periods: Customize the training length and confirmation length for better adaptability to different market conditions.

- 🎨 Visual Clarity: Clearly distinguish bullish and bearish zones with customizable color schemes.

- 📉 Trailing and Fixed Levels: Option to display both trailing and fixed support/resistance levels for comprehensive analysis.

- 🚮 Auto-Cleaning: Automatically removes outdated levels after a specified number of bars to keep your chart clean and relevant.

Quick Guide to Using the Machine Learning Dynamic Support and Resistance Indicator

Maximize your trading with this powerful indicator by following these streamlined steps! 🚀✨

- 🛠 Add the Indicator: Add the indicator to favorites by pressing the star icon. Customize settings like clustering training length, confirmation length, and whether to show trailing or fixed levels to fit your trading style.

- 📊 Market Analysis: Monitor the dynamic levels to identify potential reversal points. Use these levels to inform entry and exit points, or to set stop losses.

How It Works

This indicator employs a K-means clustering algorithm to dynamically identify key price levels based on the historical price data within a specified lookback window. It starts by initializing three centroids based on the highest, lowest, and an average between the highest and lowest price over the lookback period. The algorithm then iterates through the price data to cluster the prices around these centroids, dynamically adjusting them until they stabilize, representing potential support and resistance levels. These levels are further confirmed based on a separate confirmation length parameter to identify "fixed" levels, which are then drawn as horizontal lines on the chart. The script continuously updates these levels as new data comes in, while also removing older levels to keep the chart clean and relevant, offering traders a clear and adaptive view of market structure.

Nota Keluaran

Edited the short titleNota Keluaran

Added feature to color fixed levels based on whether price is above or below themSkrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

🚨Get premium for 50% OFF (ends Jan 31st): algoalpha.io

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

🚨Get premium for 50% OFF (ends Jan 31st): algoalpha.io

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

🛜Get FREE signals: discord.gg/xCmqTVRexz

💡Tutorials: youtube.com/@AlgoAlpha

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.