PROTECTED SOURCE SCRIPT

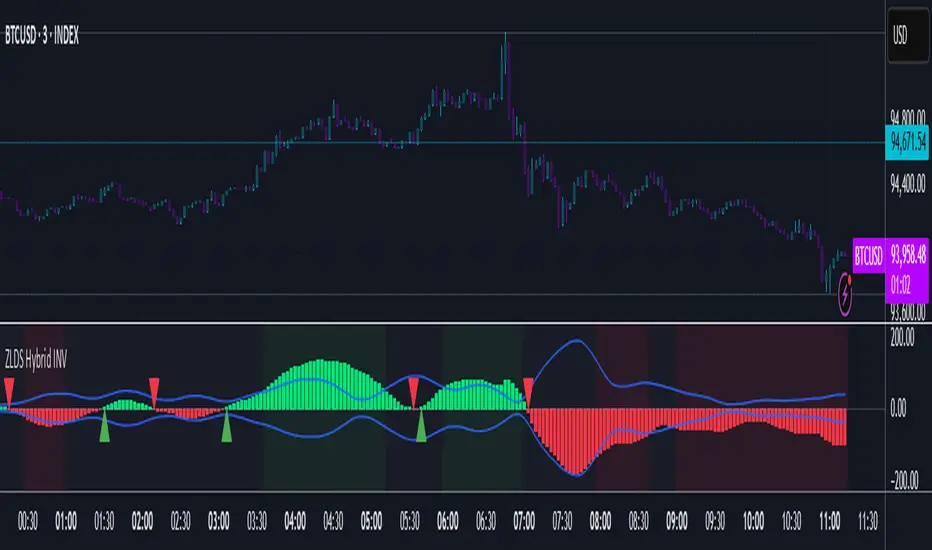

Zero Lag Delta System [Hybrid Version] - Inverted

🔹 Zero Lag Delta System [Hybrid Version] — Inverted 🔹

The Zero Lag Delta System is a hybrid momentum oscillator designed to capture real-time trend shifts and market strength with maximum responsiveness and minimum lag.

Unlike traditional moving averages or momentum indicators, this tool applies a zero lag smoothing algorithm on price data to reduce delay without sacrificing stability.

It then measures the dynamic delta — the difference between two zero lag averages — to track the push and pull between bullish and bearish pressure in real time.

Key Features:

📈 Bullish momentum appears as green bars rising above the centerline.

📉 Bearish momentum appears as red bars falling below the centerline.

🧠 Zero lag smoothing provides faster and cleaner trend recognition.

🧩 Dynamic bands adapt to volatility, highlighting when moves are statistically significant.

🎯 Auto background coloring shows when momentum is strong, weak, or neutral.

🔔 Built-in alerts for bullish and bearish zero crosses.

🧠 How to Trade with Zero Lag Delta System:

1. Bullish Cross:

Signal: Delta crosses above the zero line.

Possible Action: Look for potential long (buy) opportunities.

2. Bearish Cross:

Signal: Delta crosses below the zero line.

Possible Action: Look for potential short (sell) opportunities.

3. Breakout Above Upper Band:

Signal: Strong bullish momentum confirmed by breakout over the dynamic upper band.

Possible Action: Consider aggressive long entries with trend confirmation.

4. Breakout Below Lower Band:

Signal: Strong bearish momentum confirmed by breakout under the dynamic lower band.

Possible Action: Consider aggressive short entries with trend confirmation.

5. Return to Neutral Zone:

Signal: Delta moves back toward the centerline, indicating weakening momentum.

Possible Action: Be cautious, tighten stops, or stay neutral until a clear signal emerges.

📚 Example Trading Scenarios:

Trend Entry:

When delta crosses above the zero line and stays above, price often enters a healthy uptrend. Look for pullbacks to enter with the trend.

Breakout Confirmation:

If delta moves sharply outside the dynamic bands (especially after consolidation), it often confirms a new momentum breakout.

Divergence Detection:

If price makes new highs but delta fails to do so (or vice versa), it may hint at hidden reversal opportunities.

⚡ Why Use Dynamic Bands Instead of Fixed Levels?

Unlike traditional 20/80 fixed levels that assume static market behavior, dynamic bands adapt automatically to current volatility conditions.

This ensures the indicator remains highly sensitive during calm markets, yet avoids overreacting during high-volatility phases.

Dynamic bands provide:

✅ Better precision in spotting true momentum breakouts.

✅ More accurate filtering of noise during sideways markets.

✅ A more adaptive and universal system across different assets (forex, crypto, stocks).

🔥 Final Thoughts:

The Zero Lag Delta System provides a simple yet powerful visual framework for understanding price momentum at a deeper level.

Use it alongside your existing strategy to refine entries, exits, and overall trend bias.

As always, combine with price action and risk management for best results.

This is an educational idea, and past performance may not replicate itself.

Happy trading! 🚀

The Zero Lag Delta System is a hybrid momentum oscillator designed to capture real-time trend shifts and market strength with maximum responsiveness and minimum lag.

Unlike traditional moving averages or momentum indicators, this tool applies a zero lag smoothing algorithm on price data to reduce delay without sacrificing stability.

It then measures the dynamic delta — the difference between two zero lag averages — to track the push and pull between bullish and bearish pressure in real time.

Key Features:

📈 Bullish momentum appears as green bars rising above the centerline.

📉 Bearish momentum appears as red bars falling below the centerline.

🧠 Zero lag smoothing provides faster and cleaner trend recognition.

🧩 Dynamic bands adapt to volatility, highlighting when moves are statistically significant.

🎯 Auto background coloring shows when momentum is strong, weak, or neutral.

🔔 Built-in alerts for bullish and bearish zero crosses.

🧠 How to Trade with Zero Lag Delta System:

1. Bullish Cross:

Signal: Delta crosses above the zero line.

Possible Action: Look for potential long (buy) opportunities.

2. Bearish Cross:

Signal: Delta crosses below the zero line.

Possible Action: Look for potential short (sell) opportunities.

3. Breakout Above Upper Band:

Signal: Strong bullish momentum confirmed by breakout over the dynamic upper band.

Possible Action: Consider aggressive long entries with trend confirmation.

4. Breakout Below Lower Band:

Signal: Strong bearish momentum confirmed by breakout under the dynamic lower band.

Possible Action: Consider aggressive short entries with trend confirmation.

5. Return to Neutral Zone:

Signal: Delta moves back toward the centerline, indicating weakening momentum.

Possible Action: Be cautious, tighten stops, or stay neutral until a clear signal emerges.

📚 Example Trading Scenarios:

Trend Entry:

When delta crosses above the zero line and stays above, price often enters a healthy uptrend. Look for pullbacks to enter with the trend.

Breakout Confirmation:

If delta moves sharply outside the dynamic bands (especially after consolidation), it often confirms a new momentum breakout.

Divergence Detection:

If price makes new highs but delta fails to do so (or vice versa), it may hint at hidden reversal opportunities.

⚡ Why Use Dynamic Bands Instead of Fixed Levels?

Unlike traditional 20/80 fixed levels that assume static market behavior, dynamic bands adapt automatically to current volatility conditions.

This ensures the indicator remains highly sensitive during calm markets, yet avoids overreacting during high-volatility phases.

Dynamic bands provide:

✅ Better precision in spotting true momentum breakouts.

✅ More accurate filtering of noise during sideways markets.

✅ A more adaptive and universal system across different assets (forex, crypto, stocks).

🔥 Final Thoughts:

The Zero Lag Delta System provides a simple yet powerful visual framework for understanding price momentum at a deeper level.

Use it alongside your existing strategy to refine entries, exits, and overall trend bias.

As always, combine with price action and risk management for best results.

This is an educational idea, and past performance may not replicate itself.

Happy trading! 🚀

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

“There are those who think they are studying the market—when all they are doing is studying what someone has said about the market . . . not what the market has said about itself.”

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

“There are those who think they are studying the market—when all they are doing is studying what someone has said about the market . . . not what the market has said about itself.”

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.