OPEN-SOURCE SCRIPT

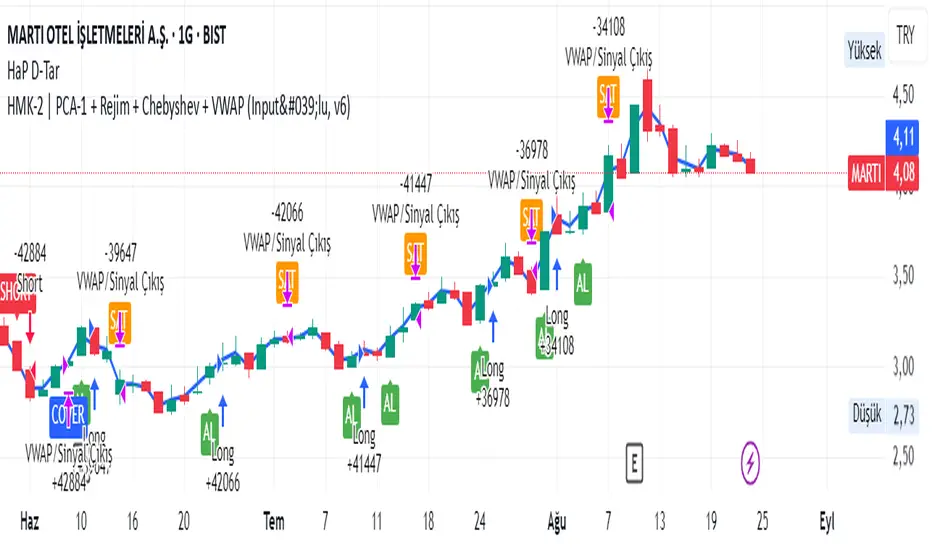

HMK-2 | PCA-1 + Rejim + Chebyshev + VWAP (Input'lu, v6)

📌 HMK-2 | PCA-1 + Regime + Chebyshev + VWAP Strategy

1️⃣ Core Structure

Instead of relying on a single indicator, this system uses the Z-Score normalized average of three oscillators (RSI, MFI, ROC).

Signal (PCA-1):

RSI(14), MFI(14), ROC(5) → each is converted into a z-score.

Their average becomes the “composite signal,” our PCA-1 value.

Trend direction: If the Z-score EMA is rising → trend UP. If falling → trend DOWN.

2️⃣ Side Filters

Regime Filter (ADX + EMA)

ADX is calculated manually.

If ADX > 20 → trend exists → a 50-period EMA of this value smooths it.

This turns “trend regime” into a probability between 0–1.

Chebyshev Filter

A return series is checked against mean ± k*sigma bands.

If the return is within this band → valid signal. Extreme moves are filtered out.

VWAP Filter

Long trades: price must be above VWAP.

Short trades: price must be below VWAP.

Trades are only taken on the correct side of institutional cost averages.

3️⃣ Entry Conditions

Long:

PCA-1 signal crosses above threshold.

Trend Up + Regime OK + Chebyshev OK + Above VWAP.

Short:

PCA-1 signal crosses below threshold.

Trend Down + Regime OK + Chebyshev OK + Below VWAP.

4️⃣ Exit Mechanism

Main Exit: ATR-based stop/target.

Stop = entry price – ATR × (SL factor).

Take profit = entry price + ATR × (TP factor).

Additional Exit:

If price crosses to the opposite side of VWAP.

If PCA-1 signal crosses zero.

👉 Prevents trades from being locked, makes exits adaptive.

5️⃣ Labels / Visualization

AL / SHORT → entry points.

SAT / COVER → exit points.

VWAP line plotted in blue.

🧩 Strategy Features

Optimizable parameters:

Z-window (zWin)

Threshold

Chebyshev factor

ATR stop/target multipliers

This system works with:

Disciplined core (PCA-1 signal)

Triple protection (Regime + Chebyshev + VWAP)

Adaptive exits (ATR + VWAP/signal cross)

👉 Not a “single-indicator robot,” but a multi-filtered trade direction engine.

💡 Final Note

This is a base model of the system — open for further development.

I’ve shared the logic to give you a roadmap.

If you spot errors, fix them → that’s how you’ll improve it.

Don’t waste time asking me questions — refine and build it better yourselves.

Wishing you profitable trades. Stay well 🙏

1️⃣ Core Structure

Instead of relying on a single indicator, this system uses the Z-Score normalized average of three oscillators (RSI, MFI, ROC).

Signal (PCA-1):

RSI(14), MFI(14), ROC(5) → each is converted into a z-score.

Their average becomes the “composite signal,” our PCA-1 value.

Trend direction: If the Z-score EMA is rising → trend UP. If falling → trend DOWN.

2️⃣ Side Filters

Regime Filter (ADX + EMA)

ADX is calculated manually.

If ADX > 20 → trend exists → a 50-period EMA of this value smooths it.

This turns “trend regime” into a probability between 0–1.

Chebyshev Filter

A return series is checked against mean ± k*sigma bands.

If the return is within this band → valid signal. Extreme moves are filtered out.

VWAP Filter

Long trades: price must be above VWAP.

Short trades: price must be below VWAP.

Trades are only taken on the correct side of institutional cost averages.

3️⃣ Entry Conditions

Long:

PCA-1 signal crosses above threshold.

Trend Up + Regime OK + Chebyshev OK + Above VWAP.

Short:

PCA-1 signal crosses below threshold.

Trend Down + Regime OK + Chebyshev OK + Below VWAP.

4️⃣ Exit Mechanism

Main Exit: ATR-based stop/target.

Stop = entry price – ATR × (SL factor).

Take profit = entry price + ATR × (TP factor).

Additional Exit:

If price crosses to the opposite side of VWAP.

If PCA-1 signal crosses zero.

👉 Prevents trades from being locked, makes exits adaptive.

5️⃣ Labels / Visualization

AL / SHORT → entry points.

SAT / COVER → exit points.

VWAP line plotted in blue.

🧩 Strategy Features

Optimizable parameters:

Z-window (zWin)

Threshold

Chebyshev factor

ATR stop/target multipliers

This system works with:

Disciplined core (PCA-1 signal)

Triple protection (Regime + Chebyshev + VWAP)

Adaptive exits (ATR + VWAP/signal cross)

👉 Not a “single-indicator robot,” but a multi-filtered trade direction engine.

💡 Final Note

This is a base model of the system — open for further development.

I’ve shared the logic to give you a roadmap.

If you spot errors, fix them → that’s how you’ll improve it.

Don’t waste time asking me questions — refine and build it better yourselves.

Wishing you profitable trades. Stay well 🙏

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.