PROTECTED SOURCE SCRIPT

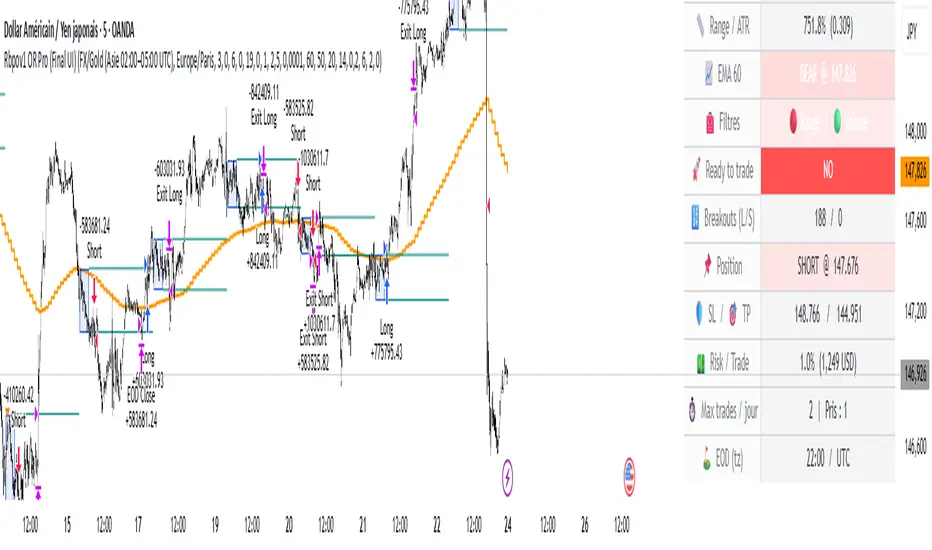

Rbpov1 – Opening Range Multi-Actifs Final

📌 Strategy Bio – Rbpov1 Opening Range Pro

🎯 Core Concept

The Rbpov1 Opening Range Pro is an advanced algorithmic trading system built around the opening range breakout concept.

It is based on the observation that, after a period of consolidation (the opening range), markets often generate strong directional moves once the range is broken.

This strategy is designed to be multi-asset (Forex, indices, commodities, crypto) and multi-timeframe, with the following key principles:

A reference range (default: 03:00 → 06:00 UTC+2, customizable).

Trade entries are taken only after the range closes.

Smart filtering (trend, volatility, volume) to reduce false signals.

Strict risk management in USD, with Stop Loss and Take Profit defined in multiples of R.

Automatic end-of-day flat rule: all positions are closed by session end.

⚙️ Filters & Conditions

🔹 1. Trend Filter (EMA HTF)

A 21-period EMA is applied to a higher timeframe (default: H4).

If price is above EMA, only longs are allowed.

If price is below EMA, only shorts are allowed.

👉 This aligns intraday trades with the dominant trend.

🔹 2. Volatility Filter (ATR)

Uses a 14-period ATR to validate range conditions.

Opening range is valid only if:

Range > minATR × ATR

Range < maxATR × ATR

Default: minATR = 0.2, maxATR = 6.0.

👉 Filters out noise (tiny ranges) or overextended volatility.

🔹 3. Volume Filter (Optional)

Breakout candle must show higher volume than the average (default SMA 20).

Prevents low-liquidity breakouts.

🔹 4. Session & Trading Rules

No trades during weekends (Forex).

Maximum X trades per day (default: 2).

Positions are force-closed at EOD (default: 19:00 UTC+2).

💰 Risk Management

Dynamic position sizing in USD (capital × risk%).

Stop Loss automatically set at the opposite side of the range (with optional buffer).

Take Profit in multiples of R (default: 1.5R).

Equity-based recalculation ensures consistency as account grows.

📊 Key Benefits

✅ Professional and modular architecture.

✅ Works across Forex, indices, gold, and crypto.

✅ Smart filtering for cleaner signals.

✅ Robust and consistent risk management.

✅ Automatic end-of-day flattening (no overnight risk).

✅ Modern and visual dashboard interface for readability.

🏆 Use Cases

Forex (USD/JPY, EUR/USD, GBP/USD) → Asian session ranges.

Indices (NAS100, US30, DAX) → NYSE opening ranges.

Gold (XAU/USD) → Tokyo or pre-London ranges.

Crypto (BTC, ETH) → Tailored to volatility peaks.

🎯 Core Concept

The Rbpov1 Opening Range Pro is an advanced algorithmic trading system built around the opening range breakout concept.

It is based on the observation that, after a period of consolidation (the opening range), markets often generate strong directional moves once the range is broken.

This strategy is designed to be multi-asset (Forex, indices, commodities, crypto) and multi-timeframe, with the following key principles:

A reference range (default: 03:00 → 06:00 UTC+2, customizable).

Trade entries are taken only after the range closes.

Smart filtering (trend, volatility, volume) to reduce false signals.

Strict risk management in USD, with Stop Loss and Take Profit defined in multiples of R.

Automatic end-of-day flat rule: all positions are closed by session end.

⚙️ Filters & Conditions

🔹 1. Trend Filter (EMA HTF)

A 21-period EMA is applied to a higher timeframe (default: H4).

If price is above EMA, only longs are allowed.

If price is below EMA, only shorts are allowed.

👉 This aligns intraday trades with the dominant trend.

🔹 2. Volatility Filter (ATR)

Uses a 14-period ATR to validate range conditions.

Opening range is valid only if:

Range > minATR × ATR

Range < maxATR × ATR

Default: minATR = 0.2, maxATR = 6.0.

👉 Filters out noise (tiny ranges) or overextended volatility.

🔹 3. Volume Filter (Optional)

Breakout candle must show higher volume than the average (default SMA 20).

Prevents low-liquidity breakouts.

🔹 4. Session & Trading Rules

No trades during weekends (Forex).

Maximum X trades per day (default: 2).

Positions are force-closed at EOD (default: 19:00 UTC+2).

💰 Risk Management

Dynamic position sizing in USD (capital × risk%).

Stop Loss automatically set at the opposite side of the range (with optional buffer).

Take Profit in multiples of R (default: 1.5R).

Equity-based recalculation ensures consistency as account grows.

📊 Key Benefits

✅ Professional and modular architecture.

✅ Works across Forex, indices, gold, and crypto.

✅ Smart filtering for cleaner signals.

✅ Robust and consistent risk management.

✅ Automatic end-of-day flattening (no overnight risk).

✅ Modern and visual dashboard interface for readability.

🏆 Use Cases

Forex (USD/JPY, EUR/USD, GBP/USD) → Asian session ranges.

Indices (NAS100, US30, DAX) → NYSE opening ranges.

Gold (XAU/USD) → Tokyo or pre-London ranges.

Crypto (BTC, ETH) → Tailored to volatility peaks.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.