OPEN-SOURCE SCRIPT

Breakout Squeeze – Early Detector (BRK-SQZ)

What it does

Squeeze — price goes quiet (Bollinger Band Width compresses vs its recent average).

Fuel — volume expands vs its 20-bar average.

Level — price takes out a recent high.

Quality — the close is near the top of the candle’s range.

When those stack up you get a signal. You can choose Strict (safer, later) or Early (faster, noisier).

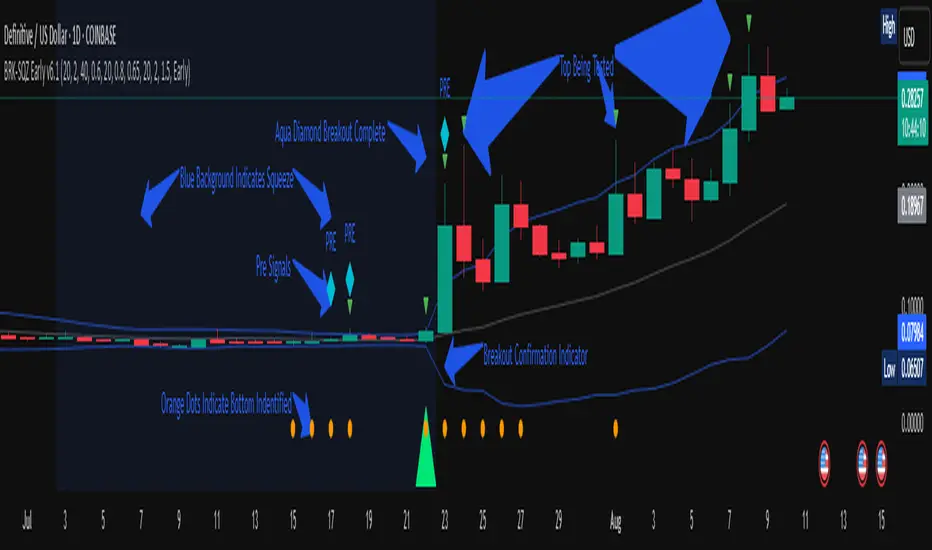

What you’ll see on the chart

Blue background → in a squeeze (coiled).

Orange dots (bottom) → volume currently above threshold.

Green tiny caret (above bar) → price is testing/clearing the breakout level.

Aqua diamond labeled “PRE” (above bar) → Pre-Signal (any 3 of 4 checks are true). Early heads-up.

Lime triangle “BRK” (below bar) → Confirmed Long breakout (all 4 checks pass).

Tip: PRE can fire intrabar for early notice. The BRK triangle is your confirmation.

Inputs (the only knobs that matter)

Early (default): high or close can break the level; looser volume/close filters.

Strict: close must break the level; stronger volume/close placement.

Core

BB Length (20), BB Mult (2.0)

Squeeze Lookback (40) — moving average window for BB Width.

Squeeze Threshold (sqzFactor) (0.60) — lower = tighter squeeze requirement.

Breakout

Breakout Lookback (brkLen) (20) — new high must clear the prior N bars.

Volume

Volume SMA Length (20)

Volume Spike ≥ (Early/Strict) (1.5 / 2.0) — multiplier vs avg volume.

Candle Quality

Close-in-Range (Early/Strict) (0.65 / 0.80) — 0.80 = close in top 20% of bar.

Options

Fire intrabar (ON = earlier PRE/BRK; OFF = bar-close only).

Plot Signal Labels (on/off).

Debug paints (show/hide squeeze tint, volume dots, breakout carets, PRE).

Alerts (set these, you’re done)

Create two alerts from the indicator’s Condition dropdown:

BRK-SQZ Pre-Signal

Trigger: Once per bar (for early pings).

Purpose: tells you the coil is heating up before the rip.

BRK-SQZ Long

Trigger: Once per bar close (clean confirmation) or Once per bar if you want it faster.

Purpose: confirms the breakout when all checks align.

How to trade it (framework, not rules)

First touch after a long squeeze is the highest-odds signal.

On Daily, manage risk with ATR or a structure stop under the base.

Scale out into strength; let a runner ride if the squeeze was multi-week.

Installation (60 seconds)

Add indicator.

Keep Mode = Early, Fire intrabar = ON.

Set alerts for Pre-Signal (Once per bar) and Long (Once per bar close).

Save inputs as a Template and apply across your watchlist.

FAQ

Q: Why did PRE fire but no BRK?

A: One of the four checks failed at close (often volume or close-placement). That’s the filter doing its job.

Q: I want even earlier signals.

A: Lower volMult_early, reduce brkLen, or enable intrabar signals. Expect more noise.

Q: Can I get bearish signals?

A: Not yet. I can ship a mirrored Breakdown version on request.

Q: Can I screen a whole watchlist?

A: This version is chart-based. I can add a mini screener panel with a consolidated alert if you want.

Changelog

v6.1 — Early/Strict modes, PRE (3-of-4), squeeze tint, volume dots, breakout carets, BRK triangle, intrabar option, two alert conditions.

Disclaimer

This is a tool, not advice. Markets slip, wick, and change regime. Size responsibly and test your settings on your market/timeframe.

Skrip sumber terbuka

Dalam semangat sebenar TradingView, pencipta skrip ini telah menjadikannya sumber terbuka supaya pedagang dapat menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupun anda boleh menggunakannya secara percuma, ingat bahawa menerbitkan semula kod ini adalah tertakluk kepada Peraturan Dalaman kami.

It be Me

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat sebenar TradingView, pencipta skrip ini telah menjadikannya sumber terbuka supaya pedagang dapat menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupun anda boleh menggunakannya secara percuma, ingat bahawa menerbitkan semula kod ini adalah tertakluk kepada Peraturan Dalaman kami.

It be Me

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.