[AngelHouse] All Eating Strategy

I would like to introduce the newly developed strategic indicators.

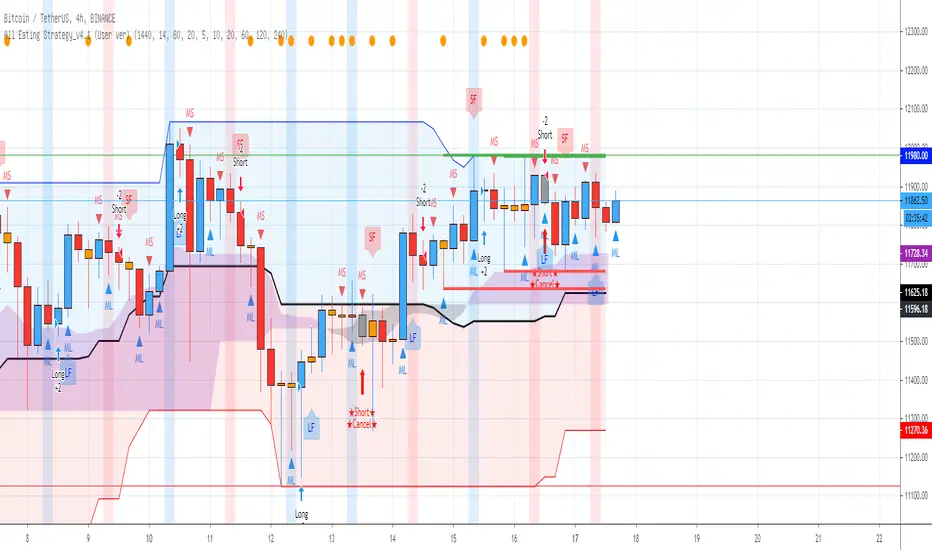

- The All Eating indicator is a strategic indicator made for trading in the crypto market.

- This indicator is based on the four-hour time zone, and is a strategic indicator using the intersection of the threshold.

- If the plot is crossed over, busy signal or crossunder, a sell signal is generated.

★ Describe the All Eating Strategy v3.2 indicator

1. Long & Short: You can configure your swing strategy based on the signal.

The All Eating Strategy indicator is based on a four-hour frame. Due to the logic nature, the signal does not match at a time higher than 4 hours. Therefore, we recommend that you use the indicator only in a time zone of 4 hours or less.

Also, the signal does not have 100% accuracy, so even if you configure a strategy based on the signal, it is recommended that you set the break/break line and respond.

2. Long Feel & Short Feel: The signal is also quite reliable. The strength of the signal is that when a strong rise and a strong fall occur, it is almost 100% probability that the signal is sold.

However, the downside is that there may be some offbeat in the transverse section. However, even if the index is offbeat, the loss is small, and if the stock price rises or falls, high expected returns can be expected.

You can use the signal alone, but if you use the Long & Short indicator, you can get better results. If the Long Feel & Short Feel signal is also generated where the Long & Short signal is generated, the probability will be higher, right?

3. Long Signal Cancel / Short Signal Cancel : After the sale signal, if the stock price moves in the opposite direction of the signal, the Long Signal Cancel / Short Signal Cancel signal will be generated. If the signal is triggered, close the sale at a break.

Please wait for the next signal.

4. Candle color: White cans are formed when cans such as the Dojorpoenor hammer are generated. The cans have a meaning of reversal when they occur after a strong rise or fall, and can continue the trend when they occur during an ongoing trend.

5. Single item band: The single item band consists of the strong area (blue area) and the weak area (red area) based on the reference line. Stock prices can indicate additional gains when they are in the bullish zone, and additional declines when they are in the weak zone.

Also, you can recognize the top of the strong zone as the resistance line and the bottom of the weak zone as the support line.

The cloud stand in the single band should be located in front of the band for 26 days, but it is also recognized as a role of support and resistance.

6. 1D Baseline: The line of one bar is recalled to 4 hours. blue when the reference line is positive, red when negative, and gray when horizontal, and red when the reference line is positive,

Or, in the opposite case, it's time to suspect a trend inflection.

※ If you want to obtain access to this indicator with a script dedicated for the first time, please contact the link shown in the signature.

★If you check the notice, please delete the existing indicator and update it to the new version.

★Update history

1. Change the Long Feel / Short Feel phrase to LF / SF and change the LF label color from aqua to blue to improve readability.

2. Change the wording of Long Signal Cancel / Short Signal Cancel to Long Cancel and double-column readability.

3. LF / SF position moves from the existing rod close position to the next bar open position (corrects the phenomenon of the signal being pushed back one step).

4. Modified to change the color of the Bong color to gray when Long Cancel / Short Cancel occurs. Improved readability.

3. LF / SF position moves from the existing rod close position to the next bar open position (corrects the phenomenon of the signal being pushed back one step).

★If you check the notice, please delete the existing indicator and update it to the new version.

★Update history

1. LF / SF position moves from the existing rod close position to the next bar open position (corrects the phenomenon where the signal was pushed back one step).

2. Fixing issues that do not automatically refresh on the PC when Long Cancel / Short Cancel occurs. Updated as soon as the signal occurs

★Update history

1. Modify the Long/Short label to be pasted to the end of the left screen.

2. Modify the bgcolor to be shown in the 9 o'clock candle at 13 o'clock when the long/short signal occurs.

★Update history

1. Restoring the long/short signal from the 9 o'clock candle to the 13 o'clock candle.

★Update history

1. Fixing the issues that appear on the left end of the screen when a short signal occurs.

2. Eliminate unnecessary source code other than required annotations

3 In addition to 4 hours, 1 hour, 30 minutes, 15 minutes, 5 minutes, 1 minute, and time zone support. When setting the time, make sure to set the Time Value as shown below.

Time - Time Value

4H -1440

1H-240

30M-120

15M-60

5M-30

★Update history

1. Labels Long & Shotr signals in the form of Circle(●) in The Monster Indicator. (Integrating indicators)

2. Change trended candle color from existing hint color to yellow sak. Also label the screen top with yellow Circle(●) flatness of the screen

3. Overpurchase based on MFI (14) and addition to ★Chaution★ label when entering an over-purchase area

4. Create a short-term support/resistance line and long & short TP line based on the high and low points of the previous 20 bars.

5. Adding a moving average line

★Update history

1. Move the Long & Shotr signal of the Monster indicator forward one bar from the Close of the existing bar to the next bar open.

(The previous Close or the next Open in the bar is the same location, but the position of the visual Open is recognized as the normal position.)

2. Adding a combo box to select sma / ema from the moving average. Check status operates as ema on sma / uncheck

★Update history

1. The Long & Shotr signal of The Monster's indicator was made in Circle(●) format, but some people were not sure what it was, so we changed it to Triang format, and the long signal was modified to be displayed in ML & Short signal in MS.

★Update history

1. Set LF & SF label transparency to 30%.

2. MFI over-sold/over-sold Labe ᄅset transparency at 10%.

3. Added moving average on/off check box. (set to default check off)

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi angelhouse161013 secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

Discord : discord.gg/FZbbnXbx

Telegram : t.me/damukja_chat

※ DAMUKJA youtube Channel

youtube : youtube.com/@Coin-Life

※ partnership & advertising enquiry

t.me/angelhouse161013

Penafian

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi angelhouse161013 secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

Discord : discord.gg/FZbbnXbx

Telegram : t.me/damukja_chat

※ DAMUKJA youtube Channel

youtube : youtube.com/@Coin-Life

※ partnership & advertising enquiry

t.me/angelhouse161013