PROTECTED SOURCE SCRIPT

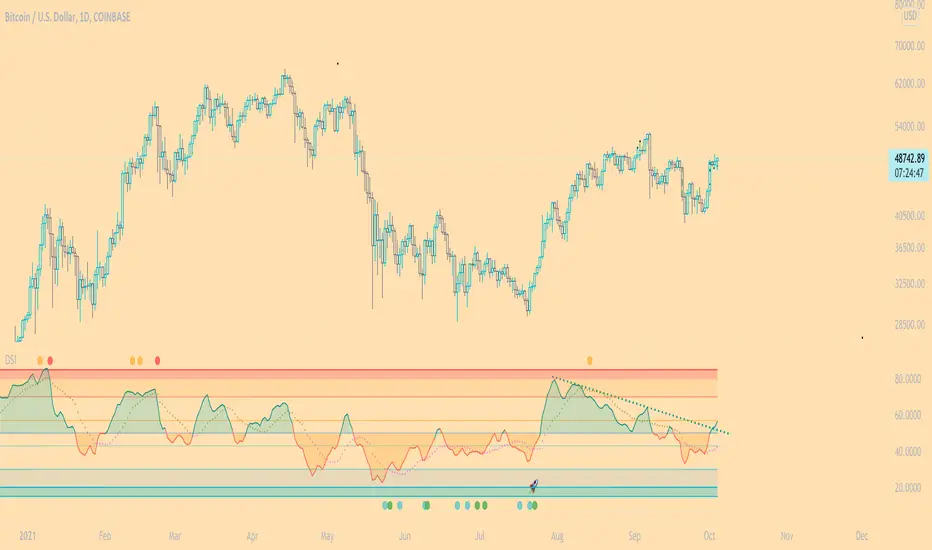

DSI - Dynamic Strength Index

The DSI is a volume weighted momentum indicator similar but superior to the traditional RSI.

The DSI algorithm takes values for RSI, MFI, OBV and stochastics, then gives them each a different weighting depending on their historic reliability in different market conditions, and then averages out the values.

This results in a very reliable, noise-free momentum indicator, especially reliable on high timeframes.

Further features include:

Auto Trendlines - Up-downtrend lines to show support, resistance and breakouts

Supertrend- A momentum (ATR based) version of the Supertrend.

Divergences - Bullish and bearish momentum divergences, with confirmation signals.

General Rules:

Bullish above 50

Bearish below 50

Enjoy!

MM

The DSI algorithm takes values for RSI, MFI, OBV and stochastics, then gives them each a different weighting depending on their historic reliability in different market conditions, and then averages out the values.

This results in a very reliable, noise-free momentum indicator, especially reliable on high timeframes.

Further features include:

Auto Trendlines - Up-downtrend lines to show support, resistance and breakouts

Supertrend- A momentum (ATR based) version of the Supertrend.

Divergences - Bullish and bearish momentum divergences, with confirmation signals.

General Rules:

Bullish above 50

Bearish below 50

Enjoy!

MM

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.