OPEN-SOURCE SCRIPT

Aurora Flow Oscillator [QuantAlgo]

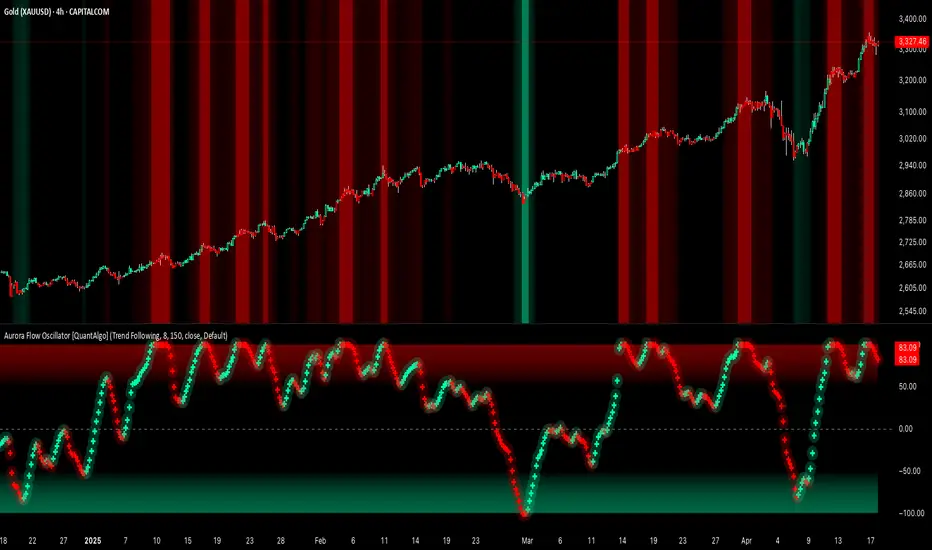

The Aurora Flow Oscillator is an advanced momentum-based technical indicator designed to identify market direction, momentum shifts, and potential reversal zones using adaptive filtering techniques. It visualizes price momentum through a dynamic oscillator that quantifies trend strength and direction, helping traders and investors recognize momentum shifts and trading opportunities across various timeframes and asset class.

🟢 Technical Foundation

The Aurora Flow Oscillator employs a sophisticated mathematical approach with adaptive momentum filtering to analyze market conditions, including:

The indicator processes price data through multiple filtering stages, applying mathematical principles including exponential smoothing with adaptive coefficients. This creates an oscillator that dynamically adjusts to market volatility while maintaining responsiveness to genuine trend changes.

🟢 Key Features & Signals

1. Momentum Flow and Extreme Zone Identification

The oscillator presents market momentum through an intuitive visual display that clearly indicates both direction and strength:

The indicator also identifies potential overbought and oversold market conditions through extreme zone markings:

These zones are displayed with gradient intensity that increases as the oscillator moves toward extremes, helping traders and investors:

→ Identify potential reversal zones

→ Determine appropriate entry and exit points

→ Gauge overall market sentiment strength

2. Customizable Trading Style Presets

The Aurora Flow Oscillator offers pre-configured settings for different trading approaches:

Each preset automatically adjusts internal parameters for optimal performance in the selected trading context, providing flexibility across different market approaches without requiring complex manual configuration.

🟢 Practical Usage Tips

1/ Trend Analysis and Interpretation

→ Direction Assessment: Evaluate the oscillator's position relative to zero to determine underlying momentum bias

→ Momentum Strength: Measure the oscillator's distance from zero within the -100 to +100 range to quantify momentum magnitude

→ Trend Consistency: Monitor the oscillator's path for sustained directional movement without frequent zero-line crossings

→ Reversal Detection: Watch for oscillator divergence from price and deceleration of movement when approaching extreme zones

2/ Signal Generation Strategies

Depending on your trading approach, multiple signal strategies can be employed:

Trend Following Signals:

Countertrend Signals:

Momentum Shift Signals:

3/ Timeframe Optimization

The indicator can be effectively applied across different timeframes with these considerations:

Lower Timeframes (1-15min):

Medium Timeframes (30min-4h):

Higher Timeframes (Daily+):

🟢 Pro Tips

Price Momentum Period:

→ Lower values (5-7) increase sensitivity to minor price fluctuations but capture more market noise

→ Higher values (10-16) emphasize sustained momentum shifts at the cost of delayed response

→ Adjust based on your timeframe (lower for shorter timeframes, higher for longer timeframes)

Oscillator Filter Period:

→ Lower values (80-120) produce more frequent directional changes and earlier response to momentum shifts

→ Higher values (200-300) filter out shorter-term fluctuations to highlight dominant market cycles

→ Match to your typical holding period (shorter holding time = lower filter values)

Multi-Timeframe Analysis:

→ Compare oscillator readings across different timeframes for confluence

→ Look for alignment between higher and lower timeframe signals

→ Use higher timeframe for trend direction, lower for earlier entries

Volatility-Adaptive Trading:

→ Use oscillator strength to adjust position sizing (stronger = larger)

→ Consider reducing exposure when oscillator reaches extreme zones

→ Implement tighter stops during periods of oscillator acceleration

Combination Strategies:

→ Pair with volume indicators for confirmation of momentum shifts

→ Use with support/resistance levels for strategic entry and exit points

→ Combine with volatility indicators for comprehensive market context

🟢 Technical Foundation

The Aurora Flow Oscillator employs a sophisticated mathematical approach with adaptive momentum filtering to analyze market conditions, including:

- Price-Based Momentum Calculation: Calculates logarithmic price changes to measure the rate and magnitude of market movement

- Adaptive Momentum Filtering: Applies an advanced filtering algorithm to smooth momentum calculations while preserving important signals

- Acceleration Analysis: Incorporates momentum acceleration to identify shifts in market direction before they become obvious

- Signal Normalization: Automatically scales the oscillator output to a range between -100 and 100 for consistent interpretation across different market conditions

The indicator processes price data through multiple filtering stages, applying mathematical principles including exponential smoothing with adaptive coefficients. This creates an oscillator that dynamically adjusts to market volatility while maintaining responsiveness to genuine trend changes.

🟢 Key Features & Signals

1. Momentum Flow and Extreme Zone Identification

The oscillator presents market momentum through an intuitive visual display that clearly indicates both direction and strength:

- Above Zero: Indicates positive momentum and potential bullish conditions

- Below Zero: Indicates negative momentum and potential bearish conditions

- Slope Direction: The angle and direction of the oscillator provide immediate insight into momentum strength

- Zero Line Crossings: Signal potential trend changes and new directional momentum

The indicator also identifies potential overbought and oversold market conditions through extreme zone markings:

- Upper Zone (>50): Indicates strong bullish momentum that may be approaching exhaustion

- Lower Zone (<-50): Indicates strong bearish momentum that may be approaching exhaustion

- Extreme Boundaries (±95): Mark potentially unsustainable momentum levels where reversals become increasingly likely

These zones are displayed with gradient intensity that increases as the oscillator moves toward extremes, helping traders and investors:

→ Identify potential reversal zones

→ Determine appropriate entry and exit points

→ Gauge overall market sentiment strength

2. Customizable Trading Style Presets

The Aurora Flow Oscillator offers pre-configured settings for different trading approaches:

- Default (80,150): Balanced configuration suitable for most trading and investing situations.

- Scalping (5,80): Highly responsive settings for ultra-short-term trades. Generates frequent signals and catches quick price movements. Best for 1-15min charts when making many trades per day.

- Day Trading (8,120): Optimized for intraday movements with faster response than default settings while maintaining reasonable signal quality. Ideal for 5-60min or 4h-12h timeframes.

- Swing Trading (10,200): Designed for multi-day positions with stronger noise filtering. Focuses on capturing larger price swings while avoiding minor fluctuations. Works best on 1-4h and daily charts.

- Position Trading (14,250): For longer-term position traders/investors seeking significant market trends. Reduces false signals by heavily filtering market noise. Ideal for daily or even weekly charts.

- Trend Following (16,300): Maximum smoothing that prioritizes established directional movements over short-term fluctuations. Best used on daily and weekly charts, but can also be used for lower timeframe trading.

- Countertrend (7,100): Tuned to detect potential reversals and exhaustion points in trends. More sensitive to momentum shifts than other presets. Effective on 15min-4h charts, as well as daily and weekly charts.

Each preset automatically adjusts internal parameters for optimal performance in the selected trading context, providing flexibility across different market approaches without requiring complex manual configuration.

🟢 Practical Usage Tips

1/ Trend Analysis and Interpretation

→ Direction Assessment: Evaluate the oscillator's position relative to zero to determine underlying momentum bias

→ Momentum Strength: Measure the oscillator's distance from zero within the -100 to +100 range to quantify momentum magnitude

→ Trend Consistency: Monitor the oscillator's path for sustained directional movement without frequent zero-line crossings

→ Reversal Detection: Watch for oscillator divergence from price and deceleration of movement when approaching extreme zones

2/ Signal Generation Strategies

Depending on your trading approach, multiple signal strategies can be employed:

Trend Following Signals:

- Enter long positions when the oscillator crosses above zero

- Enter short positions when the oscillator crosses below zero

- Add to positions on pullbacks while maintaining the overall trend direction

Countertrend Signals:

- Look for potential reversals when the oscillator reaches extreme zones (±95)

- Enter contrary positions when momentum shows signs of exhaustion

- Use oscillator divergence with price as additional confirmation

Momentum Shift Signals:

- Enter positions when oscillator changes direction after establishing a trend

- Exit positions when oscillator direction reverses against your position

- Scale position size based on oscillator strength percentage

3/ Timeframe Optimization

The indicator can be effectively applied across different timeframes with these considerations:

Lower Timeframes (1-15min):

- Use Scalping or Day Trading presets

- Focus on quick momentum shifts and zero-line crossings

- Be cautious of noise in extreme market conditions

Medium Timeframes (30min-4h):

- Use Default or Swing Trading presets

- Look for established trends and potential reversal zones

- Combine with support/resistance analysis for entry/exit precision

Higher Timeframes (Daily+):

- Use Position Trading or Trend Following presets

- Focus on major trend identification and long-term positioning

- Use extreme zones for position management rather than immediate reversals

🟢 Pro Tips

Price Momentum Period:

→ Lower values (5-7) increase sensitivity to minor price fluctuations but capture more market noise

→ Higher values (10-16) emphasize sustained momentum shifts at the cost of delayed response

→ Adjust based on your timeframe (lower for shorter timeframes, higher for longer timeframes)

Oscillator Filter Period:

→ Lower values (80-120) produce more frequent directional changes and earlier response to momentum shifts

→ Higher values (200-300) filter out shorter-term fluctuations to highlight dominant market cycles

→ Match to your typical holding period (shorter holding time = lower filter values)

Multi-Timeframe Analysis:

→ Compare oscillator readings across different timeframes for confluence

→ Look for alignment between higher and lower timeframe signals

→ Use higher timeframe for trend direction, lower for earlier entries

Volatility-Adaptive Trading:

→ Use oscillator strength to adjust position sizing (stronger = larger)

→ Consider reducing exposure when oscillator reaches extreme zones

→ Implement tighter stops during periods of oscillator acceleration

Combination Strategies:

→ Pair with volume indicators for confirmation of momentum shifts

→ Use with support/resistance levels for strategic entry and exit points

→ Combine with volatility indicators for comprehensive market context

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

🎁🎄 Christmas SALE 50% Off with code XMAS50 (ends Dec 28) at whop.com/quantalgo/

📩 DM if you need any custom-built indicators or strategies.

📩 DM if you need any custom-built indicators or strategies.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

🎁🎄 Christmas SALE 50% Off with code XMAS50 (ends Dec 28) at whop.com/quantalgo/

📩 DM if you need any custom-built indicators or strategies.

📩 DM if you need any custom-built indicators or strategies.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.