OPEN-SOURCE SCRIPT

Rate Of Change - Weekly Signals

Rate of Change - Weekly Signals

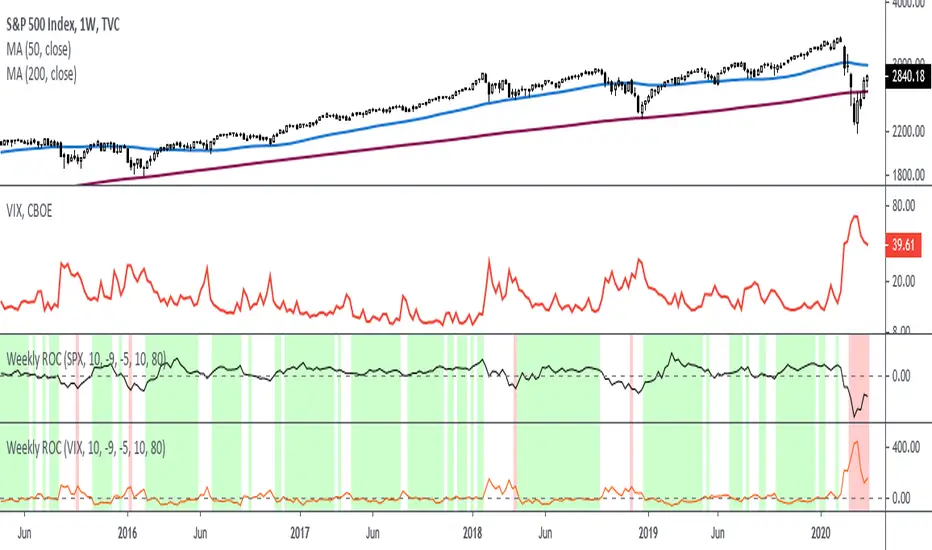

This indicator gives a potential "buy signal" using Rate of Change of SPX and VIX together,

using the following criteria:

SPX Weekly ROC(10) has been BELOW -9 and now rises ABOVE -5

*PLUS*

VIX Weekly ROC(10) has been ABOVE +80 and now falls BELOW +10

The background will turn RED when ROC(SPX) is below -9 and ROC(VIX) is above +80.

The background will turn GREEN when ROC(SPX) is above -5 and ROC(VIX) is below +10.

So the potential "buy signal" is when you start to get GREEN BARS AFTER RED - usually with

some white/empty bars in between...but wait for the green. This indicates that the volatility

has settled down, and the market is starting to turn up.

This indicator gives excellent entry points, but be careful of the occasional false signals.

See Nov. 2001 and Nov. 2008, in both cases the market dropped another 25-30% before the final

bottom was formed. Always have an exit strategy, especially when buying in after a downtrend.

How I use this indicator, pretty much as shown in the preview. Weekly SPX as the main chart with

some medium/long moving averages to identify the trend, VIX added as a "Compare Symbol" in red,

and then the Weekly ROC signals below.

For the ROC graphs, you can show SPX+VIX together, SPX alone, or VIX alone. I prefer to display

them separately because they don't scale well together (VIX crowds out the SPX when it spikes).

Background color is still based on both SPX/VIX together, regardless of which graph is shown.

Note that there is no VIX data available on Trading View prior to 1990, so for those dates the

formula is using only ROC(SPX) and the assigned thresholds (-9 and -5, or whatever you choose).

This indicator gives a potential "buy signal" using Rate of Change of SPX and VIX together,

using the following criteria:

SPX Weekly ROC(10) has been BELOW -9 and now rises ABOVE -5

*PLUS*

VIX Weekly ROC(10) has been ABOVE +80 and now falls BELOW +10

The background will turn RED when ROC(SPX) is below -9 and ROC(VIX) is above +80.

The background will turn GREEN when ROC(SPX) is above -5 and ROC(VIX) is below +10.

So the potential "buy signal" is when you start to get GREEN BARS AFTER RED - usually with

some white/empty bars in between...but wait for the green. This indicates that the volatility

has settled down, and the market is starting to turn up.

This indicator gives excellent entry points, but be careful of the occasional false signals.

See Nov. 2001 and Nov. 2008, in both cases the market dropped another 25-30% before the final

bottom was formed. Always have an exit strategy, especially when buying in after a downtrend.

How I use this indicator, pretty much as shown in the preview. Weekly SPX as the main chart with

some medium/long moving averages to identify the trend, VIX added as a "Compare Symbol" in red,

and then the Weekly ROC signals below.

For the ROC graphs, you can show SPX+VIX together, SPX alone, or VIX alone. I prefer to display

them separately because they don't scale well together (VIX crowds out the SPX when it spikes).

Background color is still based on both SPX/VIX together, regardless of which graph is shown.

Note that there is no VIX data available on Trading View prior to 1990, so for those dates the

formula is using only ROC(SPX) and the assigned thresholds (-9 and -5, or whatever you choose).

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.