OPEN-SOURCE SCRIPT

Telah dikemas kini [blackcat] L1 New TRIX Scalper

NOTE: Because the originally released script failed to comply with the House Rule in the description, it was banned. After revising and reviewing the description, it is republished again. Please forgive the inconvenience caused.

Level: 1

Background

The Triple Exponential Moving Average (TRIX) indicator is a strong technical analysis tool. It can help investors determine the price momentum and identify oversold and overbought signals in a financial asset. Jack Hutson is the creator of the TRIX indicator . He created it in the early 1980s to show the rate of change in a triple exponentially smoothed moving average.

When used as an oscillator, it shows a potential peak and trough price zones. A positive value tells traders that there is an overbought market while a negative value means an oversold market. When traders use TRIX as a momentum indicator, it filters spikes in the price that are vital to the general dominant trend.

A positive value means momentum is rising while a negative value means that momentum is reducing. A lot of analysts believe that when the TRIX crosses above the zero line it produces a buy signal, and when it closes below the zero line, it produces a sell signal.The indicator has three major components:

Function

The TRIX indicator determines overbought and oversold markets, and it can also be a momentum indicator. Just as it is with most oscillators, TRIX oscillates around a zero line. Additionally, divergences between price and TRIX can mean great turning points in the market. TRIX calculates a triple exponential moving average of the log of the price input. It calculates this based on the time specified by the length input for the current bar.

Trading TRIX indicator signals

Zero line cross

TRIX can help determine the impulse of the market. With the 0 value acting as a centerline, if it crosses from below, it will be mean that the impulse is growing in the market.Traders can, therefore, look for opportunities to place buy orders in the market. Similarly, a cross of the centerline from above will mean a shrinking impulse in the market. Traders can, therefore, look for opportunities to sell in the market.

Signal line cross

To select the best entry points, investors add a signal line on the TRIX indicator. The signal line is a moving average of the TRIX indicator, and due to this, it will lag behind the TRIX.A signal to place a buy order will occur when the TRIX crosses the signal line from below. In the same way, a signal to place a sell order will come up when the TRIX crosses the signal line from above. This is applicable in both trending and ranging markets.In trending markets, a signal line cross will indicate an end of the price retracement, and the main trend will resume. In ranging markets, a signal line confirms that resistance and support zones have been upheld in the market.

Divergences

Traders can use the Triple Exponential Average can to identify when important turning points can happen in the market. They can achieve this by looking at divergences. Divergences happen when the price is moving in the opposite direction as the TRIX indicator.When price makes higher highs but the TRIX makes lower highs, it means that the up-trend is weakening, and a bearish reversal is about to form. When the price makes lower lows, but the TRIX makes higher lows, it means that a bullish reversal is about to happen. Bullish and bearish divergences happen when the security and the indicator do not confirm themselves. A bullish divergence can happen when the security makes a lower low, but the indicator forms a higher low. This higher low means less downside momentum that may foreshadow a bullish reversal. A bearish divergence happens when the commodity makes a higher low, but the indicator forms a lower high. This lower high indicates weak upside momentum that can foreshadow a bearish reversal sometimes. Bearish divergences do not work well in strong uptrends. Even though momentum appears to be weakening due to the indicator is making lower highs, momentum still has a bullish bias as long as it is above its centerline.When bullish and bearish divergences work, they work very well. The secret is to separate the bad signals from the good signals.

Key Signal

RXval --> new TRIX indicator.

AvgTRX --> linear regression average of new TRIX indicator.

Remarks

This is a Level 1 free and open source indicator.

Feedbacks are appreciated.

Level: 1

Background

The Triple Exponential Moving Average (TRIX) indicator is a strong technical analysis tool. It can help investors determine the price momentum and identify oversold and overbought signals in a financial asset. Jack Hutson is the creator of the TRIX indicator . He created it in the early 1980s to show the rate of change in a triple exponentially smoothed moving average.

When used as an oscillator, it shows a potential peak and trough price zones. A positive value tells traders that there is an overbought market while a negative value means an oversold market. When traders use TRIX as a momentum indicator, it filters spikes in the price that are vital to the general dominant trend.

A positive value means momentum is rising while a negative value means that momentum is reducing. A lot of analysts believe that when the TRIX crosses above the zero line it produces a buy signal, and when it closes below the zero line, it produces a sell signal.The indicator has three major components:

- Zero line

- TRIX line (or histograms)

- Percentage Scale

Function

The TRIX indicator determines overbought and oversold markets, and it can also be a momentum indicator. Just as it is with most oscillators, TRIX oscillates around a zero line. Additionally, divergences between price and TRIX can mean great turning points in the market. TRIX calculates a triple exponential moving average of the log of the price input. It calculates this based on the time specified by the length input for the current bar.

Trading TRIX indicator signals

Zero line cross

TRIX can help determine the impulse of the market. With the 0 value acting as a centerline, if it crosses from below, it will be mean that the impulse is growing in the market.Traders can, therefore, look for opportunities to place buy orders in the market. Similarly, a cross of the centerline from above will mean a shrinking impulse in the market. Traders can, therefore, look for opportunities to sell in the market.

Signal line cross

To select the best entry points, investors add a signal line on the TRIX indicator. The signal line is a moving average of the TRIX indicator, and due to this, it will lag behind the TRIX.A signal to place a buy order will occur when the TRIX crosses the signal line from below. In the same way, a signal to place a sell order will come up when the TRIX crosses the signal line from above. This is applicable in both trending and ranging markets.In trending markets, a signal line cross will indicate an end of the price retracement, and the main trend will resume. In ranging markets, a signal line confirms that resistance and support zones have been upheld in the market.

Divergences

Traders can use the Triple Exponential Average can to identify when important turning points can happen in the market. They can achieve this by looking at divergences. Divergences happen when the price is moving in the opposite direction as the TRIX indicator.When price makes higher highs but the TRIX makes lower highs, it means that the up-trend is weakening, and a bearish reversal is about to form. When the price makes lower lows, but the TRIX makes higher lows, it means that a bullish reversal is about to happen. Bullish and bearish divergences happen when the security and the indicator do not confirm themselves. A bullish divergence can happen when the security makes a lower low, but the indicator forms a higher low. This higher low means less downside momentum that may foreshadow a bullish reversal. A bearish divergence happens when the commodity makes a higher low, but the indicator forms a lower high. This lower high indicates weak upside momentum that can foreshadow a bearish reversal sometimes. Bearish divergences do not work well in strong uptrends. Even though momentum appears to be weakening due to the indicator is making lower highs, momentum still has a bullish bias as long as it is above its centerline.When bullish and bearish divergences work, they work very well. The secret is to separate the bad signals from the good signals.

Key Signal

RXval --> new TRIX indicator.

AvgTRX --> linear regression average of new TRIX indicator.

Remarks

This is a Level 1 free and open source indicator.

Feedbacks are appreciated.

Nota Keluaran

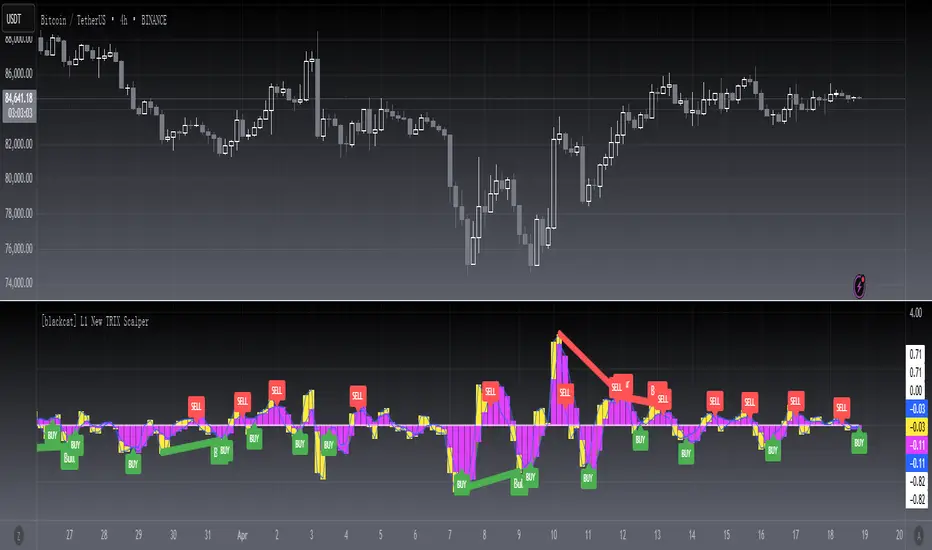

OVERVIEWThe [blackcat] L1 New TRIX Scalper is a TradingView script designed to help traders identify potential buy and sell signals using the TRIX (Triple Exponential Moving Average) indicator. This script calculates a custom TRIX value and plots it alongside its linear regression average. It also includes features for detecting divergences and provides alerts for trading opportunities.

The script is built with flexibility in mind, allowing users to customize various parameters such as the TRIX length, time series length, and level. It visually indicates long and short conditions with labels and supports alerts for real-time notifications.

The script is particularly useful for scalpers and day traders who rely on short-term price movements. It helps in identifying trends and potential reversals by analyzing the TRIX values and their interactions with the zero line and linear regression average.

FEATURES

Customizable TRIX and time series lengths.

Plots TRIX values and their linear regression average.

Visual indicators for long and short conditions.

Alerts for buy and sell signals.

Detection of bullish and bearish divergences.

Customizable lookback ranges for divergence detection.

Support for plotting hidden divergences.

HOW TO USE

Add the Script to Your Chart:

Open TradingView and go to the chart where you want to use the script.

Click on "Pine Editor" at the bottom of the screen.

Copy and paste the script code into the Pine Editor.

Click "Add to Chart" to apply the script.

Customize Inputs:

Adjust the following inputs according to your preferences:

Price Source: Select the price source (e.g., close, open, high, low).

TRIX Length: Set the length for the TRIX calculation.

TS Length: Set the length for the time series linear regression.

Level: Set the level for the TRIX calculation.

Pivot Lookback Right/Left: Set the lookback periods for pivot detection.

Max/Min Lookback Range: Set the maximum and minimum lookback ranges for divergence detection.

Plot Options: Enable or disable plotting of bullish, hidden bullish, bearish, and hidden bearish divergences.

Interpret the Plot:

The script plots the TRIX value and its linear regression average.

Long conditions are indicated by green "BUY" labels.

Short conditions are indicated by red "SELL" labels.

Divergences are plotted with different colors and labels based on the type of divergence.

Set Up Alerts:

Go to the "Alerts" tab in TradingView.

Create new alerts for the conditions defined in the script (e.g., "Alert on LONG", "Alert on SHORT").

Configure the alert actions (e.g., email, webhook, sound) as needed.

LIMITATIONS

The script relies heavily on the TRIX indicator, which may not be suitable for all market conditions.

Divergence detection is based on pivot points, which can sometimes be noisy in volatile markets.

Customization options are extensive but may require some trial and error to find the optimal settings.

NOTES

Ensure that you understand the TRIX indicator and its implications before using this script.

Always backtest the script with historical data before applying it to live trading.

Use the script as part of a broader trading strategy that includes risk management and other technical analysis tools.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Avoid losing contact!Don't miss out! The first and most important thing to do is to join my Discord chat now! Click here to start your adventure: discord.com/invite/ZTGpQJq 防止失联,请立即行动,加入本猫聊天群: discord.com/invite/ZTGpQJq

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.