OPEN-SOURCE SCRIPT

Telah dikemas kini Dynamic Breakout Master by tradingbauhaus

🌟 Code Description:

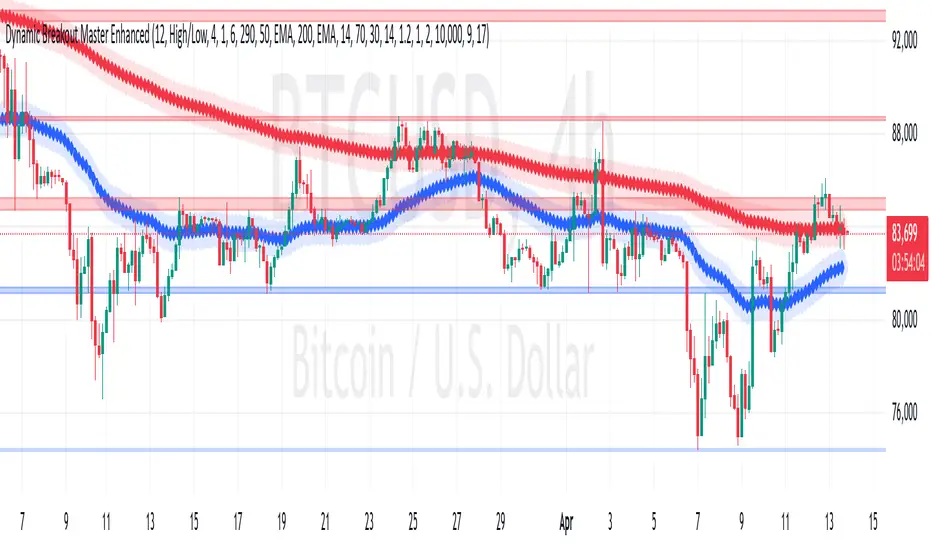

This Pine Script implements a trading strategy called "Dynamic Breakout Master" 💥. The core idea of the strategy is to identify breakouts (price movements) at key support 💙 and resistance 🔴 levels, through a dynamic channel that adapts to the market’s conditions. Here's how it works:

🔧 Customizable Input Parameters:

🧭 Pivot Period: This defines the number of bars (candles) to the left and right used to detect pivots (highs and lows) that mark the support and resistance zones.

📊 Data Source: You can choose whether to use highs and lows or closes and opens of the candles to identify the pivots.

📏 Max Channel Width: Specifies the maximum width allowed for the support/resistance channel, expressed as a percentage over the last 300 bars.

💪 Minimum Pivot Strength: This defines the minimum number of pivots needed for a support or resistance level to be considered valid.

🏔 Max Support/Resistance Zones: Limits the number of key zones displayed on the chart.

📅 Lookback Period: Adjusts how many bars back the system should check to find and validate support and resistance levels.

🎨 Custom Colors: You can choose colors for the support, resistance, and in-channel zones.

📉 Moving Averages (MA): The strategy allows adding up to two moving averages (SMA or EMA) to assist in making trading decisions.

📊 Calculating Support/Resistance Levels:

The system uses an algorithm to identify pivots from prices and calculates dynamic support and resistance zones 🔒🔓.

The closer the pivots are and the stronger their influence, the more relevant the zone becomes for the strategy.

The dynamic channel is drawn on the chart, with a maximum width limit for these zones defined by the input parameter.

📈 Trading Logic:

🚀 Identifying Breakouts:

The strategy looks for when the price breaks (breakouts) a resistance or support level.

If the price breaks upward through the resistance level, a buy order 📈 is triggered.

If the price breaks downward through the support level, a sell order 📉 is triggered.

🔔 Alerts:

Resistance Break (ResBreak) and Support Break (SupBreak) alerts are configured to notify users when a significant breakout occurs.

💰 Commissions:

The strategy includes a commission (0.1%) to simulate transaction costs for each trade.

📊 Chart Visualization:

The support and resistance zones are displayed as colored rectangles:

🔴 Resistance (red) and

🔵 Support (blue).

Pivots of support and resistance can be labeled as P (for resistance) and V (for support).

Breakouts of support or resistance levels are marked with triangles that appear on the chart 🔺🔻.

📈 Trading Strategy:

If the price breaks upward through the resistance level, a long position (buy) 📈 is opened.

If the price breaks downward through the support level, a short position (sell) 📉 is opened.

🏆 Conclusion:

This script is a dynamic breakout strategy 💥 that allows traders to capture significant price movements when support or resistance channels break. The customizable parameters let users fine-tune the strategy according to their preferences, while the visual alerts on the chart make it easier to follow trading opportunities. The inclusion of moving averages and key price zones adds an extra layer of analysis to improve decision-making 💡.

This Pine Script implements a trading strategy called "Dynamic Breakout Master" 💥. The core idea of the strategy is to identify breakouts (price movements) at key support 💙 and resistance 🔴 levels, through a dynamic channel that adapts to the market’s conditions. Here's how it works:

🔧 Customizable Input Parameters:

🧭 Pivot Period: This defines the number of bars (candles) to the left and right used to detect pivots (highs and lows) that mark the support and resistance zones.

📊 Data Source: You can choose whether to use highs and lows or closes and opens of the candles to identify the pivots.

📏 Max Channel Width: Specifies the maximum width allowed for the support/resistance channel, expressed as a percentage over the last 300 bars.

💪 Minimum Pivot Strength: This defines the minimum number of pivots needed for a support or resistance level to be considered valid.

🏔 Max Support/Resistance Zones: Limits the number of key zones displayed on the chart.

📅 Lookback Period: Adjusts how many bars back the system should check to find and validate support and resistance levels.

🎨 Custom Colors: You can choose colors for the support, resistance, and in-channel zones.

📉 Moving Averages (MA): The strategy allows adding up to two moving averages (SMA or EMA) to assist in making trading decisions.

📊 Calculating Support/Resistance Levels:

The system uses an algorithm to identify pivots from prices and calculates dynamic support and resistance zones 🔒🔓.

The closer the pivots are and the stronger their influence, the more relevant the zone becomes for the strategy.

The dynamic channel is drawn on the chart, with a maximum width limit for these zones defined by the input parameter.

📈 Trading Logic:

🚀 Identifying Breakouts:

The strategy looks for when the price breaks (breakouts) a resistance or support level.

If the price breaks upward through the resistance level, a buy order 📈 is triggered.

If the price breaks downward through the support level, a sell order 📉 is triggered.

🔔 Alerts:

Resistance Break (ResBreak) and Support Break (SupBreak) alerts are configured to notify users when a significant breakout occurs.

💰 Commissions:

The strategy includes a commission (0.1%) to simulate transaction costs for each trade.

📊 Chart Visualization:

The support and resistance zones are displayed as colored rectangles:

🔴 Resistance (red) and

🔵 Support (blue).

Pivots of support and resistance can be labeled as P (for resistance) and V (for support).

Breakouts of support or resistance levels are marked with triangles that appear on the chart 🔺🔻.

📈 Trading Strategy:

If the price breaks upward through the resistance level, a long position (buy) 📈 is opened.

If the price breaks downward through the support level, a short position (sell) 📉 is opened.

🏆 Conclusion:

This script is a dynamic breakout strategy 💥 that allows traders to capture significant price movements when support or resistance channels break. The customizable parameters let users fine-tune the strategy according to their preferences, while the visual alerts on the chart make it easier to follow trading opportunities. The inclusion of moving averages and key price zones adds an extra layer of analysis to improve decision-making 💡.

Nota Keluaran

What does the strategy do?The strategy identifies and trades breakouts and pullbacks at dynamic support and resistance levels in any financial instrument (stocks, forex, cryptocurrencies, etc.). Its goal is to capture significant price movements when the price breaks through a key zone or retraces to it, maximizing profit opportunities while managing risk.

Core Mechanics

1. Identifying Key Levels:

Detects dynamic support and resistance levels using pivot highs and lows, adjusted by a configurable period (default: 12 bars).

Groups these levels into "zones" based on a maximum channel width (default: 4% of recent range), ensuring only the most relevant levels are used.

2. Entry Signals:

Breakouts: Enters a long position (buy) when the price breaks above a resistance, or a short position (sell) when it breaks below a support, provided additional filters are met.

Pullbacks: Enters a long position if the price retraces to a broken resistance (now support) or a short position if it retraces to a broken support (now resistance).

Filters:

Trend: Uses two moving averages (EMA/SMA of 50 and 200 periods) to confirm a bullish trend (for longs) or bearish trend (for shorts).

RSI: Ensures the RSI (14 periods) is in a healthy range (30-70) to avoid overbought/oversold conditions.

Volatility: Requires the ATR (14 periods) to exceed a threshold (1.2x) to confirm sufficient price movement.

Volume: Demands volume above the 20-period average to validate the strength of the move.

Trading Hours: Restricts trades to a configurable time window (default: 9:00-17:00) to avoid low-liquidity periods.

3. Risk Management:

Calculates position size based on a fixed risk per trade (default: 1% of capital, adjustable).

Sets a stop-loss at 1.5x ATR to protect against adverse moves.

Defines a take-profit with a configurable risk-reward ratio (default: 2:1).

Includes a trailing stop to lock in profits during extended moves.

4. Exit Signals:

Automatically closes positions if:

RSI indicates overbought (>80 for longs) or oversold (<20 for shorts).

Moving averages cross against the position (e.g., fast MA crosses below slow MA for longs).

Executes exits via stop-loss, take-profit, or trailing stop based on defined rules.

5. Visualization:

Draws support (blue) and resistance (red) zones on the chart, with a neutral color (gray) for in-channel zones.

Optionally displays pivots and breakouts with visual markers for easier analysis.

Benefits for Users

Automation: Trades without manual intervention, ideal for users seeking a systematic approach.

Flexibility: Customizable for different markets (forex, stocks, crypto) and timeframes (1H, 4H, daily, etc.) via parameters like myperiod, mychannelwidth, or reward_ratio.

Robust Risk Management: Limits losses and optimizes gains with stop-loss, take-profit, and trailing stops based on volatility (ATR).

Signal Filtering: Reduces false trades using technical indicators (RSI, moving averages, volume) and time restrictions.

Clear Visualization: Support/resistance zones and visual alerts help users understand price behavior.

Alerts: Generates notifications for long/short entries and breakouts, useful for traders blending manual and automated trading.

How Users Apply It

1. Setup:

Load the script in TradingView's Pine Editor and apply it to a chart (e.g., EURUSD 1H).

Adjust parameters in the settings window:

Change myperiod (e.g., 8-15) for more/less pivot sensitivity.

Modify reward_ratio (e.g., 1.5-3.0) to balance risk-reward.

Set trading hours based on the market (e.g., 9:00-17:00 for stocks).

2. Backtesting:

Use TradingView's "Strategy Tester" to simulate performance on historical data.

Evaluate metrics like win rate, net profit, and drawdown.

Tweak parameters if signals are too few or losses are high.

3. Live Trading:

Connect the strategy to a TradingView-compatible broker (if supported) or use alerts for manual execution.

Monitor drawn zones and alerts to confirm signals visually.

4. Optimization:

Experiment with mychannelwidth (3-5%) for tighter zones.

Lower atr_multiplier (e.g., 1.0) in volatile markets for closer stops.

Test on liquid markets (e.g., forex majors, indices) for better results.

Limitations

Volatility Dependence: May generate few signals in sideways or low-volatility markets.

Parameter Sensitivity: Performance varies with settings like myperiod, mychannelwidth, or atr_multiplier, requiring market-specific tuning.

Overfitting Risk: Excessive backtest optimization may not translate to live trading.

Time Restrictions: Trading hour limits may miss opportunities outside the set window.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Join my trading community on Discord! 📈 Use all our indicators for FREE

discord.gg/xPEDcNEupw

discord.gg/xPEDcNEupw

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Join my trading community on Discord! 📈 Use all our indicators for FREE

discord.gg/xPEDcNEupw

discord.gg/xPEDcNEupw

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.