OPEN-SOURCE SCRIPT

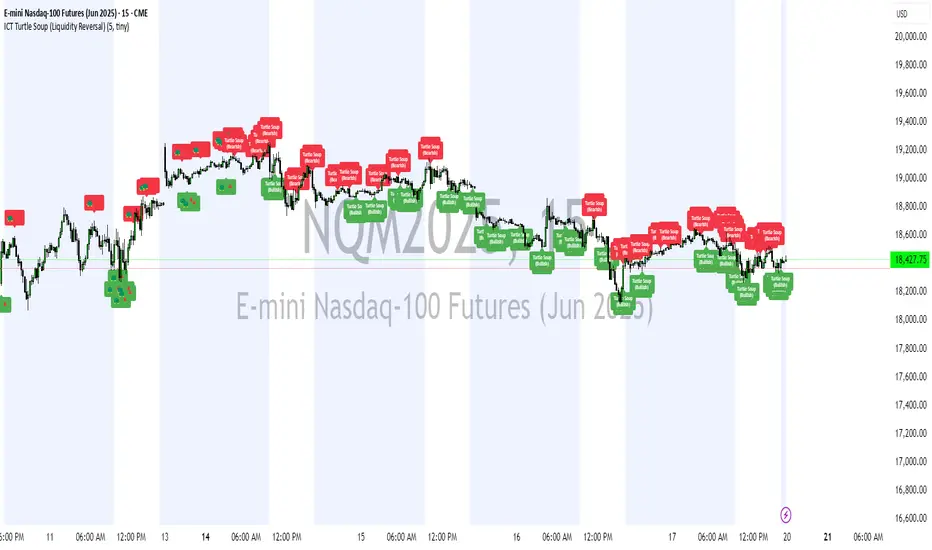

ICT Turtle Soup (Liquidity Reversal)

ICT Turtle Soup — Liquidity Reversal Detection

Classic Liquidity Trap Reversal Strategy for Smart Money Traders

This indicator implements the ICT Turtle Soup concept — a classic liquidity-based reversal pattern — which occurs when price runs above or below a recent swing level to grab liquidity, then sharply reverses. This pattern is commonly used in Smart Money Concepts (SMC) and Inner Circle Trader (ICT) strategies to anticipate false breakouts and high-probability reversals.

🔍 What This Script Does:

Identifies Swing Highs & Lows

Detects recent swing highs and lows using a customizable lookback period.

Tracks Liquidity Grabs

A bearish Turtle Soup setup is triggered when price breaks above a recent swing high but closes back below it.

A bullish Turtle Soup setup is triggered when price breaks below a recent swing low but closes back above it.

These conditions often signal liquidity traps, where price sweeps resting orders before reversing.

Plots Signals Directly on the Chart

Turtle Soup setups are marked with 🐢🔻 (bearish) and 🐢🔺 (bullish) labels.

Optional full-text labels can also be displayed for clarity and journaling.

Includes Alert Conditions

Alerts can be enabled to notify you of bullish or bearish Turtle Soup reversals in real-time.

⚙️ Customization Features:

Adjustable swing lookback period

Enable/disable Turtle Soup labels

Set label font size

Choose your preferred bullish/bearish signal colors

💡 How to Use:

Add this script to your chart (ideally on intraday timeframes such as 5m–15m).

Wait for a Turtle Soup signal near a key swing high/low or liquidity zone.

Combine with other confirmation tools (e.g., FVGs, Order Blocks, OTE) for stronger setups.

Use alerts to stay ahead of fast-moving reversals.

🧠 Why It Works:

Turtle Soup setups are rooted in liquidity theory — they exploit the market’s tendency to sweep obvious swing levels before reversing. These moves often trap retail traders and mark the beginning of Smart Money entries.

🔗 Best Used With:

Maximize the edge by combining this with other SMC tools:

✅ First FVG — Opening Range Fair Value Gap Detector

✅ ICT SMC Liquidity Grabs + OB + Fibonacci OTE Levels

✅ Liquidity Levels — Smart Swing Lows

Together, they create a complete ecosystem for identifying, confirming, and executing liquidity-driven trade setups with precision.

Classic Liquidity Trap Reversal Strategy for Smart Money Traders

This indicator implements the ICT Turtle Soup concept — a classic liquidity-based reversal pattern — which occurs when price runs above or below a recent swing level to grab liquidity, then sharply reverses. This pattern is commonly used in Smart Money Concepts (SMC) and Inner Circle Trader (ICT) strategies to anticipate false breakouts and high-probability reversals.

🔍 What This Script Does:

Identifies Swing Highs & Lows

Detects recent swing highs and lows using a customizable lookback period.

Tracks Liquidity Grabs

A bearish Turtle Soup setup is triggered when price breaks above a recent swing high but closes back below it.

A bullish Turtle Soup setup is triggered when price breaks below a recent swing low but closes back above it.

These conditions often signal liquidity traps, where price sweeps resting orders before reversing.

Plots Signals Directly on the Chart

Turtle Soup setups are marked with 🐢🔻 (bearish) and 🐢🔺 (bullish) labels.

Optional full-text labels can also be displayed for clarity and journaling.

Includes Alert Conditions

Alerts can be enabled to notify you of bullish or bearish Turtle Soup reversals in real-time.

⚙️ Customization Features:

Adjustable swing lookback period

Enable/disable Turtle Soup labels

Set label font size

Choose your preferred bullish/bearish signal colors

💡 How to Use:

Add this script to your chart (ideally on intraday timeframes such as 5m–15m).

Wait for a Turtle Soup signal near a key swing high/low or liquidity zone.

Combine with other confirmation tools (e.g., FVGs, Order Blocks, OTE) for stronger setups.

Use alerts to stay ahead of fast-moving reversals.

🧠 Why It Works:

Turtle Soup setups are rooted in liquidity theory — they exploit the market’s tendency to sweep obvious swing levels before reversing. These moves often trap retail traders and mark the beginning of Smart Money entries.

🔗 Best Used With:

Maximize the edge by combining this with other SMC tools:

✅ First FVG — Opening Range Fair Value Gap Detector

✅ ICT SMC Liquidity Grabs + OB + Fibonacci OTE Levels

✅ Liquidity Levels — Smart Swing Lows

Together, they create a complete ecosystem for identifying, confirming, and executing liquidity-driven trade setups with precision.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.