OPEN-SOURCE SCRIPT

Auto Faust

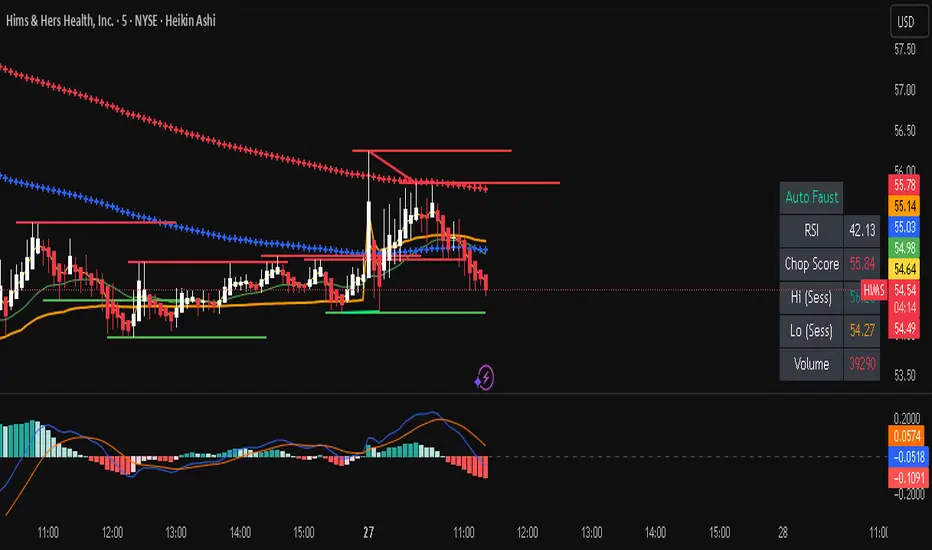

Auto Faust – Intraday Market Context & Structure

Auto Faust is a visual market overlay designed for intraday traders who want fast context without relying on signals or automation. It combines classic price tools — VWAP, EMAs, RSI, Chop Score, and market structure trendlines — into a single glanceable dashboard.

🔍 What It Does:

VWAP (Volume Weighted Average Price): Shows the day's fair value price anchor.

EMAs (3, 21, 113, 200): Map short-term to long-term trend alignment. Crossovers can be used for confluence or caution.

RSI (10): Monitors local momentum. Displayed in a compact table.

Chop Score: Measures how directional price action is. High chop = ranging conditions; low = trending.

Session High/Low Tracker: Tracks the daily extremes in real-time.

Volume Monitor: Shows current candle volume, color-coded vs previous bar (green = higher, red = lower).

Dynamic Support & Resistance Lines: Plotted from pivot highs/lows (not static levels).

Automatic Trendlines: Drawn from swing structure, updating live.

📊 How to Use:

Use EMAs + VWAP alignment to assess directional bias.

Confirm clean trends with low Chop Score and RSI support.

Watch for price interaction around dynamic S/R lines and trendline breaks.

Use volume coloring to assess if momentum is increasing or fading.

No buy/sell signals are generated — this is a trader-facing tool to guide discretionary decision-making.

Auto Faust is a visual market overlay designed for intraday traders who want fast context without relying on signals or automation. It combines classic price tools — VWAP, EMAs, RSI, Chop Score, and market structure trendlines — into a single glanceable dashboard.

🔍 What It Does:

VWAP (Volume Weighted Average Price): Shows the day's fair value price anchor.

EMAs (3, 21, 113, 200): Map short-term to long-term trend alignment. Crossovers can be used for confluence or caution.

RSI (10): Monitors local momentum. Displayed in a compact table.

Chop Score: Measures how directional price action is. High chop = ranging conditions; low = trending.

Session High/Low Tracker: Tracks the daily extremes in real-time.

Volume Monitor: Shows current candle volume, color-coded vs previous bar (green = higher, red = lower).

Dynamic Support & Resistance Lines: Plotted from pivot highs/lows (not static levels).

Automatic Trendlines: Drawn from swing structure, updating live.

📊 How to Use:

Use EMAs + VWAP alignment to assess directional bias.

Confirm clean trends with low Chop Score and RSI support.

Watch for price interaction around dynamic S/R lines and trendline breaks.

Use volume coloring to assess if momentum is increasing or fading.

No buy/sell signals are generated — this is a trader-facing tool to guide discretionary decision-making.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.