OPEN-SOURCE SCRIPT

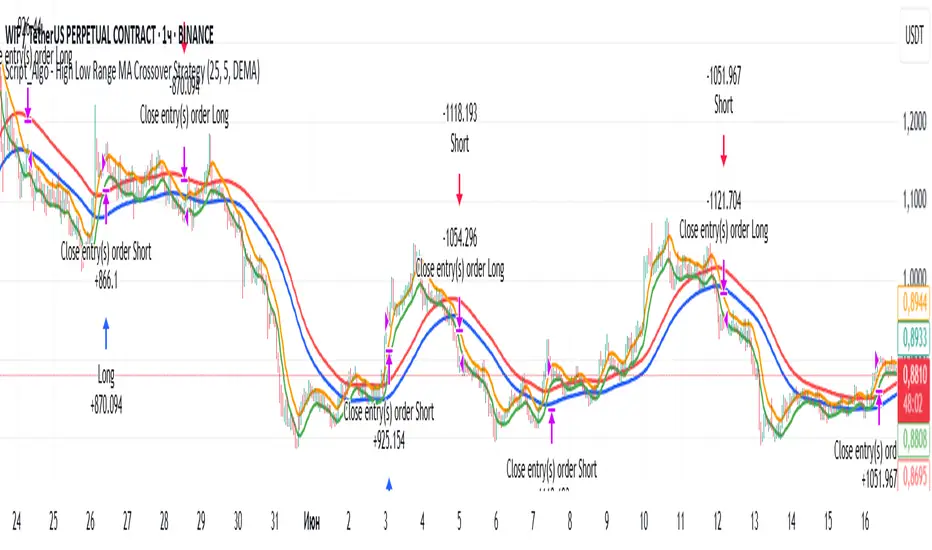

Script_Algo - High Low Range MA Crossover Strategy

🎯 Core Concept

This strategy uses modified moving averages crossover, built on maximum and minimum prices, to determine entry and exit points in the market. A key advantage of this strategy is that it avoids most false signals in trendless conditions, which is characteristic of traditional moving average crossover strategies. This makes it possible to improve the risk/reward ratio and, consequently, the strategy's profitability.

📊 How the Strategy Works

Main Mechanism

The strategy builds 4 moving averages:

Two senior MAs (on high and low) with a longer period

Two junior MAs (on high and low) with a shorter period

Buy signal 🟢: when the junior MA of lows crosses above the senior MA of highs

Sell signal 🔴: when the junior MA of highs crosses below the senior MA of lows

As seen on the chart, it was potentially possible to make 9X on the WIFUSDT cryptocurrency pair in just a year and a half. However, be careful—such results may not necessarily be repeated in the future.

Special Feature

Position closing priority ❗: if an opposite signal arrives while a position is open, the strategy first closes the current position and only then opens a new one

⚙️ Indicator Settings

Available Moving Average Types

EMA - Exponential MA

SMA - Simple MA

SSMA - Smoothed MA

WMA - Weighted MA

VWMA - Volume Weighted MA

RMA - Adaptive MA

DEMA - Double EMA

TEMA - Triple EMA

Adjustable Parameters

Senior MA Length - period for long-term moving averages

Junior MA Length - period for short-term moving averages

✅ Advantages of the Strategy

🛡️ False Signal Protection - using two pairs of modified MAs reduces the number of false entries

🔄 Configuration Flexibility - ability to choose MA type and calculation periods

⚡ Automatic Switching - the strategy automatically closes the current position when receiving an opposite signal

📈 Visual Clarity - all MAs are displayed on the chart in different colors

⚠️ Disadvantages and Risks

📉 Signal Lag - like all MA-based strategies, it may provide delayed signals during sharp movements

🔁 Frequent Switching - in sideways markets, it may lead to multiple consecutive position openings/closings

📊 Requires Optimization - optimal parameters need to be selected for different instruments and timeframes

💡 Usage Recommendations

Backtest - test the strategy's performance on historical data

Optimize Parameters - select MA periods suitable for the specific trading instrument

Use Filters - add additional filters to confirm signals

Manage Risks - always use stop-loss and take-profit orders.

You can safely connect to the exchange via webhook and enjoy trading.

Good luck and profits to everyone!!

This strategy uses modified moving averages crossover, built on maximum and minimum prices, to determine entry and exit points in the market. A key advantage of this strategy is that it avoids most false signals in trendless conditions, which is characteristic of traditional moving average crossover strategies. This makes it possible to improve the risk/reward ratio and, consequently, the strategy's profitability.

📊 How the Strategy Works

Main Mechanism

The strategy builds 4 moving averages:

Two senior MAs (on high and low) with a longer period

Two junior MAs (on high and low) with a shorter period

Buy signal 🟢: when the junior MA of lows crosses above the senior MA of highs

Sell signal 🔴: when the junior MA of highs crosses below the senior MA of lows

As seen on the chart, it was potentially possible to make 9X on the WIFUSDT cryptocurrency pair in just a year and a half. However, be careful—such results may not necessarily be repeated in the future.

Special Feature

Position closing priority ❗: if an opposite signal arrives while a position is open, the strategy first closes the current position and only then opens a new one

⚙️ Indicator Settings

Available Moving Average Types

EMA - Exponential MA

SMA - Simple MA

SSMA - Smoothed MA

WMA - Weighted MA

VWMA - Volume Weighted MA

RMA - Adaptive MA

DEMA - Double EMA

TEMA - Triple EMA

Adjustable Parameters

Senior MA Length - period for long-term moving averages

Junior MA Length - period for short-term moving averages

✅ Advantages of the Strategy

🛡️ False Signal Protection - using two pairs of modified MAs reduces the number of false entries

🔄 Configuration Flexibility - ability to choose MA type and calculation periods

⚡ Automatic Switching - the strategy automatically closes the current position when receiving an opposite signal

📈 Visual Clarity - all MAs are displayed on the chart in different colors

⚠️ Disadvantages and Risks

📉 Signal Lag - like all MA-based strategies, it may provide delayed signals during sharp movements

🔁 Frequent Switching - in sideways markets, it may lead to multiple consecutive position openings/closings

📊 Requires Optimization - optimal parameters need to be selected for different instruments and timeframes

💡 Usage Recommendations

Backtest - test the strategy's performance on historical data

Optimize Parameters - select MA periods suitable for the specific trading instrument

Use Filters - add additional filters to confirm signals

Manage Risks - always use stop-loss and take-profit orders.

You can safely connect to the exchange via webhook and enjoy trading.

Good luck and profits to everyone!!

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.