PROTECTED SOURCE SCRIPT

Telah dikemas kini Separators & Liquidity [K]

Separators & Liquidity [K]

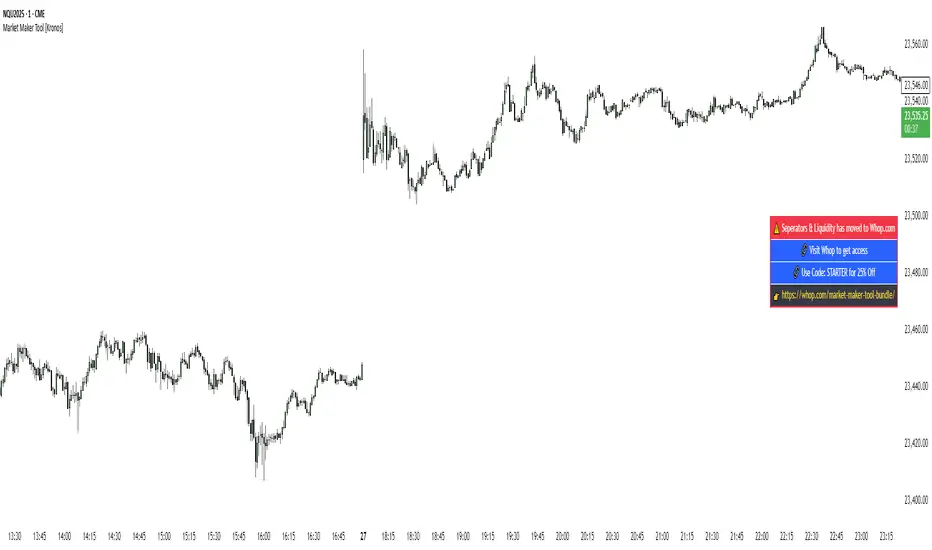

This indicator offers a unified visual framework for institutional price behaviour, combining calendar-based levels, intraday session liquidity, and opening price anchors. It is specifically designed for ICT-inspired traders who rely on time-of-day context, prior high/low sweeps, and mitigation dynamics to structure their trading decisions.

Previous Day, Week, and Month Highs/Lows

These levels are dynamically updated and optionally stop projecting forward once mitigated. Mitigation is defined as a confirmed price interaction (touch or break), and labels visually adjust upon confirmation.

Intraday Session Liquidity Zones

Includes:

Asia Session (18:00–02:30 EST)

London Session (02:00–07:00 EST)

New York AM Session (07:00–11:30 EST)

New York Lunch Session (11:30–13:00 EST)

Each session tracks its own high/low with mitigation logic and duplicate filtering to avoid plotting overlapping levels when values are identical to previous session or daily levels.

Opening Price Anchors

Plots key opens:

Midnight (00:00 EST) (Customizable)

New York Open (09:30 EST) (Customizable)

PM Session Open (13:30 EST) (Customizable)

Weekly Open

Monthly Open

These levels serve as orientation for daily range expansion/contraction and premium/discount analysis.

Time Labels

Includes weekday markers and mid-month labels for better visual navigation on intraday and higher timeframes.

All components feature user-defined controls for visibility, line extension, color, label size, and plotting style. Filtering logic prevents redundant lines and maintains chart clarity.

Originality and Justification

While elements such as daily highs/lows and session ranges exist in other indicators, this script combines them under a fully mitigation-aware, duplicate-filtering, and session-synchronized logic model. Each level is tracked and managed independently, but drawn cooperatively using a shared visual and behavioral control system.

This script is not a mashup but an integrated tool designed to support precise execution timing, market structure analysis, and liquidity-based interpretation within ICT-style trading frameworks.

This version does not reuse any code from open-source scripts, and no built-in indicators are merged. The logic is independently constructed for real-time tracking and multi-session visualization.

Inspiration

This tool is inspired by core ICT concepts and time-based session structures commonly discussed in educational content and the broader ICT community.

It also draws conceptual influence from the TFO Killzones & Pivots script by tradeforopp, particularly in the spirit of time-based liquidity tracking and institutional session segmentation. This script was developed independently but aligns in purpose. Full credit is given to TFO as an inspiration source, especially for traders using similar timing models.

Intended Audience

Designed for traders studying or applying:

ICT’s core market structure principles

Power of Three (PO3) setups

Session bias models (e.g., AM reversals, London continuations)

Liquidity sweep and mitigation analysis

Time-of-day-based confluence planning

The script provides structural levels—not signals—and is intended for visual scaffolding around discretionary execution strategies.

This indicator offers a unified visual framework for institutional price behaviour, combining calendar-based levels, intraday session liquidity, and opening price anchors. It is specifically designed for ICT-inspired traders who rely on time-of-day context, prior high/low sweeps, and mitigation dynamics to structure their trading decisions.

Previous Day, Week, and Month Highs/Lows

These levels are dynamically updated and optionally stop projecting forward once mitigated. Mitigation is defined as a confirmed price interaction (touch or break), and labels visually adjust upon confirmation.

Intraday Session Liquidity Zones

Includes:

Asia Session (18:00–02:30 EST)

London Session (02:00–07:00 EST)

New York AM Session (07:00–11:30 EST)

New York Lunch Session (11:30–13:00 EST)

Each session tracks its own high/low with mitigation logic and duplicate filtering to avoid plotting overlapping levels when values are identical to previous session or daily levels.

Opening Price Anchors

Plots key opens:

Midnight (00:00 EST) (Customizable)

New York Open (09:30 EST) (Customizable)

PM Session Open (13:30 EST) (Customizable)

Weekly Open

Monthly Open

These levels serve as orientation for daily range expansion/contraction and premium/discount analysis.

Time Labels

Includes weekday markers and mid-month labels for better visual navigation on intraday and higher timeframes.

All components feature user-defined controls for visibility, line extension, color, label size, and plotting style. Filtering logic prevents redundant lines and maintains chart clarity.

Originality and Justification

While elements such as daily highs/lows and session ranges exist in other indicators, this script combines them under a fully mitigation-aware, duplicate-filtering, and session-synchronized logic model. Each level is tracked and managed independently, but drawn cooperatively using a shared visual and behavioral control system.

This script is not a mashup but an integrated tool designed to support precise execution timing, market structure analysis, and liquidity-based interpretation within ICT-style trading frameworks.

This version does not reuse any code from open-source scripts, and no built-in indicators are merged. The logic is independently constructed for real-time tracking and multi-session visualization.

Inspiration

This tool is inspired by core ICT concepts and time-based session structures commonly discussed in educational content and the broader ICT community.

It also draws conceptual influence from the TFO Killzones & Pivots script by tradeforopp, particularly in the spirit of time-based liquidity tracking and institutional session segmentation. This script was developed independently but aligns in purpose. Full credit is given to TFO as an inspiration source, especially for traders using similar timing models.

Intended Audience

Designed for traders studying or applying:

ICT’s core market structure principles

Power of Three (PO3) setups

Session bias models (e.g., AM reversals, London continuations)

Liquidity sweep and mitigation analysis

Time-of-day-based confluence planning

The script provides structural levels—not signals—and is intended for visual scaffolding around discretionary execution strategies.

Nota Keluaran

This is a major update, bringing a host of powerful new features and a more organized settings menu! We've focused on adding key institutional levels and improving the overall user experience.What's New:

🔧 Restructured Settings & New NY PM Session

The input menu has been completely reorganized with clear sections for a cleaner, more intuitive experience.

Added the NY PM Session to the Intraday Liquidity tools, completing the full New York trading day analysis.

📈 New Levels: All-Time High & Yearly Open

All-Time High (ATH): A new, fully dynamic ATH line that tracks the absolute highest price in real-time.

Yearly Open (YO): You can now display the yearly opening price, a key level for long-term market analysis.

📊 Opening Gap Analysis: NWOG & NDOG

Introducing New Week Opening Gaps (NWOG) and New Day Opening Gaps (NDOG).

This tool automatically draws boxes to highlight price gaps between the previous close and the new session's open, providing valuable insight into market imbalances.

🖼️ New Chart Watermark

A clean, customizable watermark now displays the Date, Ticker Symbol, and Timeframe directly on your chart.

Perfect for keeping your analysis organized and for sharing clear screenshots.

⚠️ IMPORTANT NOTICE: Upcoming Renaming

Please be aware that this indicator is scheduled for a significant update in the near future which will include a name change to better reflect its expanded capabilities.

When this happens, the current "Separators & Liquidity [Kronos]" script will be deprecated and will stop working.

We will make this transition obvious by causing the old indicator to throw an error that will redirect you to the new version. You will simply need to remove the old indicator from your chart and apply the new one. Thank you for your understanding as we continue to improve this tool.

Happy trading

Nota Keluaran

Minor Bug Fixes.New Features

- Added 08:30 Opening Line

- Added Custom Opening Line

Nota Keluaran

More Bug Fixes And New Extra Settings For NWOG And NDOG, Like A Text Label. Nota Keluaran

https://whop.com/market-maker-toolsThis tool now is available on Whop.

Nota Keluaran

Link updateNota Keluaran

https://whop.com/market-maker-tool-bundle/Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya dengan percuma dan tanpa had – ketahui lebih lanjut di sini.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.