PROTECTED SOURCE SCRIPT

Fractal Time Grid

Overview

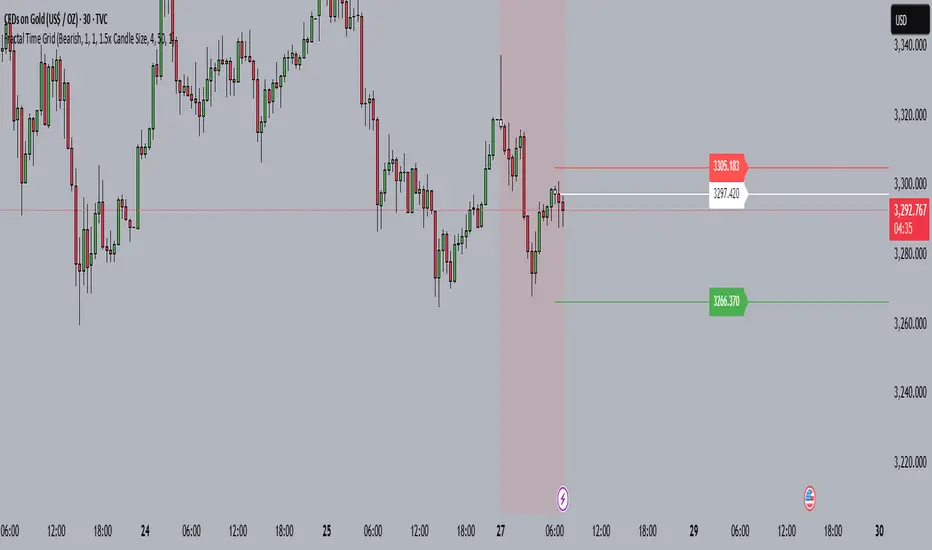

The Fractal Time Grid is a Pine-Script v5 TradingView indicator designed to automate session-based entries, stops, and targets. It overlays on your chart, shading trading “quarters” of any chosen timezone, highlighting bullish or bearish bias zones, and marking up to N entries per quarter with on-chart signals. Optional SL/TP rays and built-in alerts make it a one-stop tool for disciplined session trading.

1. User Inputs

All inputs appear in the indicator’s Settings panel:

Category Input Description

Trend & History Trend Source („Auto“, Bull, Bear) Auto-detects daily bias or forces Bull/Bear

History (days) (≥1) How far back (in days) to keep session shading active

Session Limits Max Entries per 6H Quarter (1–10) Caps how many signals you’ll get in each 6-hour window

Risk Management & Visuals Show Entry/SL/TP Rays (On/Off) Toggles horizontal lines and price labels

SL Method („Bar High/Low“ or „1.5× Candle“) How the stop-loss distance is calculated

Risk:Reward Ratio (e.g. 4.0) Multiplier applied to SL distance to plot TP

Ray Length (bars) (≥1) How far right SL/TP rays extend

Session Timing Timezone Offset (hours, –12 to +14) Shifts session shading to your local clock

Colors Bullish/Bearish Session BG opacity Semi-transparent fill for bias zones

Entry candle colors (Bull/Bear) Highlights actual entry bars

2. Bias Determination

Daily Close vs. Open

Fetches prior-day open/close via request.security(..., "D", …)

If close > open → bullish bias; close < open → bearish

Manual Override

“Bullish” or “Bearish” mode forces one direction

“Auto” follows daily bias

3. Time-Grid Logic

Timezone Handling

Converts UTC bar timestamps by your tzOffset input

Quarter Windows (6H each)

Q1: 23:00–05:00 local

Q2: 05:00–11:00

Q3: 11:00–17:00

Q4: 17:00–23:00

Session Shading

During Q1–Q3 (configurable days back), background colored to match bias

4. Entry Logic

Conditions:

Within an active quarter, bias must match candle direction (bullish candle in bullish quarter, etc.)

Entry count for the quarter must be below your maximum

Counters:

Automatically resets on quarter switch

Tracks how many entries you’ve taken, preventing over-trading

5. Visual Signals

Bar Coloring: Flags entry bars green/red

Shape Markers:

BUY label below bar for long entries

SELL label above bar for shorts

6. Optional SL/TP Rays

When “Show Entry/SL/TP Rays” is enabled:

Computes SL distance either from bar high/low or a multiple of candle size

TP = SL × R:R ratio

Draws three horizontal rays (entry, SL, TP) with end-of-ray price labels

7. Alerts

Pre-built alertcondition calls let you create TradingView alerts instantly:

Names: “BUY Alert” and “SELL Alert”

Messages:

arduino

Copy

Edit

BUY {{ticker}} at {{close}} – Q{{quarter}} – {{entryCount}}/{{maxEntriesQuarter}} entries

(same format for SELL)

8. Why Publish This?

Discipline Built-In: Caps over-trading per session

Timezone-Agnostic: Works equally for NY, London, Tokyo sessions

All-in-One: Bias, timing, entries, risk and alerts in one script

Fully Customizable: Colors, risk settings, time windows, and more

The Fractal Time Grid is a Pine-Script v5 TradingView indicator designed to automate session-based entries, stops, and targets. It overlays on your chart, shading trading “quarters” of any chosen timezone, highlighting bullish or bearish bias zones, and marking up to N entries per quarter with on-chart signals. Optional SL/TP rays and built-in alerts make it a one-stop tool for disciplined session trading.

1. User Inputs

All inputs appear in the indicator’s Settings panel:

Category Input Description

Trend & History Trend Source („Auto“, Bull, Bear) Auto-detects daily bias or forces Bull/Bear

History (days) (≥1) How far back (in days) to keep session shading active

Session Limits Max Entries per 6H Quarter (1–10) Caps how many signals you’ll get in each 6-hour window

Risk Management & Visuals Show Entry/SL/TP Rays (On/Off) Toggles horizontal lines and price labels

SL Method („Bar High/Low“ or „1.5× Candle“) How the stop-loss distance is calculated

Risk:Reward Ratio (e.g. 4.0) Multiplier applied to SL distance to plot TP

Ray Length (bars) (≥1) How far right SL/TP rays extend

Session Timing Timezone Offset (hours, –12 to +14) Shifts session shading to your local clock

Colors Bullish/Bearish Session BG opacity Semi-transparent fill for bias zones

Entry candle colors (Bull/Bear) Highlights actual entry bars

2. Bias Determination

Daily Close vs. Open

Fetches prior-day open/close via request.security(..., "D", …)

If close > open → bullish bias; close < open → bearish

Manual Override

“Bullish” or “Bearish” mode forces one direction

“Auto” follows daily bias

3. Time-Grid Logic

Timezone Handling

Converts UTC bar timestamps by your tzOffset input

Quarter Windows (6H each)

Q1: 23:00–05:00 local

Q2: 05:00–11:00

Q3: 11:00–17:00

Q4: 17:00–23:00

Session Shading

During Q1–Q3 (configurable days back), background colored to match bias

4. Entry Logic

Conditions:

Within an active quarter, bias must match candle direction (bullish candle in bullish quarter, etc.)

Entry count for the quarter must be below your maximum

Counters:

Automatically resets on quarter switch

Tracks how many entries you’ve taken, preventing over-trading

5. Visual Signals

Bar Coloring: Flags entry bars green/red

Shape Markers:

BUY label below bar for long entries

SELL label above bar for shorts

6. Optional SL/TP Rays

When “Show Entry/SL/TP Rays” is enabled:

Computes SL distance either from bar high/low or a multiple of candle size

TP = SL × R:R ratio

Draws three horizontal rays (entry, SL, TP) with end-of-ray price labels

7. Alerts

Pre-built alertcondition calls let you create TradingView alerts instantly:

Names: “BUY Alert” and “SELL Alert”

Messages:

arduino

Copy

Edit

BUY {{ticker}} at {{close}} – Q{{quarter}} – {{entryCount}}/{{maxEntriesQuarter}} entries

(same format for SELL)

8. Why Publish This?

Discipline Built-In: Caps over-trading per session

Timezone-Agnostic: Works equally for NY, London, Tokyo sessions

All-in-One: Bias, timing, entries, risk and alerts in one script

Fully Customizable: Colors, risk settings, time windows, and more

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip dilindungi

Skrip ini diterbitkan sebagai sumber tertutup. Akan tetapi, anda boleh menggunakannya secara bebas dan tanpa apa-apa had – ketahui lebih di sini.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.