OPEN-SOURCE SCRIPT

Gaussian Smooth Trend | QuantEdgeB

🧠 Introducing Gaussian Smooth Trend (GST) by QuantEdgeB

🛠️ Overview

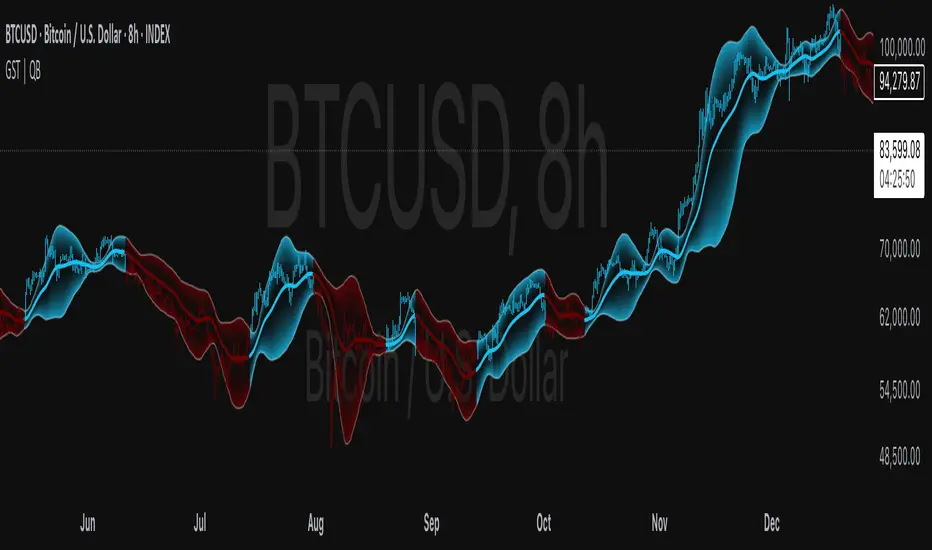

Gaussian Smooth Trend (GST) is an advanced volatility-filtered trend-following system that blends multiple smoothing techniques into a single directional bias tool. It is purpose-built to reduce noise, isolate meaningful price shifts, and deliver early trend detection while dynamically adapting to market volatility.

GST leverages the Gaussian filter as its core engine, wrapped in a layered framework of DEMA smoothing, SMMA signal tracking, and standard deviation-based breakout thresholds, producing a powerful toolset for trend confirmation and momentum-based decision-making.

🔍 How It Works

1️⃣ DEMA Smoothing Engine

The indicator begins by calculating a Double Exponential Moving Average (DEMA), which provides a responsive and noise-resistant base input for subsequent filtering.

2️⃣ Gaussian Filter

A custom Gaussian kernel is applied to the DEMA signal, allowing the system to detect smooth momentum shifts while filtering out short-term volatility.

This is especially powerful during low-volume or sideways markets where traditional MAs struggle.

3️⃣ SMMA Layer with Z-Filtering

The filtered Gaussian signal is then passed through a custom Smoothed Moving Average (SMMA). A standard deviation envelope is constructed around this SMMA, dynamically expanding/contracting based on market volatility.

4️⃣ Signal Generation

• ✅ Long Signal: Price closes above Upper SD Band

• ❌ Short Signal: Price closes below Lower SD Band

• ➖ No trade: Price stays within the band → market indecision

✨ Key Features

🔹 Multi-Stage Trend Detection

Combines DEMA → Gaussian Kernel → SMMA → SD Bands for robust signal integrity across market conditions.

🔹 Gaussian Adaptive Filtering

Applies a tunable sigma parameter for the Gaussian kernel, enabling you to fine-tune smoothness vs. responsiveness.

🔹 Volatility-Aware Trend Zones

Price must close outside of dynamic SD envelopes to trigger signals — reducing whipsaws and increasing signal quality.

🔹 Dynamic Color-Coded Visualization

Candle coloring and band fills reflect live trend state, making the chart intuitive and fast to read.

⚙️ Custom Settings

• DEMA Source: Price stream used for smoothing (default: close)

• DEMA Length: Period for initial exponential smoothing (default: 7)

• Gaussian Length / Sigma: Controls smoothing strength of kernel filter

• SMMA Length: Final smoothing layer (default: 12)

• SD Length: Lookback period for standard deviation filtering (default: 30)

• SD Mult Up / Down: Adjusts distance of upper/lower breakout zones (default: 2.5 / 1.8)

• Color Modes: Six distinct color palettes (e.g., Strategy, Warm, Cool)

• Signal Labels: Toggle on/off entry markers ("𝓛𝓸𝓷𝓰", "𝓢𝓱𝓸𝓻𝓽")

📌 Trading Applications

✅ Trend-Following → Enter on confirmed breakouts from Gaussian-smoothed volatility zones

✅ Breakout Validation → Use SD bands to avoid false breakouts during chop

✅ Volatility Compression Monitoring → Narrowing bands often precede large directional moves

✅ Overlay-Based Confirmation → Can complement other QuantEdgeB indicators like K-DMI, BMD, or Z-SMMA

📌 Conclusion

Gaussian Smooth Trend (GST) delivers a precision-built trend model tailored for modern traders who demand both clarity and control. The layered signal architecture, combined with volatility awareness and Gaussian signal enhancement, ensures accurate entries, clean visualizations, and actionable trend structure — all in real-time.

🔹 Summary Highlights

1️⃣ Multi-stage Smoothing — DEMA → Gaussian → SMMA for deep signal integrity

2️⃣ Volatility-Aware Filtering — SD bands prevent false entries

3️⃣ Visual Trend Mapping — Gradient fills + candle coloring for clean charts

4️⃣ Highly Customizable — Adapt to your timeframe, style, and volatility

📌 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

📌 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

🛠️ Overview

Gaussian Smooth Trend (GST) is an advanced volatility-filtered trend-following system that blends multiple smoothing techniques into a single directional bias tool. It is purpose-built to reduce noise, isolate meaningful price shifts, and deliver early trend detection while dynamically adapting to market volatility.

GST leverages the Gaussian filter as its core engine, wrapped in a layered framework of DEMA smoothing, SMMA signal tracking, and standard deviation-based breakout thresholds, producing a powerful toolset for trend confirmation and momentum-based decision-making.

🔍 How It Works

1️⃣ DEMA Smoothing Engine

The indicator begins by calculating a Double Exponential Moving Average (DEMA), which provides a responsive and noise-resistant base input for subsequent filtering.

2️⃣ Gaussian Filter

A custom Gaussian kernel is applied to the DEMA signal, allowing the system to detect smooth momentum shifts while filtering out short-term volatility.

This is especially powerful during low-volume or sideways markets where traditional MAs struggle.

3️⃣ SMMA Layer with Z-Filtering

The filtered Gaussian signal is then passed through a custom Smoothed Moving Average (SMMA). A standard deviation envelope is constructed around this SMMA, dynamically expanding/contracting based on market volatility.

4️⃣ Signal Generation

• ✅ Long Signal: Price closes above Upper SD Band

• ❌ Short Signal: Price closes below Lower SD Band

• ➖ No trade: Price stays within the band → market indecision

✨ Key Features

🔹 Multi-Stage Trend Detection

Combines DEMA → Gaussian Kernel → SMMA → SD Bands for robust signal integrity across market conditions.

🔹 Gaussian Adaptive Filtering

Applies a tunable sigma parameter for the Gaussian kernel, enabling you to fine-tune smoothness vs. responsiveness.

🔹 Volatility-Aware Trend Zones

Price must close outside of dynamic SD envelopes to trigger signals — reducing whipsaws and increasing signal quality.

🔹 Dynamic Color-Coded Visualization

Candle coloring and band fills reflect live trend state, making the chart intuitive and fast to read.

⚙️ Custom Settings

• DEMA Source: Price stream used for smoothing (default: close)

• DEMA Length: Period for initial exponential smoothing (default: 7)

• Gaussian Length / Sigma: Controls smoothing strength of kernel filter

• SMMA Length: Final smoothing layer (default: 12)

• SD Length: Lookback period for standard deviation filtering (default: 30)

• SD Mult Up / Down: Adjusts distance of upper/lower breakout zones (default: 2.5 / 1.8)

• Color Modes: Six distinct color palettes (e.g., Strategy, Warm, Cool)

• Signal Labels: Toggle on/off entry markers ("𝓛𝓸𝓷𝓰", "𝓢𝓱𝓸𝓻𝓽")

📌 Trading Applications

✅ Trend-Following → Enter on confirmed breakouts from Gaussian-smoothed volatility zones

✅ Breakout Validation → Use SD bands to avoid false breakouts during chop

✅ Volatility Compression Monitoring → Narrowing bands often precede large directional moves

✅ Overlay-Based Confirmation → Can complement other QuantEdgeB indicators like K-DMI, BMD, or Z-SMMA

📌 Conclusion

Gaussian Smooth Trend (GST) delivers a precision-built trend model tailored for modern traders who demand both clarity and control. The layered signal architecture, combined with volatility awareness and Gaussian signal enhancement, ensures accurate entries, clean visualizations, and actionable trend structure — all in real-time.

🔹 Summary Highlights

1️⃣ Multi-stage Smoothing — DEMA → Gaussian → SMMA for deep signal integrity

2️⃣ Volatility-Aware Filtering — SD bands prevent false entries

3️⃣ Visual Trend Mapping — Gradient fills + candle coloring for clean charts

4️⃣ Highly Customizable — Adapt to your timeframe, style, and volatility

📌 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

📌 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

🔹 Get access to our premium tools:

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

🔹 Get access to our premium tools:

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.