OPEN-SOURCE SCRIPT

Price Heat Meter [ChartPrime]

⯁ OVERVIEW

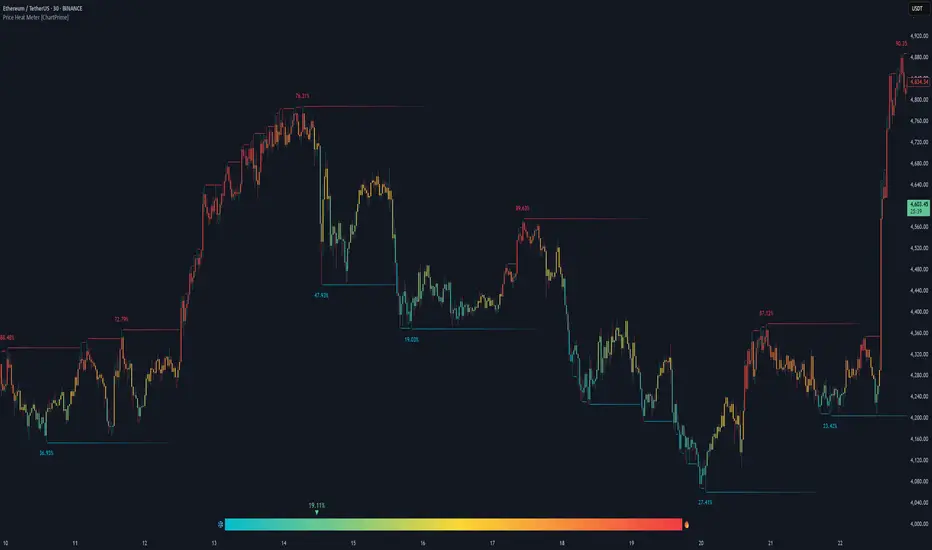

Price Heat Meter [ChartPrime] visualizes where price sits inside its recent range and turns that into an intuitive “temperature” read. Using rolling extremes, candles fade from ❄️ aqua (cold) near the lower bound to 🔥 red (hot) near the upper bound. The tool also trails recent extreme levels, tags unusually persistent extremes with a % “heat” label, and shows a bottom gauge (0–100%) with a live arrow so you can read market heat at a glance.

⯁ KEY FEATURES

⯁ HOW IT WORKS (UNDER THE HOOD)

⯁ USAGE

⯁ WHY IT’S UNIQUE

Rather than another oscillator, Price Heat Meter translates simple market geometry (rolling extremes) into a readable temperature layer with time-aware extremes and a synchronized gauge. You get a continuously updated sense of stretch, persistence, and potential reversal context—without clutter or overfitting.

Price Heat Meter [ChartPrime] visualizes where price sits inside its recent range and turns that into an intuitive “temperature” read. Using rolling extremes, candles fade from ❄️ aqua (cold) near the lower bound to 🔥 red (hot) near the upper bound. The tool also trails recent extreme levels, tags unusually persistent extremes with a % “heat” label, and shows a bottom gauge (0–100%) with a live arrow so you can read market heat at a glance.

⯁ KEY FEATURES

- Rolling Heat Map (0–100%):

The script measures where the close sits between the current Lowest Low and Highest High over the chosen Length (default 50).

Candles use a two-stage gradient: aqua → yellow (0–50%), then yellow → red (50–100%). This makes “how stretched are we?” instantly visible. - Dynamic Extremes with Time Decay:

When a new rolling High or Low is set, the script starts a faint horizontal trail at that price. Each bar that passes without a new extreme increases a counter; the line’s color gradually fades over time and fully disappears after ~100 bars, keeping the chart clean. - Persistent-Extreme Tags (Reversal Hints):

If an extreme persists for 40 bars (i.e., price hasn’t reclaimed or surpassed it), the tool stamps the original extreme pivot with its recorded Heat% at the moment the extreme formed.

• Upper extremes print a red % label (possible exhaustion/resistance context).

• Lower extremes print an aqua % label (possible exhaustion/support context). - Bottom Heat Gauge (0–100% Scale):

A compact, gradient bar renders at the bottom center showing the current Heat% with an arrow/label. ❄️ anchors the left (0%), 🔥 anchors the right (100%). The arrow adopts the same candle heat color for consistency. - Minimal Inputs, Clear Theme:

• Length (lookback window for H/L)

• Heat Color set (Cold / Mid / Hot)

The defaults give a balanced, legible gradient on most assets/timeframes. - Signal Hygiene by Design:

The meter doesn’t “call” reversals. Instead, it contextualizes price within its range and highlights the aging of extremes. That keeps it robust across regimes and assets, and ideal as a confluence layer with your existing triggers.

⯁ HOW IT WORKS (UNDER THE HOOD)

- Range Model:

H = Highest(High, Length), L = Lowest(Low, Length). Heat% = 100 × (Close − L) / (H − L). - Extreme Tracking & Fade:

When High == H, we record/update the current upper extreme; same for Low == L on the lower side. If the extreme doesn’t change on the next bar, a counter increments and the plotted line’s opacity shifts along a 0→100 fade scale (visual decay). - 40-Bar Persistence Labels:

On the bar after the extreme forms, the code stores the bar_index and the contemporaneous Heat%. If the extreme survives 40 bars, it places a % label at the original pivot price and index—flagging levels that were meaningfully “tested by time.” - Unified Color Logic:

Both candles and the gauge use the same two-stage gradient (Cold→Mid, then Mid→Hot), so your eye reads “heat” consistently across all elements.

⯁ USAGE

- Treat >80% as “hot” and <20% as “cold” context; combine with your trigger (e.g., structure, OB, div, breakouts) instead of acting on heat alone.

- Watch persistent extreme labels (40-bar marks) as reference zones for reaction or liquidity grabs.

- Use the fading extreme lines as a memory map of where price last stretched—levels that slowly matter less as they decay.

- Tighten Length for intraday sensitivity or increase it for swing stability.

⯁ WHY IT’S UNIQUE

Rather than another oscillator, Price Heat Meter translates simple market geometry (rolling extremes) into a readable temperature layer with time-aware extremes and a synchronized gauge. You get a continuously updated sense of stretch, persistence, and potential reversal context—without clutter or overfitting.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.