OPEN-SOURCE SCRIPT

Ehlers Two-Pole Stochastic

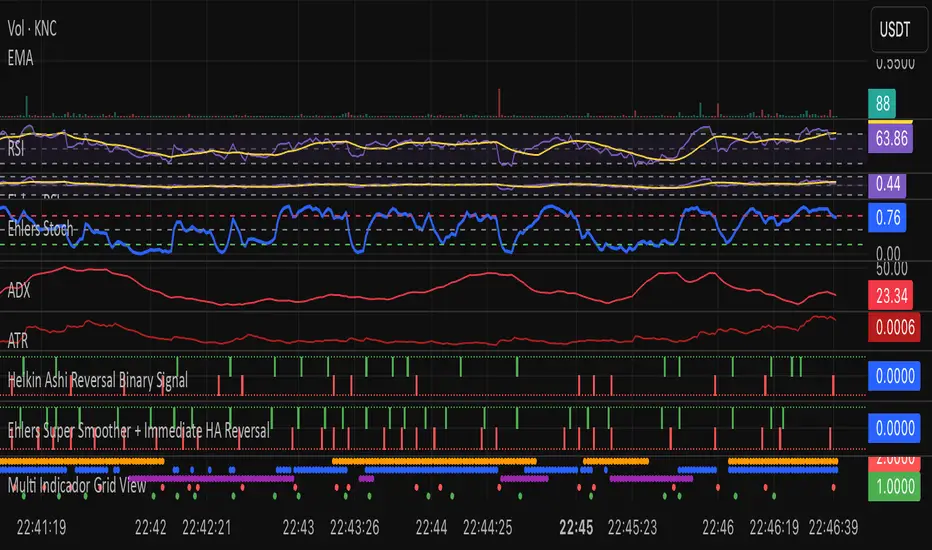

This indicator implements John Ehlers' Two-Pole Stochastic Filter, a smoother alternative to the traditional stochastic oscillator. Instead of relying on raw %K values, it applies a second-order IIR filter (recursive smoothing) to reduce noise and improve trend clarity.

It outputs a single line oscillating between 0 and 1, with less lag and false signals compared to standard stochastic implementations.

Key Features:

Uses a two-pole filter to smooth the normalized stochastic (%K).

Ideal for detecting clean reversals and trend continuations.

Designed for minimal visual noise and greater signal confidence.

Interpretation:

Values near 1.0 may suggest overbought conditions.

Values near 0.0 may suggest oversold conditions.

Crosses above 0.5 can signal bullish shifts, and below 0.5 bearish shifts.

Recommended Settings:

Default smoothing factor (alpha) is 0.7 — higher values make the output more responsive, while lower values smooth further.

Inspired by concepts from Cybernetic Analysis for Stocks and Futures by John F. Ehlers.

It outputs a single line oscillating between 0 and 1, with less lag and false signals compared to standard stochastic implementations.

Key Features:

Uses a two-pole filter to smooth the normalized stochastic (%K).

Ideal for detecting clean reversals and trend continuations.

Designed for minimal visual noise and greater signal confidence.

Interpretation:

Values near 1.0 may suggest overbought conditions.

Values near 0.0 may suggest oversold conditions.

Crosses above 0.5 can signal bullish shifts, and below 0.5 bearish shifts.

Recommended Settings:

Default smoothing factor (alpha) is 0.7 — higher values make the output more responsive, while lower values smooth further.

Inspired by concepts from Cybernetic Analysis for Stocks and Futures by John F. Ehlers.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.