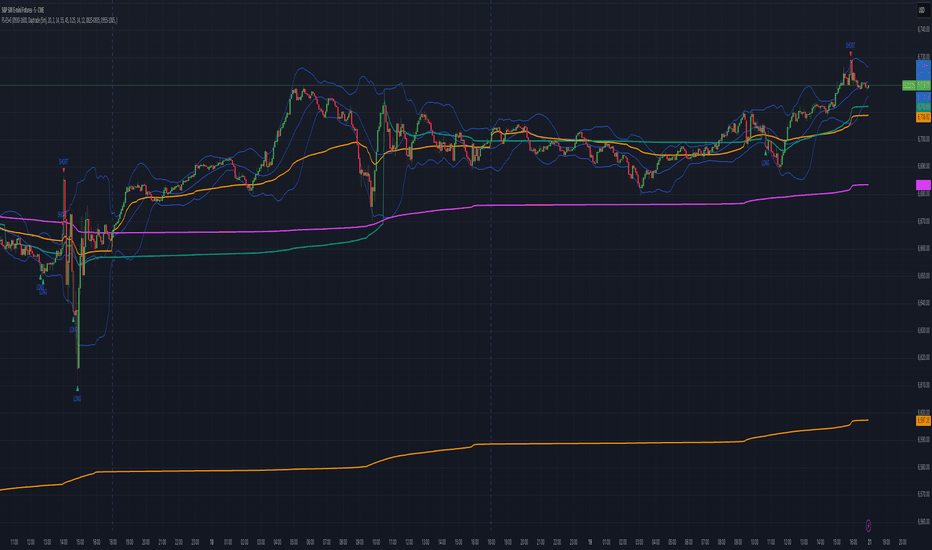

KD-NewAutoTrade for Future Trading - Heikin Ashi candles The KD-NewAutoTrade strategy is a dynamic trend-following indicator designed for scalping and swing trading across crypto, forex, and index futures. It combines the precision of EMA crossovers, RSI momentum, and ADX trend strength to deliver clear Buy/Sell signals with high reliability.

🔹 Core Logic

EMA Fast & Slow Crossover – Identifies short-term and long-term trend shifts.

RSI Confirmation – Filters out false signals by requiring RSI to cross custom Buy/Sell thresholds.

ADX Filter – Ensures trades only trigger when market trend strength exceeds your chosen ADX minimum.

🔹 Key Features

Visual Buy/Sell triangles directly on the chart.

Customizable inputs for EMA, RSI, and ADX lengths.

Works efficiently on all timeframes and all markets (Crypto, Indices, Stocks, Commodities).

Optional background highlights for active trade zones.

Alert conditions for both BUY and SELL setups – ready to use in automated strategies or alert bots.

🔹 Recommended Usage

Use Heikin Ashi candles

Works best on 1M - 5M timeframes.

Combine with volume or higher-timeframe trend confirmation for stronger signals.

Bollinger Bands (BB)

Liquidity & Momentum Master (LMM)💎 Liquidity & Momentum Master (LMM)

A professional dual-system indicator that combines:

📦 High-Volume Support/Resistance Zones and

📊 RSI + Bollinger Band Combo Signals — to visualize both smart money footprints and momentum reversals in one clean tool.

🧱 1. High-Volume Liquidity Zones (Support/Resistance Boxes)

Conditions

Visible only on 1H and higher timeframes (1H, 4H, 1D, etc.)

Detects candles with abnormally high volume and strong ATR-based range

Separates bullish (support) and bearish (resistance) zones

Visualization

All boxes are white, with adjustable transparency (alphaW, alphaBorder)

Each box extends to the right automatically

Only the most important (Top-N) zones are kept — weaker ones are removed automatically

Interpretation

White boxes = price areas with heavy liquidity and volume concentration

Price approaching these zones often leads to bounces or rejections

Narrow spacing = consolidation, wide spacing = potential large move

💎 2. RSI Exit + BB-RSI Combo Signals

RSI Exit (Overbought/Oversold Recovery)

RSI drops from overbought (>70) → plots red “RSI” above the candle

RSI rises from oversold (<30) → plots green “RSI” below the candle

Works on 15m, 30m, 1H, 4H, 1D

→ Indicates short-term exhaustion recovery

BB-RSI Combo (Momentum Reversal Confirmation)

Active on 1H and higher only

Requires both:

✅ RSI divergence (bullish or bearish)

✅ Bollinger Band re-entry (after temporary breakout)

Combo Buy (Green Diamond)

Bullish RSI divergence

Candle closes back above lower Bollinger Band

Combo Sell (Red Diamond)

Bearish RSI divergence

Candle closes back below upper Bollinger Band

→ Confirms stronger reversal momentum compared to standard RSI signals

RSI Exit + BB-RSI Combo📊 RSI Exit + BB-RSI Combo Indicator

This indicator combines RSI overbought/oversold exit signals with Bollinger Band re-entry conditions to highlight potential reversal or retracement zones.

1️⃣ RSI Exit Signal

- When RSI drops below 70 after being overbought → 🔴 "RSI" label

- When RSI rises above 30 after being oversold → 🟢 "RSI" label

- Works on 15m / 30m / 1h / 4h / 1D timeframes

2️⃣ BB-RSI Combo Signal

- When an RSI divergence forms and

- The candle body re-enters the Bollinger Band on 1H+ timeframe

→ Combo signal (💎 diamond) is shown

💡 How to Use

- Use RSI exit signals to spot overextension corrections

- Use combo signals to identify high-probability reversal or rebound setups

- Suitable for both swing and short-term trading

Volume Weighted Bollinger BandsThis indicator provides a customizable version of Bollinger Bands, enhanced with optional volume weighting and a method for decomposing market volatility.

Key Features:

Volatility Decomposition: The indicator's primary feature is its ability to separate total volatility, controlled by the 'Estimate Bar Statistics' option.

Standard Mode (Estimate Bar Statistics = OFF): The indicator functions as a customizable Bollinger Band. It calculates the standard deviation of the user-selected Source and plots a single set of bands.

Decomposition Mode (Estimate Bar Statistics = ON): The indicator uses a statistical model ('Estimator') to calculate within-bar volatility. (Assumption: In this mode, the Source input is ignored, and an estimated mean for each bar is used instead). This mode displays two sets of bands:

Inner Bands: Show only the contribution of the 'between-bar' volatility.

Outer Bands: Show the total volatility (the sum of between-bar and within-bar components).

Customizable Construction: The indicator is a hybrid:

Basis Line: The central line is calculated using a selectable Moving Average type (e.g., EMA, SMA, WMA).

Volume Weighting: An option (Volume weighted) allows for volume to be incorporated into the calculation of both the basis MA and the volatility decomposition.

Logarithmic Scaling: An optional 'Normalize' mode calculates the bands on a logarithmic scale. This results in bands that maintain a constant percentage distance from the basis, suitable for analyzing exponential markets.

Multi-Timeframe (MTF) Engine: The indicator includes an MTF conversion block. When a Higher Timeframe (HTF) is selected, advanced options become available: Fill Gaps handles data gaps, and Wait for timeframe to close prevents repainting by ensuring the indicator only updates when the HTF bar closes.

Integrated Alerts: Includes a full set of built-in alerts for the source price crossing over or under the central MA line and the outermost calculated volatility band.

DISCLAIMER

For Informational/Educational Use Only: This indicator is provided for informational and educational purposes only. It does not constitute financial, investment, or trading advice, nor is it a recommendation to buy or sell any asset.

Use at Your Own Risk: All trading decisions you make based on the information or signals generated by this indicator are made solely at your own risk.

No Guarantee of Performance: Past performance is not an indicator of future results. The author makes no guarantee regarding the accuracy of the signals or future profitability.

No Liability: The author shall not be held liable for any financial losses or damages incurred directly or indirectly from the use of this indicator.

Signals Are Not Recommendations: The alerts and visual signals (e.g., crossovers) generated by this tool are not direct recommendations to buy or sell. They are technical observations for your own analysis and consideration.

SFC Bollinger Band and Bandit概述 (Overview)

SFC 布林通道與海盜策略 (SFC Bollinger Band and Bandit Strategy) 是一個基於 Pine Script™ v6 的技術分析指標,結合布林通道 (Bollinger Bands)、移動平均線 (Moving Averages) 以及布林海盜 (Bollinger Bandit) 交易策略,旨在為交易者提供多時間框架的趨勢分析與進出場訊號。該腳本支援風險管理功能,並提供視覺化圖表與交易訊號提示,適用於多種金融市場。

This script, written in Pine Script™ v6, combines Bollinger Bands, Moving Averages, and the Bollinger Bandit strategy to provide traders with multi-timeframe trend analysis and entry/exit signals. It includes risk management features and visualizes data through charts and trading signals, suitable for various financial markets.

功能特點 (Key Features)

布林通道 (Bollinger Bands)

提供可調整的標準差參數 (σ1, σ2),支援多層布林通道顯示。

進場訊號基於價格穿越布林通道上下軌,並結合連續K線確認機制。

Provides adjustable standard deviation parameters (σ1, σ2) for multi-layer Bollinger Bands display.

Entry signals are based on price crossing the upper/lower bands, combined with a consecutive bar confirmation mechanism.

移動平均線 (Moving Averages)

支援簡單移動平均線 (SMA) 或指數移動平均線 (EMA),可自訂快、中、慢線週期。

Supports Simple Moving Average (SMA) or Exponential Moving Average (EMA) with customizable fast, medium, and slow line periods.

布林海盜策略 (Bollinger Bandit Strategy)

基於變動率 (ROC) 與布林通道動態止損,提供做多與做空訊號。

包含動態止損均線與平倉天數設定,增強交易靈活性。

Utilizes Rate of Change (ROC) and Bollinger Bands with dynamic stop-loss for long and short signals.

Includes dynamic stop-loss moving average and liquidation days for enhanced trading flexibility.

多時間框架分析 (Multi-Timeframe Analysis)

支援六個時間框架 (5分、15分、1小時、4小時、日線、週線) 的趨勢分析。

通過表格顯示各時間框架的連續上漲/下跌趨勢,輔助交易決策。

Supports trend analysis across six timeframes (5m, 15m, 1h, 4h, daily, weekly).

Displays consecutive up/down trends in a table to aid decision-making.

風險管理 (Risk Management)

提供基於 ATR 或布林通道的停利/停損設定。

自動計算交易手數,根據報價貨幣匯率調整風險敞口。

Offers take-profit/stop-loss settings based on ATR or Bollinger Bands.

Automatically calculates trading lots, adjusting risk exposure based on quote currency exchange rates.

視覺化與提示 (Visualization and Alerts)

繪製布林通道、移動平均線、海盜策略動態止損線及交易訊號。

提供多時間框架趨勢表格、交易手數標籤及浮水印。

支援交易訊號快訊,方便即時監控。

Plots Bollinger Bands, Moving Averages, Bandit strategy stop-loss lines, and trading signals.

Includes multi-timeframe trend tables, trading lot labels, and watermark.

Supports alert conditions for real-time trade monitoring.

使用說明 (Usage Instructions)

設置參數 (Parameter Setup)

布林通道 (Bollinger Bands): 可調整週期 (預設21)、標準差 (σ1=1, σ2=2) 及停利/停損依據 (ATR 或 BAND)。

移動平均線 (Moving Averages): 可選擇顯示快線 (10)、中線 (20)、慢線 (60),並切換 SMA/EMA。

布林海盜 (Bollinger Bandit): 調整通道週期 (50)、平倉均線週期 (50) 及 ROC 週期 (30)。

時間框架 (Timeframes): 自訂六個時間框架,預設為 5分、15分、1小時、4小時、日線、週線。

Adjust Bollinger Band period (default 21), standard deviations (σ1=1, σ2=2), and take-profit/stop-loss basis (ATR or BAND).

Configure Moving Averages (fast=10, medium=20, slow=60) and toggle SMA/EMA.

Set Bollinger Bandit parameters: channel period (50), liquidation MA period (50), ROC period (30).

Customize six timeframes (default: 5m, 15m, 1h, 4h, daily, weekly).

交易訊號 (Trading Signals)

買入訊號 (Buy): 價格穿越下軌且滿足連續K線條件。

賣出訊號 (Sell): 價格穿越上軌且滿足連續K線條件。

海盜策略訊號: 基於 ROC 與布林通道穿越,結合動態止損。

Buy signal: Price crosses below lower band with consecutive bar confirmation.

Sell signal: Price crosses above upper band with consecutive bar confirmation.

Bandit strategy signals: Based on ROC and band crossings with dynamic stop-loss.

視覺化 (Visualization)

布林通道以不同顏色顯示上下軌與中軌。

移動平均線以快、中、慢線區分顏色。

趨勢表格顯示各時間框架的趨勢狀態 (🔴上漲, 🟢下跌, ⚪中性)。

海盜策略顯示動態止損線與交易狀態。

Bollinger Bands display upper, lower, and middle bands in distinct colors.

Moving Averages use different colors for fast, medium, and slow lines.

Trend table shows timeframe trends (🔴 up, 🟢 down, ⚪ neutral).

Bandit strategy displays dynamic stop-loss and trading status.

Bollinger Bands Squeeze📈 Bollinger Bands Squeeze

This indicator enhances traditional Bollinger Bands by integrating Keltner Channel layers to visualize market compression and volatility expansion — allowing traders to easily identify when a squeeze is building or releasing.

🔍 Overview

This is a refined version of the classic Bollinger Bands, designed to detect volatility squeezes using multiple Keltner Channel thresholds.

The script plots standard Bollinger Bands and dynamically colors the bands according to the degree of compression relative to the Keltner Channels.

⚙️ How It Works

Bollinger Bands are calculated from a selected moving average (SMA, EMA, SMMA, WMA, or VWMA) and standard deviation multiplier.

Keltner Channels are derived from ATR (True Range) using three sensitivity levels (1.0, 1.5, and 2.0× multipliers).

When Bollinger Bands contract inside a Keltner Channel, the script marks a squeeze state:

🟠 High Compression (Orange): Very tight volatility — expect breakout soon.

🔴 Mid Compression (Red): Moderate contraction — volatility is building.

⚫ Low Compression (Gray/Black): Early compression phase.

🧩 Inputs & Customization

Length : Period for both Bollinger and Keltner calculations.

Basis MA Type: Choose from SMA, EMA, SMMA (RMA), WMA, or VWMA.

StdDev Multiplier : Controls Bollinger Bandwidth.

Keltner Multipliers (1.0 / 1.5 / 2.0) : Adjust compression thresholds.

Offset : Shifts the bands visually on the chart.

🕹️ Best Use Cases

Identify pre-breakout conditions before volatility expansion.

Combine with volume, momentum, or trend indicators (e.g., RSI) for confirmation.

Ideal for scalping, breakout trading, or volatility-based entries during session opens.

Custom Bollinger Band Squeeze Screener [Pineify]Custom Bollinger Band Squeeze Screener

Key Features

Multi-symbol scanning: Analyze up to 6 tickers simultaneously.

Multi-timeframe flexibility: Screen across four selectable timeframes for each symbol.

Bollinger Band Squeeze algorithm: Detect volatility contraction and imminent breakouts.

Advanced ATR integration: Measure expansion and squeeze states with custom multipliers.

Customizable indicator parameters: Fine-tune Bollinger and ATR settings for tailored detection.

Visual table interface: Rapidly compare squeeze and expansion signals across all instruments.

How It Works

At the core, this screener leverages a unique blend of Bollinger Bands and Average True Range (ATR) to quantify volatility states for multiple assets and timeframes at once. For each symbol and every selected timeframe, the indicator calculates Bollinger Band width and compares it against ATR levels, offering real-time squeeze (consolidation) and expansion (breakout) signals.

Bollinger Band width is computed using standard deviations around a SMA basis.

ATR is calculated to gauge market volatility independent of price direction.

Squeeze: Triggered when BB width contracts below a multiple of ATR, forecasting lower volatility and set-up for a move.

Expansion: Triggered when BB width expands above a higher ATR multiple, signaling a high-volatility breakout.

Display: Results shown in an intuitive table, marking each status per ticker and TF.

Trading Ideas and Insights

Spot assets poised for volatility-driven breakouts.

Compare squeeze presence across timeframes for optimal entry timing.

Integrate screener results with price action or volume for high-confidence setups.

Use squeeze signals to avoid choppy or non-trending conditions.

Expand and diversify watchlists with multi-symbol coverage.

How Multiple Indicators Work Together

This script seamlessly merges Bollinger Bands and ATR with customized multipliers:

Bollinger Bands identify price consolidation and volatility squeeze zones.

ATR tailors the definition of squeeze and expansion, making signals adaptive to volatility regime changes.

By layering these with multi-symbol/multi-timeframe data, traders access a high-precision view of market readiness for trend acceleration or reversal.

The real synergy is in the screener's ability to visualize volatility states for a diverse asset selection, transforming traditional single-chart analysis into a broad market view.

Unique Aspects

Original implementation: Not a simple trend or scalping indicator; utilizes advanced volatility logic.

Fully multi-symbol and multi-timeframe support uncommon in most screeners.

Custom ATR multipliers for both squeeze and expansion allow traders to match their risk profile and market dynamics.

Visual clarity: Table structure promotes actionable insights and reduces decision fatigue.

How to Use

Add the indicator to your TradingView chart (supports any asset class including crypto, forex, stocks).

Select up to six symbols (tickers) and set your preferred timeframes.

Adjust Bollinger Band Length/Deviation and ATR multipliers to refine squeeze/expansion criteria.

Review the screener table: Look for "SQZ" (squeeze) or "EXP" (expansion) cells for entry/exit ideas.

Combine screener information with other technical or fundamental signals for trade confirmation.

Customization

Symbols: Choose any tickers for scanning.

Timeframes: Select short- to long-term intervals to match your trading style.

Bollinger Band parameters: Modify length and deviation for sensitivity.

ATR multipliers: Set low or high values to adjust squeeze/expansion triggers.

Table size and layout: Adapt display for optimal workflow.

Conclusion

The Bollinger Band Squeeze Screener Pineify delivers an innovative, SEO-friendly multi-asset solution for volatility and trend detection. Harness its original algorithmic design to uncover powerful breakout opportunities and optimize your portfolio. Whether you trade crypto with dynamic volatility or scan stocks for momentum, this tool supercharges your TradingView workflow.

Bollinger Band Screener [Pineify]Multi-Symbol Bollinger Band Screener Pineify – Advanced Multi-Timeframe Market Analysis

Unlock the power of rapid, multi-asset scanning with this original TradingView Pine Script. Expose trends, volatility, and reversals across your favorite tickers—all in a single, customizable dashboard.

Key Features

Screens up to 8 symbols simultaneously with individual controls.

Covers 4 distinct timeframes per symbol for robust, multi-timeframe analysis.

Integrates advanced Bollinger Band logic, adaptable with 11+ moving average types (SMA, EMA, RMA, HMA, WMA, VWMA, TMA, VAR, WWMA, ZLEMA, and TSF).

Visualizes precise state changes: Open/Parallel Uptrends & Downtrends, Consolidation, Breakouts, and more.

Highly interactive table view for instant signal interpretation and actionable alerts.

Flexible to any market: crypto, stocks, forex, indices, and commodities.

How It Works

For each chosen symbol and timeframe, the script calculates Bollinger Bands using your specified source, length, standard deviation, and moving average method.

Real-time state recognition assigns one of several states (Open Rising, Open Falling, Parallel Rising, Parallel Falling), painting the table with unique color codes.

State detection is rigorously defined: e.g., “Open Rising” is set when both bands and the basis rise, indicating strong up momentum.

All bands, signals, and strategies dynamically update as new bars print or user inputs change.

Trading Ideas and Insights

Identify volatility expansions and compressions instantly, spotting breakouts and breakdowns before they play out.

Spot multi-timeframe confluences—when trends align across several TFs, conviction increases for potential trades.

Trade reversals or continuations based on unique Bollinger Band patterns, such as squeeze-break or persistent parallel moves.

Harness this tool for scalping, swing trading, or systematic portfolio screens—your logic, your edge!

How Multiple Indicators Work Together

This screener’s core strength is its integration of multiple moving average types into Bollinger Band construction, not just standard SMA. Each average adapts the bands’ responsiveness to trend and noise, so traders can select the underlying logic that matches their market environment (e.g., HMA for fast moves or ZLEMA for smoothed lag). Overlaying 4 timeframes per symbol ensures trends, reversals, and volatility shifts never slip past your radar. When all MAs and bands synchronize across symbols and TFs, it becomes easy to separate real opportunity from market noise.

Unique Aspects

Perhaps the most flexible Bollinger Band screener for TradingView—choose from over 10 moving average methods.

Powerful multi-timeframe and multi-asset design, rare among Pine scripts.

Immediate visual clarity with color-coded table cells indicating band state—no need for guesswork or chart clutter.

Custom configuration for each asset and time slice to suit any trading style.

How to Use

Add the script to your TradingView chart.

Use the user-friendly input settings to specify up to 8 symbols and 4 timeframes each.

Customize the Bollinger Band parameters: source (price type), band length, standard deviation, and type of moving average.

Interpret the dashboard: Color codes and “state” abbreviations show you instantly which symbols and timeframes are trending, consolidating, or breaking out.

Take trades according to your strategy, using the screener as a confirmation or primary scan tool.

Customization

Fully customize: symbols, timeframes, source, band length, standard deviation multiplier, and moving average type.

Supports intricate watchlists—anything TradingView allows, this script tracks.

Adapt for cryptos, equities, forex, or derivatives by changing symbol inputs.

Conclusion

The Multi-Symbol Bollinger Band Screener “Pineify” is a comprehensive, SEO-optimized Pine Script tool to supercharge your market scanning, trend spotting, and decision-making on TradingView. Whether you trade crypto, stocks, or forex—its fast, intuitive, multi-timeframe dashboard gives you the informational edge to stay ahead of the market.

Try it now to streamline your trading workflow and see all the bands, all the trends, all the time!

Bollinger Band ToolkitBollinger Band Toolkit

An advanced, adaptive Bollinger Band system for traders who want more context, precision, and edge.

This indicator expands on the classic Bollinger Bands by combining statistical and volatility-based methods with modern divergence and squeeze detection tools. It helps identify volatility regimes, potential breakouts, and early momentum shifts — all within one clean overlay.

🔹 Core Features

1. Adaptive Bollinger Bands (σ + ATR)

Classic 20-period bands enhanced with an ATR-based volatility adjustment, making them more responsive to true market movement rather than just price variance.

Reduces “overreacting” during chop and avoids bands collapsing too tightly during trends.

2. %B & RSI Divergence Detection

🟢 Green dots: Positive %B divergence — price makes a lower low, but %B doesn’t confirm (bullish).

🔴 Red dots: Negative %B divergence — price makes a higher high, but %B doesn’t confirm (bearish).

✚ Red/green crosses: RSI divergence confirmation — momentum fails to confirm the price’s new extreme.

These signals highlight potential reversal or slowdown zones that are often invisible to the naked eye.

3. Bollinger Band Squeeze (with Volume Filter)

Yellow squares (■) show periods when Bollinger Bands are at their narrowest relative to recent history.

Volume confirmation ensures the squeeze only triggers when both volatility and participation contract.

Often marks the “calm before the storm” — breakout potential zones.

4. Multi-Timeframe Breakout Markers

Optionally displays breakouts from higher or lower timeframes using different colors/symbols.

Lets you see when a higher timeframe band break aligns with your current chart — a strong trend continuation signal.

5. Dual- and Triple-Band Visualization (±1σ, ±2σ, ±3σ)

Optional inner (±1σ) and outer (±3σ) bands provide a layered volatility map:

Price holding between ±1σ → stable range / mean-reverting behavior

Price riding near ±2σ → trending phase, sustained momentum

Price touching or exceeding ±3σ → volatility expansion or exhaustion zone

This triple-band layout visually distinguishes normal movement from statistical extremes, helping you read when the market is balanced, expanding, or approaching its limits.

⚙️ Inputs & Customization

Choose band type (SMA/EMA/SMMA/WMA/VWMA)

Adjust deviation multiplier (σ) and ATR multiplier

Toggle individual features (divergence dots, squeeze markers, inner bands, etc.)

Multi-timeframe and colour controls for advanced users

🧠 How to Use

Watch for squeeze markers followed by a breakout bar beyond ±2σ → volatility expansion signal.

Combine divergence dots with RSI or price structure to anticipate slowdowns or reversals.

Confirm direction using multi-timeframe breakouts and volume expansion.

💬 Why It Works

This toolkit transforms qualitative chart reading (tight bands, hidden divergence) into quantitative, testable conditions — giving you objective insights that can be backtested, coded, or simply trusted in live setups.

Triple SuperTrend + RSI + Fib BBTriple SuperTrend + RSI + Fibonacci Bollinger Bands Strategy

📊 Overview

This advanced trading strategy combines the power of three SuperTrend indicators with RSI confirmation and Fibonacci Bollinger Bands to generate high-probability trade signals. The strategy is designed to capture strong trending moves while filtering out false signals through multi-indicator confluence.

🔧 Core Components

Three SuperTrend Indicators

The strategy uses three SuperTrend indicators with progressively longer periods and multipliers:

SuperTrend 1: 10-period ATR, 1.0 multiplier (fastest, most sensitive)

SuperTrend 2: 11-period ATR, 2.0 multiplier (medium sensitivity)

SuperTrend 3: 12-period ATR, 3.0 multiplier (slowest, most stable)

This layered approach ensures that all three timeframe perspectives align before generating a signal, significantly reducing false entries.

RSI Confirmation (7-period)

The Relative Strength Index acts as a momentum filter:

Long signals require RSI > 50 (bullish momentum)

Short signals require RSI < 50 (bearish momentum)

This prevents entries during weak or divergent price action.

Fibonacci Bollinger Bands (200, 2.618)

Uses a 200-period Simple Moving Average with 2.618 standard deviation bands (Fibonacci ratio). These bands serve dual purposes:

Visual representation of price extremes

Automatic exit trigger when price reaches overextended levels

📈 Entry Logic

LONG Entry (BUY Signal)

A LONG position is opened when ALL of the following conditions are met simultaneously:

All three SuperTrend indicators turn green (bullish)

RSI(7) is above 50

This is the first bar where all conditions align (no repainting)

SHORT Entry (SELL Signal)

A SHORT position is opened when ALL of the following conditions are met simultaneously:

All three SuperTrend indicators turn red (bearish)

RSI(7) is below 50

This is the first bar where all conditions align (no repainting)

🚪 Exit Logic

Positions are automatically closed when ANY of these conditions occur:

SuperTrend Color Change: Any one of the three SuperTrend indicators changes direction

Fibonacci BB Touch: Price reaches or exceeds the upper or lower Fibonacci Bollinger Band (2.618 standard deviations)

This dual-exit approach protects profits by:

Exiting quickly when trend momentum shifts (SuperTrend change)

Taking profits at statistical price extremes (Fib BB touch)

🎨 Visual Features

Signal Arrows

Green Up Arrow (BUY): Appears below the bar when long entry conditions are met

Red Down Arrow (SELL): Appears above the bar when short entry conditions are met

Yellow Down Arrow (EXIT): Appears above the bar when exit conditions are met

Background Coloring

Light Green Tint: All three SuperTrends are bullish (uptrend environment)

Light Red Tint: All three SuperTrends are bearish (downtrend environment)

SuperTrend Lines

Three colored lines plotted with varying opacity:

Solid line (ST1): Most responsive to price changes

Semi-transparent (ST2): Medium-term trend

Most transparent (ST3): Long-term trend structure

Dashboard

Real-time information panel showing:

Individual SuperTrend status (UP/DOWN)

Current RSI value and color-coded status

Current position (LONG/SHORT/FLAT)

Net Profit/Loss

⚙️ Customizable Parameters

SuperTrend Settings

ATR periods for each SuperTrend (default: 10, 11, 12)

Multipliers for each SuperTrend (default: 1.0, 2.0, 3.0)

RSI Settings

RSI length (default: 7)

RSI source (default: close)

Fibonacci Bollinger Bands

BB length (default: 200)

BB multiplier (default: 2.618)

Strategy Options

Enable/disable long trades

Enable/disable short trades

Initial capital

Position sizing

Commission settings

💡 Strategy Philosophy

This strategy is built on the principle of confluence trading - waiting for multiple independent indicators to align before taking a position. By requiring three SuperTrend indicators AND RSI confirmation, the strategy filters out the majority of low-probability setups.

The multi-timeframe SuperTrend approach ensures that short-term, medium-term, and longer-term trends are all in agreement, which typically occurs during strong, sustainable price moves.

The exit strategy is equally important, using both trend-following logic (SuperTrend changes) and mean-reversion logic (Fibonacci BB touches) to adapt to different market conditions.

📊 Best Use Cases

Trending Markets: Works best in markets with clear directional bias

Higher Timeframes: Designed for 15-minute to daily charts

Volatile Assets: SuperTrend indicators excel in assets with clear trends

Swing Trading: Hold times typically range from hours to days

⚠️ Important Notes

No Repainting: All signals are confirmed and will not change on historical bars

One Signal Per Setup: The strategy prevents duplicate signals on consecutive bars

Exit Protection: Always exits before potentially taking an opposite position

Visual Clarity: All three SuperTrend lines are visible simultaneously for transparency

🎯 Recommended Settings

While default parameters are optimized for general use, consider:

Crypto/Volatile Markets: May benefit from slightly higher multipliers

Forex: Default settings work well for major pairs

Stocks: Consider longer BB periods (250-300) for daily charts

Lower Timeframes: Reduce all periods proportionally for scalping

📝 Alerts

Built-in alert conditions for:

BUY signal triggered

SELL signal triggered

EXIT signal triggered

Set up notifications to never miss a trade opportunity!

Disclaimer: This strategy is for educational and informational purposes only. Past performance does not guarantee future results. Always backtest thoroughly and practice proper risk management before live trading.

RSI Bollinger Bands [DCAUT]█ RSI Bollinger Bands

📊 ORIGINALITY & INNOVATION

The RSI Bollinger Bands indicator represents a meaningful advancement in momentum analysis by combining two proven technical tools: the Relative Strength Index (RSI) and Bollinger Bands. This combination addresses a significant limitation in traditional RSI analysis - the use of fixed overbought/oversold thresholds (typically 70/30) that fail to adapt to changing market volatility conditions.

Core Innovation:

Rather than relying on static threshold levels, this indicator applies Bollinger Bands statistical analysis directly to RSI values, creating dynamic zones that automatically adjust based on recent momentum volatility. This approach helps reduce false signals during low volatility periods while remaining sensitive to genuine extremes during high volatility conditions.

Key Enhancements Over Traditional RSI:

Dynamic Thresholds: Overbought/oversold zones adapt to market conditions automatically, eliminating the need for manual threshold adjustments across different instruments and timeframes

Volatility Context: Band width provides immediate visual feedback about momentum volatility, helping traders distinguish between stable trends and erratic movements

Reduced False Signals: During ranging markets, narrower bands filter out minor RSI fluctuations that would trigger traditional fixed-threshold signals

Breakout Preparation: Band squeeze patterns (similar to price-based BB) signal potential momentum regime changes before they occur

Self-Referencing Analysis: By measuring RSI against its own statistical behavior rather than arbitrary levels, the indicator provides more relevant context

📐 MATHEMATICAL FOUNDATION

Two-Stage Calculation Process:

Stage 1: RSI Calculation

RSI = 100 - (100 / (1 + RS))

where RS = Average Gain / Average Loss over specified period

The RSI normalizes price momentum into a bounded 0-100 scale, making it ideal for statistical band analysis.

Stage 2: Bollinger Bands on RSI

Basis = MA(RSI, BB Length)

Upper Band = Basis + (StdDev(RSI, BB Length) × Multiplier)

Lower Band = Basis - (StdDev(RSI, BB Length) × Multiplier)

Band Width = Upper Band - Lower Band

The Bollinger Bands measure RSI's standard deviation from its own moving average, creating statistically-derived dynamic zones.

Statistical Interpretation:

Under normal distribution assumptions with default 2.0 multiplier, approximately 95% of RSI values should fall within the bands

Band touches represent statistically significant momentum extremes relative to recent behavior

Band width expansion indicates increasing momentum volatility (strengthening trend or increasing uncertainty)

Band width contraction signals momentum consolidation and potential regime change preparation

📊 COMPREHENSIVE SIGNAL ANALYSIS

Visual Color Signals:

This indicator features dynamic color fills that highlight extreme momentum conditions:

Green Fill (Above Upper Band):

Appears when RSI breaks above the upper band, indicating exceptionally strong bullish momentum

Represents dynamic overbought zone - not necessarily a reversal signal but a warning of extreme conditions

In strong uptrends, green fills can persist as RSI "rides the band" - this indicates sustained momentum strength

Exit of green zone (RSI falling back below upper band) often signals initial momentum weakening

Red Fill (Below Lower Band):

Appears when RSI breaks below the lower band, indicating exceptionally weak bearish momentum

Represents dynamic oversold zone - potential reversal or continuation signal depending on trend context

In strong downtrends, red fills can persist as RSI "rides the band" - this indicates sustained selling pressure

Exit of red zone (RSI rising back above lower band) often signals initial momentum recovery

Position-Based Signals:

Upper Band Interactions:

RSI Touching Upper Band: Dynamic overbought condition - momentum is extremely strong relative to recent volatility, potential exhaustion or continuation depending on trend context

RSI Riding Upper Band: Sustained strong momentum, often seen in powerful trends, not necessarily an immediate reversal signal but warrants monitoring for exhaustion

RSI Crossing Below Upper Band: Initial momentum weakening signal, particularly significant if accompanied by price divergence

Lower Band Interactions:

RSI Touching Lower Band: Dynamic oversold condition - momentum is extremely weak relative to recent volatility, potential reversal or continuation of downtrend

RSI Riding Lower Band: Sustained weak momentum, common in strong downtrends, monitor for potential exhaustion

RSI Crossing Above Lower Band: Initial momentum strengthening signal, early indication of potential reversal or consolidation

Basis Line Signals:

RSI Above Basis: Bullish momentum regime - upward pressure dominant

RSI Below Basis: Bearish momentum regime - downward pressure dominant

Basis Crossovers: Momentum regime shifts, more significant when accompanied by band width changes

RSI Oscillating Around Basis: Balanced momentum, often indicates ranging market conditions

Volatility-Based Signals:

Band Width Patterns:

Narrow Bands (Squeeze): Momentum volatility compression, often precedes significant directional moves, similar to price coiling patterns

Expanding Bands: Increasing momentum volatility, indicates trend acceleration or growing uncertainty

Narrowest Band in 100 Bars: Extreme compression alert, high probability of upcoming volatility expansion

Advanced Pattern Recognition:

Divergence Analysis:

Bullish Divergence: Price makes lower lows while RSI touches or stays above previous lower band touch, suggests downward momentum weakening

Bearish Divergence: Price makes higher highs while RSI touches or stays below previous upper band touch, suggests upward momentum weakening

Hidden Bullish: Price makes higher lows while RSI makes lower lows at the lower band, indicates strong underlying bullish momentum

Hidden Bearish: Price makes lower highs while RSI makes higher highs at the upper band, indicates strong underlying bearish momentum

Band Walk Patterns:

Upper Band Walk: RSI consistently touching or staying near upper band indicates exceptionally strong trend, wait for clear break below basis before considering reversal

Lower Band Walk: RSI consistently at lower band signals very weak momentum, requires break above basis for reversal confirmation

🎯 STRATEGIC APPLICATIONS

Strategy 1: Mean Reversion Trading

Setup Conditions:

Market Type: Ranging or choppy markets with no clear directional trend

Timeframe: Works best on lower timeframes (5m-1H) or during consolidation phases

Band Characteristic: Normal to narrow band width

Entry Rules:

Long Entry: RSI touches or crosses below lower band, wait for RSI to start rising back toward basis before entry

Short Entry: RSI touches or crosses above upper band, wait for RSI to start falling back toward basis before entry

Confirmation: Use price action confirmation (candlestick reversal patterns) at band touches

Exit Rules:

Target: RSI returns to basis line or opposite band

Stop Loss: Fixed percentage or below recent swing low/high

Time Stop: Exit if position not profitable within expected timeframe

Strategy 2: Trend Continuation Trading

Setup Conditions:

Market Type: Clear trending market with higher highs/lower lows

Timeframe: Medium to higher timeframes (1H-Daily)

Band Characteristic: Expanding or wide bands indicating strong momentum

Entry Rules:

Long Entry in Uptrend: Wait for RSI to pull back to basis line or slightly below, enter when RSI starts rising again

Short Entry in Downtrend: Wait for RSI to rally to basis line or slightly above, enter when RSI starts falling again

Avoid Counter-Trend: Do not fade RSI at bands during strong trends (band walk patterns)

Exit Rules:

Trailing Stop: Move stop to break-even when RSI reaches opposite band

Trend Break: Exit when RSI crosses basis against trend direction with conviction

Band Squeeze: Reduce position size when bands start narrowing significantly

Strategy 3: Breakout Preparation

Setup Conditions:

Market Type: Consolidating market after significant move or at key technical levels

Timeframe: Any timeframe, but longer timeframes provide more reliable breakouts

Band Characteristic: Narrowest band width in recent 100 bars (squeeze alert)

Preparation Phase:

Identify band squeeze condition (bands at multi-period narrowest point)

Monitor price action for consolidation patterns (triangles, rectangles, flags)

Prepare bracket orders for both directions

Wait for band expansion to begin

Entry Execution:

Breakout Confirmation: Enter in direction of RSI band breakout (RSI breaks above upper band or below lower band)

Price Confirmation: Ensure price also breaks corresponding technical level

Volume Confirmation: Look for volume expansion supporting the breakout

Risk Management:

Stop Loss: Place beyond consolidation pattern opposite extreme

Position Sizing: Use smaller size due to false breakout risk

Quick Exit: Exit immediately if RSI returns inside bands within 1-3 bars

Strategy 4: Multi-Timeframe Analysis

Timeframe Selection:

Higher Timeframe: Daily or 4H for trend context

Trading Timeframe: 1H or 15m for entry signals

Confirmation Timeframe: 5m or 1m for precise entry timing

Analysis Process:

Trend Identification: Check higher timeframe RSI position relative to bands, trade only in direction of higher timeframe momentum

Setup Formation: Wait for trading timeframe RSI to show pullback to basis in trending direction

Entry Timing: Use confirmation timeframe RSI band touch or crossover for precise entry

Alignment Confirmation: All timeframes should show RSI moving in same direction for highest probability setups

📋 DETAILED PARAMETER CONFIGURATION

RSI Source:

Close (Default): Standard price point, balances responsiveness and reliability

HL2: Reduces noise from intrabar volatility, provides smoother RSI values

HLC3 or OHLC4: Further smoothing for very choppy markets, slower to respond but more stable

Volume-Weighted: Consider using VWAP or volume-weighted prices for additional liquidity context

RSI Length Parameter:

Shorter Periods (5-10): More responsive but generates more signals, suitable for scalping or very active trading, higher noise level

Standard (14): Default and most widely used setting, proven balance between responsiveness and reliability, recommended starting point

Longer Periods (21-30): Smoother momentum measurement, fewer but potentially more reliable signals, better for swing trading or position trading

Optimization Note: Test across different market regimes, optimal length often varies by instrument volatility characteristics

RSI MA Type Parameter:

RMA (Default): Wilder's original smoothing method, provides traditional RSI behavior with balanced lag, most widely recognized and tested, recommended for standard technical analysis

EMA: Exponential smoothing gives more weight to recent values, faster response to momentum changes, suitable for active trading and trending markets, reduces lag compared to RMA

SMA: Simple average treats all periods equally, smoothest output with highest lag, best for filtering noise in choppy markets, useful for long-term position analysis

WMA: Weighted average emphasizes recent data less aggressively than EMA, middle ground between SMA and EMA characteristics, balanced responsiveness for swing trading

Advanced Options: Full access to 25+ moving average types including HMA (reduced lag), DEMA/TEMA (enhanced responsiveness), KAMA/FRAMA (adaptive behavior), T3 (smoothness), Kalman Filter (optimal estimation)

Selection Guide: RMA for traditional analysis and backtesting consistency, EMA for faster signals in trending markets, SMA for stability in ranging markets, adaptive types (KAMA/FRAMA) for varying volatility regimes

BB Length Parameter:

Short Length (10-15): Tighter bands that react quickly to RSI changes, more frequent band touches, suitable for active trading styles

Standard (20): Balanced approach providing meaningful statistical context without excessive lag

Long Length (30-50): Smoother bands that filter minor RSI fluctuations, captures only significant momentum extremes, fewer but higher quality signals

Relationship to RSI Length: Consider BB Length greater than RSI Length for cleaner signals

BB MA Type Parameter:

SMA (Default): Standard Bollinger Bands calculation using simple moving average for basis line, treats all periods equally, widely recognized and tested approach

EMA: Exponential smoothing for basis line gives more weight to recent RSI values, creates more responsive bands that adapt faster to momentum changes, suitable for trending markets

RMA: Wilder's smoothing provides consistent behavior aligned with traditional RSI when using RMA for both RSI and BB calculations

WMA: Weighted average for basis line balances recent emphasis with historical context, middle ground between SMA and EMA responsiveness

Advanced Options: Full access to 25+ moving average types for basis calculation, including HMA (reduced lag), DEMA/TEMA (enhanced responsiveness), KAMA/FRAMA (adaptive to volatility changes)

Selection Guide: SMA for standard Bollinger Bands behavior and backtesting consistency, EMA for faster band adaptation in dynamic markets, matching RSI MA type creates unified smoothing behavior

BB Multiplier Parameter:

Conservative (1.5-1.8): Tighter bands resulting in more frequent touches, useful in low volatility environments, higher signal frequency but potentially more false signals

Standard (2.0): Default setting representing approximately 95% confidence interval under normal distribution, widely accepted statistical threshold

Aggressive (2.5-3.0): Wider bands capturing only extreme momentum conditions, fewer but potentially more significant signals, reduces false signals in high volatility

Adaptive Approach: Consider adjusting multiplier based on instrument characteristics, lower multiplier for stable instruments, higher for volatile instruments

Parameter Optimization Workflow:

Start with default parameters (RSI:14, BB:20, Mult:2.0)

Test across representative sample period including different market regimes

Adjust RSI length based on desired responsiveness vs stability tradeoff

Tune BB length to match your typical holding period

Modify multiplier to achieve desired signal frequency

Validate on out-of-sample data to avoid overfitting

Document optimal parameters for different instruments and timeframes

Reference Levels Display:

Enabled (Default): Shows traditional 30/50/70 levels for comparison with dynamic bands, helps visualize the adaptive advantage

Disabled: Cleaner chart focusing purely on dynamic zones, reduces visual clutter for experienced users

Educational Value: Keeping reference levels visible helps understand how dynamic bands differ from fixed thresholds across varying market conditions

📈 PERFORMANCE ANALYSIS & COMPETITIVE ADVANTAGES

Comparison with Traditional RSI:

Fixed Threshold RSI Limitations:

In ranging low-volatility markets: RSI rarely reaches 70/30, missing tradable extremes

In trending high-volatility markets: RSI frequently breaks through 70/30, generating excessive false reversal signals

Across different instruments: Same thresholds applied to volatile crypto and stable forex pairs produce inconsistent results

Threshold Adjustment Problem: Manually changing thresholds for different conditions is subjective and lagging

RSI Bollinger Bands Advantages:

Automatic Adaptation: Bands adjust to current volatility regime without manual intervention

Consistent Logic: Same statistical approach works across different instruments and timeframes

Reduced False Signals: Band width filtering helps distinguish meaningful extremes from noise

Additional Information: Band width provides volatility context missing in standard RSI

Objective Extremes: Statistical basis (standard deviations) provides objective extreme definition

Comparison with Price-Based Bollinger Bands:

Price BB Characteristics:

Measures absolute price volatility

Affected by large price gaps and outliers

Band position relative to price not normalized

Difficult to compare across different price scales

RSI BB Advantages:

Normalized Scale: RSI's 0-100 bounds make band interpretation consistent across all instruments

Momentum Focus: Directly measures momentum extremes rather than price extremes

Reduced Gap Impact: RSI calculation smooths price gaps impact on band calculations

Comparable Analysis: Same RSI BB appearance across stocks, forex, crypto enables consistent strategy application

Performance Characteristics:

Signal Quality:

Higher Signal-to-Noise Ratio: Dynamic bands help filter RSI oscillations that don't represent meaningful extremes

Context-Aware Alerts: Band width provides volatility context helping traders adjust position sizing and stop placement

Reduced Whipsaws: During consolidations, narrower bands prevent premature signals from minor RSI movements

Responsiveness:

Adaptive Lag: Band calculation introduces some lag, but this lag is adaptive to current conditions rather than fixed

Faster Than Manual Adjustment: Automatic band adjustment is faster than trader's ability to manually modify thresholds

Balanced Approach: Combines RSI's inherent momentum lag with BB's statistical smoothing for stable yet responsive signals

Versatility:

Multi-Strategy Application: Supports both mean reversion (ranging markets) and trend continuation (trending markets) approaches

Universal Instrument Coverage: Works effectively across equities, forex, commodities, cryptocurrencies without parameter changes

Timeframe Agnostic: Same interpretation applies from 1-minute charts to monthly charts

Limitations and Considerations:

Known Limitations:

Dual Lag Effect: Combines RSI's momentum lag with BB's statistical lag, making it less suitable for very short-term scalping

Requires Volatility History: Needs sufficient bars for BB calculation, less effective immediately after major regime changes

Statistical Assumptions: Assumes RSI values are somewhat normally distributed, extreme trending conditions may violate this

Not a Standalone System: Like all indicators, should be combined with price action analysis and risk management

Optimal Use Cases:

Best for swing trading and position trading timeframes

Most effective in markets with alternating volatility regimes

Ideal for traders who use multiple instruments and timeframes

Suitable for systematic trading approaches requiring consistent logic

Suboptimal Conditions:

Very low timeframes (< 5 minutes) where lag becomes problematic

Instruments with extreme volatility spikes (gap-prone markets)

Markets in strong persistent trends where mean reversion rarely occurs

Periods immediately following major structural changes (new trading regime)

USAGE NOTES

This indicator is designed for technical analysis and educational purposes to help traders understand the interaction between momentum measurement and statistical volatility bands. The RSI Bollinger Bands has limitations and should not be used as the sole basis for trading decisions.

Important Considerations:

No Predictive Guarantee: Past band touches and patterns do not guarantee future price behavior

Market Regime Dependency: Indicator performance varies significantly between trending and ranging market conditions

Complementary Analysis Required: Should be used alongside price action, support/resistance levels, and fundamental analysis

Risk Management Essential: Always use proper position sizing, stop losses, and risk controls regardless of signal quality

Parameter Sensitivity: Different instruments and timeframes may require parameter optimization for optimal results

Continuous Monitoring: Band characteristics change with market conditions, requiring ongoing assessment

Recommended Supporting Analysis:

Price structure analysis (support/resistance, trend lines)

Volume confirmation for breakout signals

Multiple timeframe alignment

Market context awareness (news events, session times)

Correlation analysis with related instruments

The indicator aims to provide adaptive momentum analysis that adjusts to changing market volatility, but traders must apply sound judgment, proper risk management, and comprehensive market analysis in their decision-making process.

Multiple Symbol Trend Screener [Pineify]Multiple Symbol Trend Screener Pineify – Ultimate Multi-Indicator Scanner for TradingView

Empower your trading with deep market insights across multiple symbols using this feature-rich Pine Script screener. The Multiple Symbol Trend Screener Pineify enables traders to monitor and compare trends, reversals, and consolidations in real-time across the biggest equity symbols on TradingView, through a synergistic blend of popular technical indicators.

Key Features

Monitor up to 15 symbols and their trends simultaneously

Integrates 7 professional-grade indicators: MA Distance, Aroon, Parabolic SAR (PSAR), ADX, Supertrend, Keltner Channel, and BBTrend

Color-coded table display for instant visual assessment

Customizable lookback periods, indicator types, and calculation methods

SEO optimized for multi-symbol trend detection, screener, and advanced TradingView indicator

How It Works

This indicator leverages TradingView’s Pine Script v6 and request.security() to process multiple symbols across selected timeframes. Data populates a dynamic table, updating each cell based on the calculated value of every underlying indicator. MA Distance highlights deviation from moving averages; Aroon flags emerging trend strength; PSAR marks potential trend reversals; ADX assesses trend momentum; Supertrend detects bullish/bearish phases; Keltner Channel and BBTrend offer volatility and power insights.

Set up your preferred symbols and timeframes

Each indicator runs its calculation per symbol using its parameter group

All results are displayed in a table for a comprehensive dashboard view

Trading Ideas and Insights

Traders can use this screener for cross-market comparison, directional bias, entry/exit filtering, and comprehensive trend evaluation. The screener is excellent for swing trading, day trading, and portfolio tracking. It enables confirmation across multiple frameworks — for example, spotting momentum with ADX before confirming direction with Supertrend and PSAR.

Identify correlated movements or divergences across selected assets

Spot synchronized trend changes for basket trading ideas

Filter symbols by volatility, strength, or trend status for precise trade selection

How Multiple Indicators Work Together

The screener’s edge lies in its intelligent correlation of popular indicators. MA Distance measures the proximity to chosen moving averages, ideal for spotting overbought/oversold conditions. Aroon reveals the strength of new price trends, PSAR indicates reversal signals, and ADX quantifies the momentum of these trends. Supertrend provides a directional phase, while Keltner Channel & BBTrend analyze volatility shifts and band compressions. This amalgamation allows for a robust, multi-dimensional market snapshot, capturing details missed by single-indicator tools.

By displaying all key metrics side-by-side, the screener enables holistic decision-making, revealing confluence zones and contradiction areas across multiple tickers and timeframes.

Unique Aspects

Original implementation combining seven independent trend and momentum indicators for each symbol

Rich customization for symbols, timeframes, and all indicator parameters

Intuitive color-coding for quick reading of bullish/bearish/neutral signals

Comprehensive dashboard for instant actionable insights

How to Use

Load the indicator onto your TradingView chart

Go to the script’s settings and input your preferred symbols and relevant timeframes

Set your desired parameters for each indicator group: Moving Average type, Aroon length, PSAR values, ADX smoothing, etc.

Observe the results in the top-right table, then use it to filter candidates and validate trade setups

The screener is suitable for all timeframes and asset classes available on TradingView. Make sure your chart’s timeframe matches the one used in the scanner for optimal accuracy.

Customization

Choose up to 15 symbols to monitor in a single dashboard

Customize lookback periods, indicator types, colors, and display settings

Configure alerting options and thresholds for advanced trade automation

Conclusion

The Multiple Symbol Trend Screener Pineify sets a new standard for multi-asset screening on TradingView. By elegantly merging seven proven technical indicators, the screener delivers powerful trend detection, reversal analysis, and volatility monitoring — all in one dashboard. Take your trading to new heights with in-depth, customizable market surveillance.

TTM Squeeze Range Lines (with Forward Extension) By Gautam KumarThis TTM Squeeze Range Lines script helps visualize breakout levels by marking the recent squeeze’s high and low, making it easier to identify potential trade setups. Each signal line is extended for visibility, showing possible entry levels after a squeeze.

Interpreting the LinesLight blue background marks periods when the TTM squeeze is active (tight volatility).

Green line is drawn at the highest price during the squeeze, extended forward—this is commonly used as the breakout level for long entries.

Red line shows the lowest price during the squeeze, indicating the bottom of the range—potential stop loss positioning or an invalidation level.

When the squeeze background disappears, the horizontal lines will have just appeared and extended forward for several bars after the squeeze ends.

If the price breaks above the green line (the squeeze high), it signals a possible momentum breakout, which traders often use as a long entry.

The red line can be used for placing stop losses or monitoring failed breakouts if price falls below this level.

Best Practices

Combine these levels with volume and momentum confirmation for strong entries.

Adjust the extension length (number of bars forward) from the settings menu to fit your preference.

For systematic trading, use these breakout signals alongside chart pattern or histogram confirmation.

This makes it easy to visualize strong entry zones based on the end of squeeze compression, supporting both discretionary and automated swing trading approaches

John Bollinger's Bollinger BandsJapanese below / 日本語説明は下記

This indicator replicates how John Bollinger, the inventor of Bollinger Bands, uses Bollinger Bands, displaying Bollinger Bands, %B and Bandwidth in one indicator with alerts and signals.

Bollinger Bands is created by John Bollinger in 1980s who is an American financial trader and analyst. He introduced %B and Bandwidth 30 years later.

🟦 What's different from other Bollinger Bands indicator?

Unlike the default Bollinger Bands or other custom Bollinger Bands indicators on TradingView, this indicator enables to display three Bollinger Bands tools into a single indicator with signals and alerts capability.

You can plot the classic Bollinger Bands together with either %B or Bandwidth or three tools altogether which requires the specific setting(see below settings).

This makes it easy to quantitatively monitor volatility changes and price position in relation to Bollinger Bands in one place.

🟦 Features:

Plots Bollinger Bands (Upper, Basis, Lower) with fill between bands.

Option to display %B or Bandwidth with Bollinger Bands.

Plots highest and lowest Bandwidth levels over a customizable lookback period.

Adds visual markers when Bandwidth reaches its highest (Bulge) or lowest (Squeeze) value.

Includes ready-to-use alert conditions for Bulge and Squeeze events.

📈Chart

Green triangles and red triangles in the bottom chart mark Bulges and Squeezes respectively.

🟦 Settings:

Length: Number of bars used for Bollinger Band middleline calculation.

Basis MA Type: Choose SMA, EMA, SMMA (RMA), WMA, or VWMA for the midline.

StdDev: Standard deviation multiplier (default = 2.0).

Option: Select "Bandwidth" or "%B" (add the indicator twice if you want to display both).

Period for Squeeze and Bulge: Lookback period for detecting the highest and lowest Bandwidth levels.(default = 125 as specified by John Bollinger )

Style Settings: Colors, line thickness, and transparency can be customized.

📈Chart

The chart below shows an example of three Bollinger Bands tools: Bollinger Band, %B and Bandwidth are in display.

To do this, you need to add this indicator TWICE where you select %B from Option in the first addition of this indicator and Bandwidth from Option in the second addition.

🟦 Usage:

🟠Monitor Volatility:

Watch Bandwidth values to spot volatility contractions (Squeeze) and expansions (Bulge) that often precede strong price moves.

John Bollinger defines Squeeze and Bulge as follows;

Squeeze:

The lowest bandwidth in the past 125 period, where trend is born.

Bulge:

The highest bandwidth in the past 125 period where trend is going to die.

According to John Bollinger, this 125 period can be used in any timeframe.

📈Chart1

Example of Squeeze

You can see uptrends start after squeeze(red triangles)

📈Chart2

Example of Bulge

You can see the trend reversal from downtrend to uptrends at the bulge(green triangles)

📈Chart3

Bulge DOES NOT NECESSARILY mean the beginning of a trend in opposite direction.

For example, you can see a bulge happening in the right side of the chart where green triangles are marked. Nevertheless, uptrend still continues after the bulge.

In this case, the bulge marks the beginning of a consolidation which lead to the continuation of the trend. It means that a phase of the trend highlighted in the light blue box came to an end.

Note: light blue box is not drawn by the indicator.

Like other technical analysis methods or tools, these setups do not guarantee birth of new trends and trend reversals. Traders should be carefully observing these setups along with other factors for making decisions.

🟠Track Price Position:

Use %B to see where price is located in relation to the Bollinger Bands.

If %B is close to 1, the price is near upper band while %B is close to 0, the price is near lower band.

🟠Set Alerts:

Receive alerts when Bandwidth hits highest and lowest values of bandwidth, helping you prepare for potential breakout, ending of trends and trend reversal opportunities.

🟠Combine with Other Tools:

This indicator would work best when combined with price action, trend analysis, or

market environmental analysis.

—————————————————————————————

このインジケーターはボリンジャーバンドの考案者であるジョン・ボリンジャー氏が提唱するボリンジャーバンドの使い方を再現するために、ボリンジャーバンド、%B、バンドウィズ(Bandwidth) の3つを1つのインジケーターで表示可能にしたものです。シグナルやアラートにも対応しています。

ボリンジャーバンドは1980年代にアメリカ人トレーダー兼アナリストのジョン・ボリンジャー氏によって開発されました。彼はその30年後に%Bとバンドウィズを導入しました。

🟦 他のボリンジャーバンドとの違い

TradingView標準のボリンジャーバンドや他のボリンジャーバンドとは異なり、このインジケーターでは3つのボリンジャーバンドツールを1つのインジケーターで表示し、シグナルやアラート機能も利用できるようになっています。

一般的に知られている通常のボリンジャーバンドに加え、%Bやバンドウィズを組み合わせて表示でき、設定次第では3つすべてを同時にモニターすることも可能です。これにより、価格とボリンジャーバンドの位置関係とボラティリティ変化をひと目で、かつ定量的に把握することができます。

🟦 機能:

ボリンジャーバンド(アッパーバンド・基準線・ロワーバンド)を描画し、バンド間を塗りつぶし表示。

オプションで%Bまたはバンドウィズを追加表示可能。

バンドウィズの最高値・最安値を、任意の期間で検出して表示。

バンドウィズが指定期間の最高値(バルジ※)または最安値(スクイーズ)に達した際にシグナルを表示。

※バルジは一般的にボリンジャーバンドで用いられるエクスパンションとほぼ同じ意味ですが、定義が異なります。(下記参照)

バルジおよびスクイーズ発生時のアラート設定が可能。

📈 チャート例

下記チャートの緑の三角と赤の三角は、それぞれバルジとスクイーズを示しています。

🟦 設定:

Length: ボリンジャーバンドの基準線計算に使う期間。

Basis MA Type: SMA, EMA, SMMA (RMA), WMA, VWMAから選択可能。

StdDev: 標準偏差の乗数(デフォルト2.0)。

Option: 「Bandwidth」または「%B」を選択(両方表示するにはこのインジケーターを2回追加)。

Period for Squeeze and Bulge: Bandwidthの最高値・最安値を検出する期間(デフォルトはジョン・ボリンジャー氏が推奨する125)。

Style Settings: 色、線の太さ、透明度などをカスタマイズ可能。

📈 チャート例

下のチャートは「ボリンジャーバンド」「%B」「バンドウィズ」の3つを同時に表示した例です。

この場合、インジケーターを2回追加し、最初に追加した方ではOptionを「%B」に、次に追加した方では「Bandwidth」を選択します。

🟦 使い方:

🟠 ボラティリティを監視する:

バンドウィズの値を見ることで、価格変動の収縮(スクイーズ)や拡大(バルジ)を確認できます。

これらはしばしば強い値動きの前兆となります。

ジョン・ボリンジャー氏はスクイーズとバルジを次のように定義しています:

スクイーズ: 過去125期間の中で最も低いバンドウィズ→ 新しいトレンドが生まれる場所。

バルジ: 過去125期間の中で最も高いバンドウィズ → トレンドが終わりを迎える場所。

この「125期間」はどのタイムフレームでも利用可能とされています。

📈 チャート1

スクイーズの例

赤い三角のスクイーズの後に上昇トレンドが始まっているのが確認できます。

📈 チャート2

バルジの例

緑の三角のバルジの箇所で下降トレンドから上昇トレンドへの反転が見られます。

📈 チャート3

バルジが必ずしも反転を意味しない例

下記のチャート右側の緑の三角で示されたバルジの後も、上昇トレンドが継続しています。

この場合、バルジは反転ではなく「トレンド一時的な調整(レンジ入り)」を示しており、結果的に上昇トレンドが継続しています。

この場合、バルジは水色のボックスで示されたトレンドのフェーズの終わりを示しています。

※水色のボックスはインジケーターが描画したものではありません。

また、他のテクニカル分析と同様に、これらのセットアップは必ず新しいトレンドの発生やトレンド転換を保証するものではありません。トレーダーは他の要素も考慮し、慎重に意思決定する必要があります。

🟠 価格とボリンジャーバンドの位置関係を確認する:

%Bを利用すれば、価格がバンドのどこに位置しているかを簡単に把握できます。

%Bが1に近ければ価格はアッパーバンド付近、0に近ければロワーバンド付近にあります。

🟠 アラートを設定する:

バンドウィズが一定期間の最高値または最安値に到達した際にアラートを設定することで、ブレイクアウトやトレンド終了、反転の可能性に備えることができます。

🟠 他のツールと組み合わせる:

このインジケーターは、プライスアクション、トレンド分析、環境認識などと組み合わせて活用すると最も効果的です。

BBKC Combined Channels OverlayBBKC Combined Channels Overlay (Volatility & Mean Reversion)This indicator provides a clean, single-view envelope combining the Bollinger Bands (BB) and Keltner Channels (KC) directly onto your price chart. It is an essential tool for traders operating with Volatility Compression (The Squeeze) and Mean Reversion strategies in fast-moving markets like Futures, High BTC Beta Equities, and Crypto. The goal of this tool is twofold: to visually frame the market's current volatility state and to identify high-probability entry points based on expansion or extreme contraction. How to Use the BBKC Overlay: Spotting the Squeeze (Accumulation Phase):The Squeeze is identified when the Bollinger Bands (BB) contract and fit inside the Keltner Channels (KC).The area is clearly marked with a subtle Orange Background Highlight on the main chart. This is the Accumulation phase, signaling low volatility before a potential large directional move. Trading Mean Reversion: When price pushes aggressively outside the outermost bands (the BB Upper/Lower), it signals an extreme volatility expansion and over-extension. This is a strong setup for mean reversion—a high-probability trade targeting a snap-back towards the central Basis Line (SMA).Customizing for Extreme Compression: For traders looking only for the tightest, highest-probability Squeezes, adjust the following setting: KC Multiplier (ATR): Lower this value from the default of 1.5 down to 1.25 or 1.0. This narrows the KC, forcing the Bollinger Bands to contract even further to trigger the Squeeze signal, thus filtering for only the most minimal volatility. Recommended Synergy: For a complete volatility system, pair this BBKC Combined Channels Overlay (your visualization tool) with the BBKC Squeeze Indicator (the sub-pane momentum histogram).Overlay (Main Chart): Shows where the Squeeze is occurring and identifies mean reversion targets. Squeeze Indicator (Lower Pane): Shows if the Squeeze is active and the directional momentum building up, helping you time the breakout entry for the Manipulation/Distribution phase.

Bollinger Keltner Squeeze Indicator (BBKC)Bollinger Keltner Squeeze Indicator (BBKC)This single-pane indicator combines the power of Bollinger Bands (BB) and Keltner Channels (KC) to accurately identify periods of low volatility compression—the famous Squeeze—which often precedes large, directional moves.Designed for traders utilizing Accumulation, Manipulation, Distribution (AMD) strategies, this tool makes spotting the 'Accumulation' phase simple and visually clear, perfect for high BTC Beta equities or futures markets like MES and MNQ.Key Features:Clear Squeeze Visualization:The background of the main chart is shaded Orange when the Squeeze is active (BB is inside KC). This immediately highlights periods of extreme compression.A simple Red/Green Dot below the chart confirms the Squeeze state (Red = Squeeze ON, Green = Squeeze OFF).Momentum Histogram:A built-in momentum oscillator smooths price action and guides the anticipated direction of the breakout.Teal/Orange Bars: Indicate momentum direction while the Squeeze is active (building pressure).Bright Green/Red Bars: Indicate momentum direction after the Squeeze has broken (expansion/breakout).How to Find Maximum Volatility Compression (The "Tightest" Squeeze)To align this indicator with a strategy focused on catching only the most extreme volatility compression—the key to those explosive moves—traders should adjust the Keltner Channel Multiplier setting.Setting Name: KC Multiplier (ATR)Default Value: 1.5Recommended Adjustment: To filter for only the absolute tightest squeezes (where price is least volatile), decrease this multiplier value, typically down to 1.25 or even 1.0.By lowering the KC Multiplier (ATR), you narrow the Keltner Channel boundaries. This requires the Bollinger Bands to compress even further to fit inside, ensuring the indicator only signals the Squeeze state during moments of truly minimal volatility, setting you up for maximum opportunity.

Bollinger Bands with 4 Moving AveragesCombines Bollinger Bands (BB) with up to four optional Moving Averages (MA) to read volatility, trend direction, and dynamic support–resistance in one overlay.

How It Works

BB: basis = MA(length, type) with standard deviation mult. upper = basis + dev, lower = basis − dev.

MA1–MA4: additional averages you can toggle (default only MA4/200 enabled).

Key Features

Flexible basis MA type for BB: SMA / EMA / RMA (Wilder) / WMA / VWMA.

Four optional MAs with independent length, color, and width (defaults: 7, 25, 99, 200; only 200 on by default).

Offset to shift BB for visual testing.

Overlay on price with shaded band between Upper–Lower.

Inputs & Defaults

BB Length = 20, StdDev = 2.0, Source = close.

Basis MA Type = SMA.

MA4 active (200), MA1–MA3 off (7/25/99 ready).

Offset = 0.

Practical Use

Use BB for volatility context: squeeze → potential breakout; expansion → strong trend.

Treat Basis / Upper / Lower as dynamic levels:

Pullbacks to Basis often become decision zones in trends.

Upper/Lower touches = relative extremes.

Add MA4(200) for primary bias; enable MA1–MA3 for finer timing.

Typical behavior:

Price > MA200 and rising basis → bullish bias; watch pullbacks to basis/MA25-like zones.

Price < MA200 and falling basis → bearish bias; watch rejections at basis/MAs.

Common Signals (not financial advice)

Breakout + BB expansion confirms momentum.

Squeeze + basis break can preface volatility expansion.

Confluence: Lower touch + fast MA in uptrends → mean-reversion setups; inverse for downtrends.

Notes

MA1–MA4 are SMA in the code; BB basis follows the selected MA type.

Test across timeframes; tune length and mult to the asset.

Disclaimer

Visual tool only. Combine with risk management, multi-timeframe confirmation, and a tested plan.

10MAs + BB10 MAs riboon + Bollinger Bands

I used two basic Multiple MA ribbons. so I just merge them to one indicaotor

BB Crosses Optimized - [JTCAPITAL]BB Crosses Optimized - is a modified way to use Bollinger Bands combined with volatility filtering (ATR) and flexible smoothing methods for Trend-Following.

The indicator works by calculating in the following steps:

Source Selection & Smoothing

The script begins by letting the user select a preferred price source (default is Close, but options include Open, High, Low, HL2, etc.). This raw input is then passed through a smoothing process.

Multiple smoothing techniques can be chosen: SMA, EMA, HMA, DEMA, TEMA, RMA, and FRAMA. Each method reduces short-term noise differently, ensuring flexibility for traders who prefer faster or slower reaction speeds in trend detection.

Bollinger Band Construction

Once the smoothed source is prepared, Bollinger Bands are calculated. The middle band is a moving average of the smoothed data over the defined BB Period . The upper and lower bands are then generated by adding and subtracting the Standard Deviation × Deviation multiplier . These dynamic bands capture volatility and help define breakout zones.

ATR Volatility Measurement

Parallel to the band calculation, the Average True Range (ATR) is computed over the chosen ATR Period . This measures market volatility. The ATR can optionally act as a filter, refining buy and sell levels so signals adapt to current market conditions rather than being fixed to price alone.

Bollinger Band Signals

-If the smoothed price closes above the upper band, a potential bullish event is marked.

-If the smoothed price closes below the lower band, a potential bearish event is marked.

Trend Line Construction

When a bullish event occurs, the script anchors a trend-following line beneath price. If ATR filtering is enabled, the line is set at Low – ATR , otherwise at the simple Low. Conversely, when a bearish event occurs, the line is anchored above price at High + ATR (or just High without the filter). The line is designed to only move in the direction of the trend—if price action does not exceed the prior value, the previous level is held. This prevents unnecessary whipsaws and keeps the indicator aligned with dominant momentum.

Final Trend Detection

The slope of the trend line defines the trend itself:

-Rising line → bullish trend.

-Falling line → bearish trend.

Visual Output

The indicator plots the trend line with dynamic coloring: Blue for bullish phases, Purple for bearish phases. A subtle filled background area emphasizes the active trend zone for clearer chart interpretation.

Buy and Sell Conditions:

- Buy Signal : Triggered when smoothed price closes above the upper Bollinger Band. Trend line then anchors below price (with or without ATR offset depending on settings).

- Sell Signal : Triggered when smoothed price closes below the lower Bollinger Band. Trend line then anchors above price (with or without ATR offset).

Additional filtering is possible via:

- ATR Toggle : Switch ATR on or off to adapt the strategy to either volatile or steady markets.

- Smoothing Method : Adjust smoothing to speed up or slow down responsiveness.

- Deviation Multiplier : Tight or wide bands adjust the sensitivity of signals.

Features and Parameters:

- Source : Choose between Close, Open, High, Low, HL2, etc.

- Average Type : Options include SMA, EMA, HMA, DEMA, TEMA, RMA, FRAMA.

- ATR Period : Defines how ATR volatility is measured.

- BB Period : Lookback length for Bollinger Band construction.

- Deviation : Multiplier for the standard deviation in Bollinger Bands.

- Smoothing Period : Controls how much the source data is smoothed.

- ATR Filter On/Off : Enables or disables ATR integration in signal calculation.

Specifications:

Smoothing (MA Types)

Smoothing is essential to reduce chart noise. By offering multiple MA choices, traders can balance between lag (SMA, RMA) and responsiveness (EMA, HMA, FRAMA). This flexibility allows the indicator to adapt across asset classes and trading styles.

Bollinger Bands

Bollinger Bands measure price deviation around a moving average. They help identify volatility expansion and contraction. In this script, the bands serve as breakout triggers—price crossing outside suggests momentum strong enough to sustain a trend.

Standard Deviation

Standard Deviation is a statistical measure that quantifies the dispersion of price data around the mean. With a multiplier applied, it creates bands that contain a probabilistic portion of price action. Crossing beyond these suggests a higher likelihood of trend continuation.

ATR (Average True Range)

ATR measures the degree of volatility. Instead of simply reacting to price crossing the bands, ATR ensures the trend line placement adapts to current conditions. In volatile markets, wider buffers prevent premature signals; in calmer markets, tighter placement keeps signals responsive.

Trend Line Logic

The trend line only adjusts in the direction of the trend. If new values do not exceed the prior, the line remains unchanged. This prevents false reversals and makes the line a reliable visual confirmation of trend direction.

Signal Detection

The indicator does not repaint: signals are based on confirmed closes relative to the Bollinger Bands. This makes it more reliable for both live trading and backtesting scenarios.

Visual Enhancements

The use of dual plots and fill shading creates a clearer separation of bullish vs. bearish phases. This helps traders visually align entries and exits without second-guessing.

Enjoy!

FlowSpike ES — BB • RSI • VWAP + AVWAP + News MuteThis indicator is purpose-built for E-mini S&P 500 (ES) futures traders, combining volatility bands, momentum filters, and session-anchored levels into a streamlined tool for intraday execution.

Key Features:

• ES-Tuned Presets

Automatically optimized settings for scalping (1–2m), daytrading (5m), and swing trading (15–60m) timeframes.

• Bollinger Band & RSI Signals

Entry signals trigger only at statistically significant extremes, with RSI filters to reduce false moves.

• VWAP & Anchored VWAPs

Session VWAP plus anchored VWAPs (RTH open, weekly, monthly, and custom) provide high-confidence reference levels used by professional order-flow traders.

• Volatility Filter (ATR in ticks)

Ensures signals are only shown when the ES is moving enough to offer tradable edges.

• News-Time Mute

Suppresses signals around scheduled economic releases (customizable windows in ET), helping traders avoid whipsaw conditions.

• Clean Alerts

Long/short alerts are generated only when all conditions align, with optional bar-close confirmation.

Why It’s Tailored for ES Futures:

• Designed around ES tick size (0.25) and volatility structure.

• Session settings respect RTH hours (09:30–16:00 ET), the period where most liquidity and institutional flows concentrate.

• ATR thresholds and RSI bands are pre-tuned for ES market behavior, reducing the need for manual optimization.

⸻

This is not a generic indicator—it’s a futures-focused tool created to align with the way ES trades day after day. Whether you scalp the open, manage intraday swings, or align to weekly/monthly anchored flows, FlowSpike ES gives you a clear, rules-based signal framework.