MSFT Setting Up for a Breakdown or Bounce – Key Option Levels in Play 💥

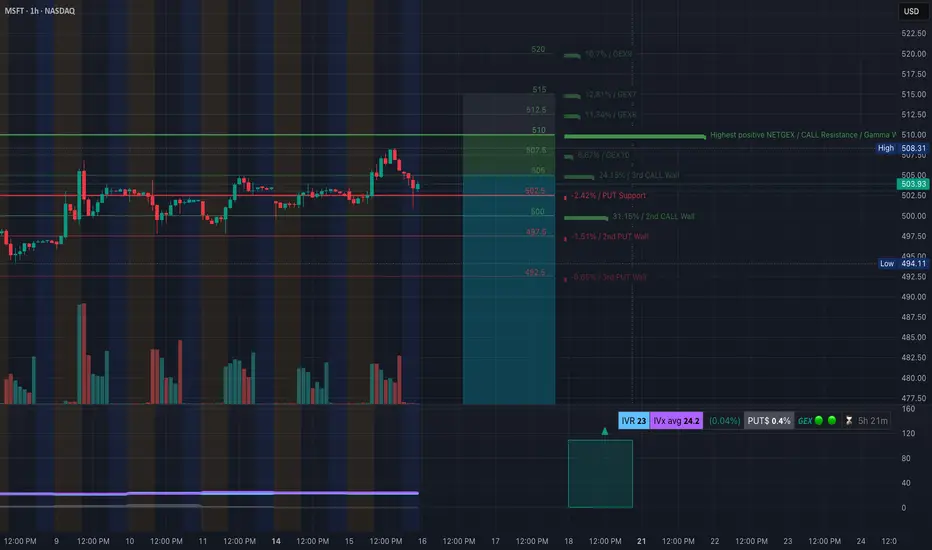

🔹 Options GEX Analysis (Tanuki GEX View):

* Gamma Resistance (Call Wall): → $510 is the highest GEX level, acting as a ceiling. → $507.5 is the 3rd Call Wall and minor resistance.

* PUT Walls and Gamma Support: → $502.5 = HVL (High Volume Level) → $500 = key strike with heavy Put interest → $497.5 and $492.5 = deeper support levels

* GEX Bias: → IVR = 23, IVx avg = 24.2 → 0.4% Put Skew → Neutral bias with slight downside lean → If MSFT trades below $502.5, dealers may start to hedge short, increasing downside gamma pressure.

🟩 Option Trade Idea:

* Bearish Put Debit Spread: Buy $505p / Sell $495p for next week Entry near $503, looking for breakdown to $497.

* Neutral Fade: Sell Call spread near $507.5–510 if price stays below $504 by open.

🔹 1-Hour Chart Trading Setup (Price Action):

* Structure: MSFT printed a CHoCH after failing to break the $507 supply zone (order block). Price lost trendline support and is testing $502 area again.

* Smart Money Concepts:

* BOS occurred into 506s before reversal

* CHoCH confirmed at $502

* Current price is consolidating just above $502. Break below signals weakness.

* Support Zones:

* 502.5 → 500 → 497.5

* Demand at 493–488

* Resistance Zones:

* 504.5 → 506.5 → 510

* Overhead OB rejection seen on last attempt

🟦 Intraday Trade Setup:

Bearish Breakdown Setup:

* Entry: Below $502

* Target: $497.5 → $493

* Stop-loss: $504.50

Reclaim & Squeeze Setup:

* Entry: If holds above $504.5

* Target: $507.5 → $510

* Stop-loss: $502

🧠 My Thoughts: The failed breakout and CHoCH hint that MSFT may drift down unless it reclaims $504. With options GEX neutral-to-bearish and IV low, a fade toward 497.5–493 could be in play. However, if buyers step in at HVL $502.5 and flip the trendline, we may see a gamma squeeze attempt to $507–510.

This analysis is for educational purposes only and does not constitute financial advice. Always trade with a plan and proper risk management.

🔹 Options GEX Analysis (Tanuki GEX View):

* Gamma Resistance (Call Wall): → $510 is the highest GEX level, acting as a ceiling. → $507.5 is the 3rd Call Wall and minor resistance.

* PUT Walls and Gamma Support: → $502.5 = HVL (High Volume Level) → $500 = key strike with heavy Put interest → $497.5 and $492.5 = deeper support levels

* GEX Bias: → IVR = 23, IVx avg = 24.2 → 0.4% Put Skew → Neutral bias with slight downside lean → If MSFT trades below $502.5, dealers may start to hedge short, increasing downside gamma pressure.

🟩 Option Trade Idea:

* Bearish Put Debit Spread: Buy $505p / Sell $495p for next week Entry near $503, looking for breakdown to $497.

* Neutral Fade: Sell Call spread near $507.5–510 if price stays below $504 by open.

🔹 1-Hour Chart Trading Setup (Price Action):

* Structure: MSFT printed a CHoCH after failing to break the $507 supply zone (order block). Price lost trendline support and is testing $502 area again.

* Smart Money Concepts:

* BOS occurred into 506s before reversal

* CHoCH confirmed at $502

* Current price is consolidating just above $502. Break below signals weakness.

* Support Zones:

* 502.5 → 500 → 497.5

* Demand at 493–488

* Resistance Zones:

* 504.5 → 506.5 → 510

* Overhead OB rejection seen on last attempt

🟦 Intraday Trade Setup:

Bearish Breakdown Setup:

* Entry: Below $502

* Target: $497.5 → $493

* Stop-loss: $504.50

Reclaim & Squeeze Setup:

* Entry: If holds above $504.5

* Target: $507.5 → $510

* Stop-loss: $502

🧠 My Thoughts: The failed breakout and CHoCH hint that MSFT may drift down unless it reclaims $504. With options GEX neutral-to-bearish and IV low, a fade toward 497.5–493 could be in play. However, if buyers step in at HVL $502.5 and flip the trendline, we may see a gamma squeeze attempt to $507–510.

This analysis is for educational purposes only and does not constitute financial advice. Always trade with a plan and proper risk management.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.