Hi, I’m The Cafe Trader.

Today we’re diving into the heart of this very bullish run on MSFT. One of the key lessons I’ve learned:

Never get in the way of a strong bull trend — especially just after a breakout.

⸻

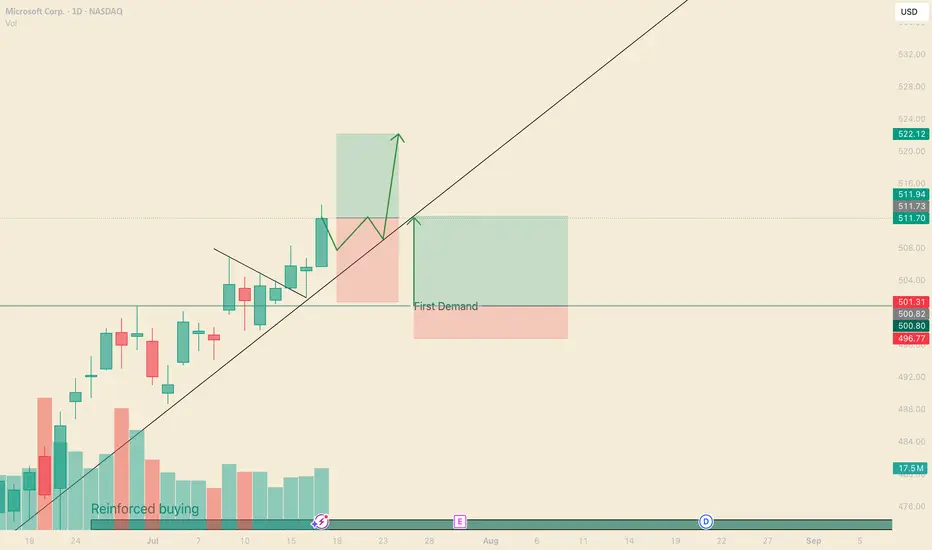

🔍 Price Action Overview:

MSFT has been respecting a strong trendline since its initial gap-up.

This has created multiple breakout trade opportunities — and we’ve just spotted another one. I’ve also outlined a secondary setup worth watching.

We recently completed a 3-bar break.

Combine that with rising volume, and this suggests a potential move to $522.23.

⏳ I’m expecting a brief consolidation (2–3 trading days) before the next leg up.

⸻

🟢 Trade Setup:

• Entry: $511.70

• Risk Level: Trade remains valid until a daily close below $500

• Reward: TP at $522.23

• Risk-to-Reward: 1:1 at entry; improves with any dip before breakout

⸻

💡 Optional Trade: Swing Trading Options

Options are about two things: price and timing.

Right now, timing looks great — but option pricing is a bit high.

The key is to go from out-of-the-money to in-the-money, and to give yourself at least 5 days on your contracts.

Here are some strike prices I’m watching (assumes expiration 7/25 or later):

• $515 Call — Entry: $2.00 or less → TP: $6.00+

• $517.5 Call — Entry: $1.30 or less → TP: $3.90+

• $520 Call — Entry: $0.70 or less → TP: $2.10+

These levels give you a strong RR if you can catch the right pullback.

⸻

🔁 Secondary Trade Idea: Bounce at $500

The $500 level is both a psychological number and a reinforced demand zone.

While it overlaps with the stop on our main setup, this trade assumes MSFT pushes higher first, then retraces to $500 for a fresh leg up.

This area will likely play a key role in future price action.

If we see a pullback into this zone with contextual selling pressure, it could offer a clean high-probability bounce.

Take profit levels would depend on how price behaves as it sells into this level — but keep this area marked.

⸻

Thanks for reading — be sure to check out my other MAG 7 analysis.

thecafetrader

Today we’re diving into the heart of this very bullish run on MSFT. One of the key lessons I’ve learned:

Never get in the way of a strong bull trend — especially just after a breakout.

⸻

🔍 Price Action Overview:

MSFT has been respecting a strong trendline since its initial gap-up.

This has created multiple breakout trade opportunities — and we’ve just spotted another one. I’ve also outlined a secondary setup worth watching.

We recently completed a 3-bar break.

Combine that with rising volume, and this suggests a potential move to $522.23.

⏳ I’m expecting a brief consolidation (2–3 trading days) before the next leg up.

⸻

🟢 Trade Setup:

• Entry: $511.70

• Risk Level: Trade remains valid until a daily close below $500

• Reward: TP at $522.23

• Risk-to-Reward: 1:1 at entry; improves with any dip before breakout

⸻

💡 Optional Trade: Swing Trading Options

Options are about two things: price and timing.

Right now, timing looks great — but option pricing is a bit high.

The key is to go from out-of-the-money to in-the-money, and to give yourself at least 5 days on your contracts.

Here are some strike prices I’m watching (assumes expiration 7/25 or later):

• $515 Call — Entry: $2.00 or less → TP: $6.00+

• $517.5 Call — Entry: $1.30 or less → TP: $3.90+

• $520 Call — Entry: $0.70 or less → TP: $2.10+

These levels give you a strong RR if you can catch the right pullback.

⸻

🔁 Secondary Trade Idea: Bounce at $500

The $500 level is both a psychological number and a reinforced demand zone.

While it overlaps with the stop on our main setup, this trade assumes MSFT pushes higher first, then retraces to $500 for a fresh leg up.

This area will likely play a key role in future price action.

If we see a pullback into this zone with contextual selling pressure, it could offer a clean high-probability bounce.

Take profit levels would depend on how price behaves as it sells into this level — but keep this area marked.

⸻

Thanks for reading — be sure to check out my other MAG 7 analysis.

thecafetrader

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.