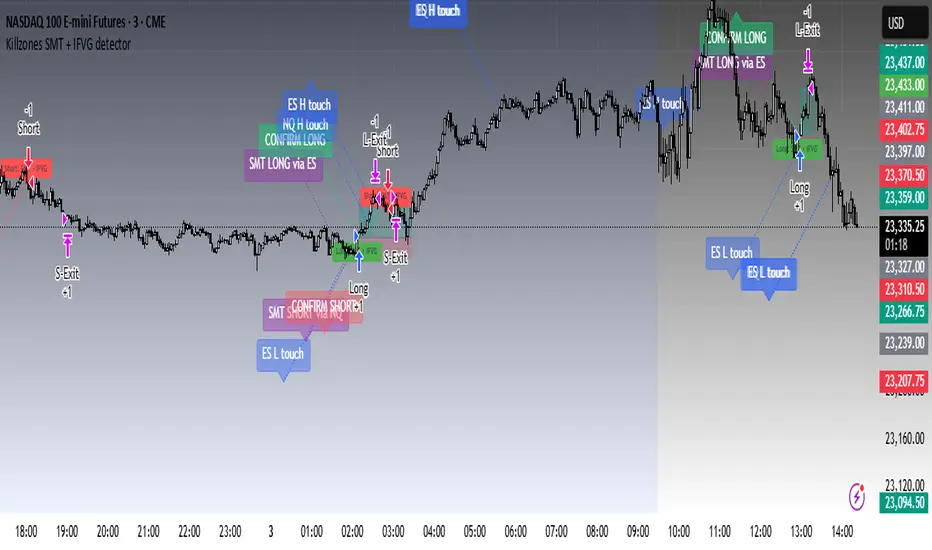

Killzones SMT + IFVG detector

Killzones SMT + IFVG detector is a rules-based tool that highlights short-term directional setups during defined “killzone” sessions by combining SMT (cross-market divergence between NQ and ES) with strict ICT-style IFVG confirmation. It draws clean, off-candle markers and (if enabled) alerts when conditions are met.

Killzones (what they are and default times)

The tool focuses on intraday windows where liquidity and directional moves commonly concentrate. It records session extremes (H/L) inside these windows and then looks for cross-market divergence and IFVG confirmation around those levels.

- []20:00–00:00 NY time — Early overnight window where new liquidity forms and prior sessions’ levels are often tested.

[]02:00–05:00 NY time — European/London activity window; fresh extremes often set here.

[]09:30–11:00 NY time — U.S. morning data/price discovery window (includes major economic prints at :30).

[]12:00–13:00 NY time — Midday probe/pause window; sweeps can occur as liquidity thins. - 13:30–16:00 NY time — U.S. PM window; continuation/unwind into the session close.

What the script does (high-level mechanics)

- []Tracks each killzone’s session extremes (recent highs/lows) for NQ and ES and stores a limited number of untouched levels.

[]Identifies SMT divergence (exclusive sweep): within the same bar, only one index sweeps a stored session high/low while the other does not.

• Bullish SMT: one index sweeps the low while the other remains above its session low.

• Bearish SMT: one index sweeps the high while the other remains below its session high.

Detection supports Sweep (Cross) with a user-set minimum tick penetration or Exact Tick equality.

[]After an SMT candidate, the script locks onto a qualifying 3-bar IFVG on the chosen confirmation symbol (NQ or ES). A setup only confirms when the candle closes beyond the IFVG boundary in the candle’s direction (bull close above upper gap for longs; bear close below lower gap for shorts). An optional “re-lock” keeps tracking the newest valid IFVG until confirmation or expiry.

[]Safety gates reduce low-quality triggers: same-bar high+low sweep on the same symbol suspends new setups until the next killzone; weekend lockout; optional cooldown; and an initial-stop size gate that skips entries when the computed initial SL exceeds a user-defined maximum. - Optional stop/target engine: initial stop from last opposite-candle wick (+ buffer), fixed TP in points, and step-ups to BE → 50% → 80% of target as progress thresholds are reached.

How to use it

- []Apply to a chart with access to NQ and ES data (e.g., continuous futures).

[]Select the confirmation symbol (NQ or ES). - Manage risk according to your plan.

*

Alerts: enable SMT Bullish/Bearish and/or Confirm LONG/SHORT; “Once per bar close” is generally recommended.

What markets it is meant for

The logic is designed around the NQ/ES index futures pair on intraday timeframes during common session “killzones.”

Under which conditions

Works best when sessions produce clear highs/lows and a nearby IFVG forms on the confirmation symbol. Expect weaker performance on days with one-sided trend continuation without divergence or when spreads/feeds cause mismatched levels.

Limitations

Signals depend on data quality and session definitions; small variations across feeds/timeframes are normal. Divergence does not guarantee reversal; confirmations can fail. Past performance is not indicative of future results; use prudent risk management.

Strategy Properties used for this publication

- []Initial capital: $50,000

[]Commission: 0%(defualt)

[]Slippage: 0 ticks(default)

[]Position sizing: 1 contract by default (adjust to account size)

[][b} Time frame: 3mins time frame(can also work on any other time frame)

Skrip jemputan sahaja

Hanya pengguna yang diluluskan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Ini selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi terus eliran5060.

TradingView tidak menyarankan pembayaran untuk atau menggunakan skrip kecuali anda benar-benar mempercayai penulisnya dan memahami bagaimana ia berfungsi. Anda juga boleh mendapatkan alternatif sumber terbuka lain yang percuma dalam skrip komuniti kami.

Arahan penulis

Amaran: sila baca panduan kami untuk skrip jemputan sahaja sebelum memohon akses.

Feel free to contact me via: eliran5060@gmail.com

Penafian

Skrip jemputan sahaja

Hanya pengguna yang diluluskan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Ini selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi terus eliran5060.

TradingView tidak menyarankan pembayaran untuk atau menggunakan skrip kecuali anda benar-benar mempercayai penulisnya dan memahami bagaimana ia berfungsi. Anda juga boleh mendapatkan alternatif sumber terbuka lain yang percuma dalam skrip komuniti kami.

Arahan penulis

Amaran: sila baca panduan kami untuk skrip jemputan sahaja sebelum memohon akses.

Feel free to contact me via: eliran5060@gmail.com