OPEN-SOURCE SCRIPT

Telah dikemas kini Rapid Candle PATTERNS V2.0

Indicator Title: Rapid Candle Patterns - High-Probability Signals

Description

Tired of noisy charts filled with weak and ambiguous candlestick patterns? The Rapid Candle Patterns indicator is engineered to solve this problem by moving beyond simple textbook definitions. It identifies only high-probability reversal and continuation signals by focusing on the underlying market dynamics: momentum, liquidity, and confirmation.

This is not just another pattern indicator; it's a professional-grade tool designed to help you spot truly significant price action events.

How The Logic Works & Why It's More Accurate

Each pattern in this script has been enhanced with stricter, more intelligent rules to filter out noise and reduce false signals. Here’s what makes our logic superior:

1. The Liquidity Grab Hammer & Inverted Hammer

Standard Logic: A simple hammer shows a long lower wick, suggesting buyers pushed the price back up.

Our Enhanced Logic: We don't just look for a hammer shape. Our signal is only valid if the hammer’s low takes out the low of the previous candle (a "liquidity grab" or "stop hunt").

Why It's More Accurate: This sequence is incredibly powerful. It shows that sellers attempted to push the market lower, triggered stop-loss orders below the prior low, and then were decisively overpowered by buyers who reversed the price. This isn't just a reversal; it's a failed breakdown, often trapping sellers and fueling a stronger move in the opposite direction.

2. The "True" Bullish & Bearish Harami

Standard Logic: A small candle forms within the high-low range of the previous candle. This can often be misleading if the prior candle has long wicks and a tiny body.

Our Enhanced Logic: We enforce a "dual containment" rule. For a Harami to be valid, its body must be contained within the body of the previous candle. We also ensure the Harami candle itself is not a Doji, meaning it must show some conviction.

Why It's More Accurate: This ensures you are seeing a genuine and significant contraction in momentum. It filters out scenarios where a large-bodied candle forms inside the wicks of a doji-like candle, which is not a true Harami. Our logic captures the "pregnant" pattern as it was intended—a moment of quiet consolidation before a potential new move.

3. The "Power" Bullish & Bearish Engulfing

Standard Logic: A candle's body engulfs the body of the previous candle. This is a common signal, but it often lacks follow-through.

Our Enhanced Logic: Our "Power Engulfing" requires two conditions: (1) The body must engulf the prior candle's body, AND (2) the candle must close beyond the entire high/low range of the prior candle.

Why It's More Accurate: This is the ultimate sign of confirmation. It doesn't just show that one side has won the battle for the session; it proves they had enough force to break the entire structure of the previous candle. This signifies immense momentum and dramatically increases the probability that the trend will continue in the direction of the engulfing candle.

4. The Quantified Doji

Our Logic: Instead of being a subjective pattern, a Doji is defined quantitatively. It's a candle whose body is less than or equal to a user-defined percentage (default 9%) of its total range.

Why It's More Accurate: It provides a consistent and objective measure of market indecision. Furthermore, any candle identified as a Doji is automatically disqualified from being a Hammer, ensuring clear and distinct signals.

User Customization

Toggle Patterns On/Off: Declutter your chart by only showing the patterns you want to see.

Fine-Tune Logic: Use the "Pattern Logic" settings to adjust the sensitivity of the Doji and Harami detectors to perfectly match your trading style, asset, and timeframe.

Disclaimer: This indicator is a powerful tool for identifying high-probability price action. However, no single indicator is a complete trading system. Always use these signals as part of a comprehensive strategy, combined with analysis of market structure, support/resistance levels, and other forms of confluence.

Description

Tired of noisy charts filled with weak and ambiguous candlestick patterns? The Rapid Candle Patterns indicator is engineered to solve this problem by moving beyond simple textbook definitions. It identifies only high-probability reversal and continuation signals by focusing on the underlying market dynamics: momentum, liquidity, and confirmation.

This is not just another pattern indicator; it's a professional-grade tool designed to help you spot truly significant price action events.

How The Logic Works & Why It's More Accurate

Each pattern in this script has been enhanced with stricter, more intelligent rules to filter out noise and reduce false signals. Here’s what makes our logic superior:

1. The Liquidity Grab Hammer & Inverted Hammer

Standard Logic: A simple hammer shows a long lower wick, suggesting buyers pushed the price back up.

Our Enhanced Logic: We don't just look for a hammer shape. Our signal is only valid if the hammer’s low takes out the low of the previous candle (a "liquidity grab" or "stop hunt").

Why It's More Accurate: This sequence is incredibly powerful. It shows that sellers attempted to push the market lower, triggered stop-loss orders below the prior low, and then were decisively overpowered by buyers who reversed the price. This isn't just a reversal; it's a failed breakdown, often trapping sellers and fueling a stronger move in the opposite direction.

2. The "True" Bullish & Bearish Harami

Standard Logic: A small candle forms within the high-low range of the previous candle. This can often be misleading if the prior candle has long wicks and a tiny body.

Our Enhanced Logic: We enforce a "dual containment" rule. For a Harami to be valid, its body must be contained within the body of the previous candle. We also ensure the Harami candle itself is not a Doji, meaning it must show some conviction.

Why It's More Accurate: This ensures you are seeing a genuine and significant contraction in momentum. It filters out scenarios where a large-bodied candle forms inside the wicks of a doji-like candle, which is not a true Harami. Our logic captures the "pregnant" pattern as it was intended—a moment of quiet consolidation before a potential new move.

3. The "Power" Bullish & Bearish Engulfing

Standard Logic: A candle's body engulfs the body of the previous candle. This is a common signal, but it often lacks follow-through.

Our Enhanced Logic: Our "Power Engulfing" requires two conditions: (1) The body must engulf the prior candle's body, AND (2) the candle must close beyond the entire high/low range of the prior candle.

Why It's More Accurate: This is the ultimate sign of confirmation. It doesn't just show that one side has won the battle for the session; it proves they had enough force to break the entire structure of the previous candle. This signifies immense momentum and dramatically increases the probability that the trend will continue in the direction of the engulfing candle.

4. The Quantified Doji

Our Logic: Instead of being a subjective pattern, a Doji is defined quantitatively. It's a candle whose body is less than or equal to a user-defined percentage (default 9%) of its total range.

Why It's More Accurate: It provides a consistent and objective measure of market indecision. Furthermore, any candle identified as a Doji is automatically disqualified from being a Hammer, ensuring clear and distinct signals.

User Customization

Toggle Patterns On/Off: Declutter your chart by only showing the patterns you want to see.

Fine-Tune Logic: Use the "Pattern Logic" settings to adjust the sensitivity of the Doji and Harami detectors to perfectly match your trading style, asset, and timeframe.

Disclaimer: This indicator is a powerful tool for identifying high-probability price action. However, no single indicator is a complete trading system. Always use these signals as part of a comprehensive strategy, combined with analysis of market structure, support/resistance levels, and other forms of confluence.

Nota Keluaran

## Rapid Candle Patterns V4.0: From Detector to High-Probability Signal GeneratorHello, fellow traders!

I'm excited to release Version 4.0 of the Rapid Candle Patterns indicator. This is not just a minor update; it's a complete evolution in philosophy. The original script was designed to detect common candlestick patterns. This new version is engineered to identify high-probability, actionable trade signals by adding layers of context and confirmation.

The core idea is to move beyond simply identifying a shape and instead ask, "Does this pattern have a higher chance of succeeding based on the market structure around it?" If you're a trader who uses candlestick patterns for confluence with other strategies like Order Blocks (OD) or Fair Value Gaps (iFVG), this tool is now tailored for you.

## What's New? A Detailed Comparison

Let's break down the significant upgrades for each pattern.

### 1. The Hammer: From Simple Shape to "Swing Rejection"

Old Logic: The previous version identified any candle that looked like a hammer—a small body with a long wick.

New V4.0 Logic: We now ask, "Did this hammer form at a meaningful price level?" A hammer is most powerful when it signifies a rejection at a potential bottom.

Swing Point Confirmation: The script now only flags a Hammer if its low is the lowest low of the last 'X' bars (you can set the lookback period). This ensures the pattern occurs at a critical swing low, not in the middle of random chop.

Optional Liquidity Grab: The powerful "stop hunt" filter (low < low[1]) is now a toggle. You can choose to enforce this for the highest quality signals or turn it off for more opportunities.

Reversal Confirmation: We added a new rule that the Hammer must close back inside the range of the previous candle. This proves that sellers failed to hold prices down and buyers have regained control, confirming the rejection.

### 2. The Harami: From Inside Bar to "Momentum Shift"

Old Logic: The script identified a small candle inside a larger one.

New V4.0 Logic: A Harami is significant when it shows a powerful trend is losing steam. We now filter for this specific scenario.

Trend Context: The script now checks if the first (large) candle of the pattern has a body that is bigger than the recent average body size. This ensures the Harami is interrupting a genuine, high-momentum trend, not just forming in a sideways market.

Positional Filtering: For a bullish Harami, the small candle must now form in the lower 50% of the prior bearish candle. This indicates a deeper loss of downward momentum and a more significant stall.

Body Quality Control: We've kept the filter that ensures the Harami itself has a meaningful body, not just wicks, filtering out indecisive doji-like candles.

### 3. The Engulfing: From Basic Pattern to "Confirmed Breakout"

Old Logic: The script looked for one candle's body engulfing the previous one. Our "Power Engulfing" was a step up, but it could be better.

New V4.0 Logic: A true engulfing reversal is a power move. It should be decisive, confirmed by volume, and not a random spike.

Volume Confirmation (Optional): You can now require the engulfing candle to have higher volume than the previous candle. This is a classic confirmation technique, now built right in. It's also a toggle, so you can turn it off if your broker's volume data is unreliable.

News Spike Filter: We now filter out absurdly large candles. If an engulfing candle is, for example, 3x larger than the average candle, it's likely a news event and not a reliable technical pattern. This filter keeps you out of unpredictable volatility.

Body Conviction Filter: A truly powerful engulfing candle should close strong. We've added a filter to ensure the candle's body makes up a significant percentage of its own range. This avoids signals on engulfing candles that have long, opposing wicks, which show indecision.

## How to Use the New Version

This script is now a professional-grade tool designed for tuning. In the settings, you have full control over every new rule. I recommend starting with the balanced default settings and adjusting them to fit your preferred market and timeframe. Find the "sweet spot" that gives you the quality of signals you need for your trading system.

Thank you for your support, and I hope this major upgrade helps you find more A+ trading opportunities!

Nota Keluaran

Rapid Candle Patterns V5.0 - Now with Trend Filters!Hello, fellow traders!

I'm thrilled to release V5.0 of the Rapid Candle Patterns indicator. This is a massive upgrade focused on one key concept: signal qualification.

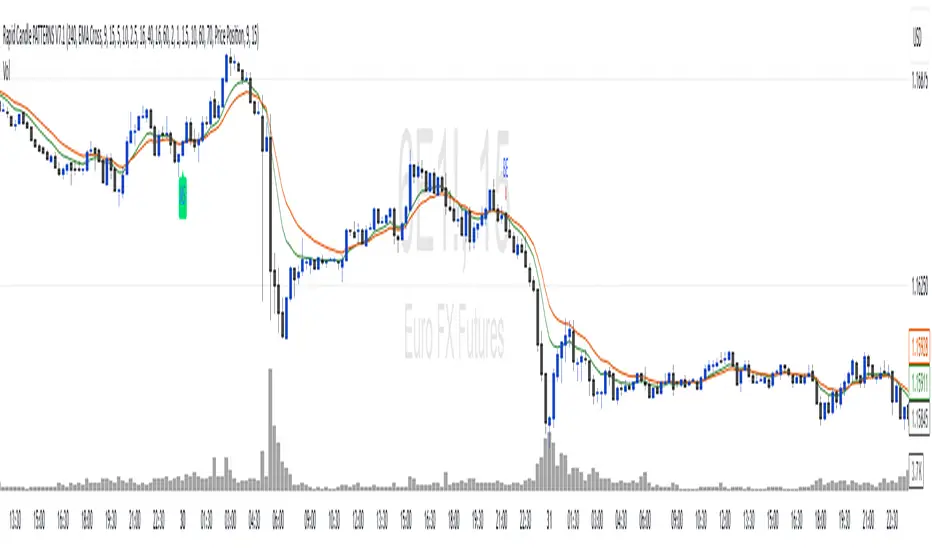

The previous V4.0 was excellent at finding high-probability "smart money" patterns. This new version takes it a step further by introducing a powerful EMA Trend Filter. Now, you can automatically filter every single pattern to ensure it aligns with your defined market trend, dramatically cleaning up your charts and focusing you on the highest-probability setups.

What's New in V5.0: The Trend is Your Friend!

- []MAJOR UPGRADE: Built-in EMA Trend Filter This is the biggest new feature. You can now filter ALL signals (Hammers, Haramis, and Engulfing) based on the trend. You have three powerful modes: []Disabled: No trend filter. Shows all V4.0 signals (ideal for range trading or manual S/R analysis). []EMA Cross: Only shows bullish patterns (H, BuH, BuE) when the Fast EMA is above the Slow EMA. Only shows bearish patterns (IH, BeH, BeE) when the Fast EMA is below the Slow. []Price Position: A stricter filter. Only shows bullish patterns when the price is above both EMAs, and bearish patterns only when the price is below both EMAs.

- Volume Confirmation for Hammers Our powerful "Swing Rejection" Hammers (H) and Inverted Hammers (IH) now have an additional layer of confirmation. They will only be flagged if they also have volume > volume[1], just like our Engulfing patterns. This ensures the rejection is backed by conviction.

- Visible EMA Lines The fast and slow EMAs used for the trend filter are now plotted directly on your chart. This "what you see is what you get" approach lets you visually confirm the trend context at all times.

- Harmonized Volume Logic The volume confirmation logic is now consistent and correct. Both Engulfing and Hammer patterns now require volume > volume[1] to signal. This ensures that all "power" patterns are backed by an increase in market participation.

A Reminder of Our Core 'Smart' Filters (from V4.0)

This update includes all the powerful filters from V4.0 that make this indicator unique:

- []Hammers are 'Swing Rejection' points: They must be the lowest low or highest high of the last 'X' bars. []Optional 'Liquidity Grab' filter: Ensures Hammers are "stop hunting" below/above the prior candle. []Haramis are 'Momentum Shift' signals: They must appear after a stronger-than-average trend candle and form in the "weak" half of that candle. []Engulfing patterns filter 'News Spikes': Ignores absurdly large candles.

- Body Quality Control: All patterns filter out wicky, indecisive candles and require a strong, decisive body.

Nota Keluaran

Rapid Candle Patterns V6.0: The Dual-Trend Alignment UpdateHello, fellow traders!

This is the update I've been most excited to build. V6.0 transitions our indicator from a simple pattern filter into a professional-grade, dual-timeframe confirmation system.

The problem with most single-timeframe indicators is that you can get "perfect" buy signals... right into a brick wall of HTF bearish pressure. V6.0 is designed to solve this.

What's New in V6.0: Total Trend Alignment

- MAJOR UPGRADE: Higher Timeframe (HTF) Trend Filter We now have a completely new "HTF Trend Determination" section. This allows you to set a reference timeframe (e.g., "240" for 4H) and filter all signals based on the trend from that timeframe.

- ANTI-REPAINTING LOGIC: Wait for the Close! This is the most professional part of the upgrade. The indicator will not change its HTF trend opinion mid-bar. It waits for the HTF bar to close before confirming the trend. This eliminates "flicker" and repainting, giving you signals you can actually trust.

- NEW Filter Modes: Set Your Bias The new HTF filter includes "Long Only" and "Short Only" modes. This is perfect for when you have a strong, fixed directional bias for the day or week and want the indicator to only find signals in that one direction.

[]The "Dual Filter" Confirmation System This is the new "secret sauce." A signal is now only valid if it passes BOTH trend filters:- []1. The new HTF Filter must be bullish.

- 2. The existing Chart Trend Filter (from V5.0) must ALSO be bullish.

A Note on Our Advanced Volume Logic

As a reminder, our volume logic is nuanced and intentional, based on Effort vs. Result (EVR):

- []Hammers/IH: Require volume > volume[1]. This is "Effort with Result" – high volume confirms the strong rejection. []Engulfing (BuE/BeE): Require volume < volume[1]. This is an advanced "Effort with No Result" or "stealth" concept, often seen in two-bar reversals where the breakout happens on surprisingly low volume, trapping traders.

How to Use V6.0

- []Set your 'Ref Timeframe' to your "anchor" chart (e.g., 240 for 4H). []Set the 'HTF Trend Filter' to 'EMA Cross' or 'Price Position'.

- Set the 'Chart Trend Filter' (under EMA Settings) to 'EMA Cross' or 'Price Position'.

Now, when a signal like a Bullish Hammer appears on your 15M chart, you know with confidence that both your 15M and 4H charts are in a bullish trend, giving you a true A+ setup.

This is the cleanest, safest, and most powerful version we've ever built.

Happy trading!

Nota Keluaran

Sorry published it without the alters. Just updated it.New in V6.0: Clean, Simple Alerts

This was a highly requested feature! The script now includes a simple and efficient alert system.

When you create an alert on TradingView, simply select the indicator and choose the "Any Alert() Function Call" condition.

The alerts are tied directly to your user settings.

This means:

- If you uncheck "Show Swing Hammers" in the inputs, you will not receive Hammer alerts.

- The alert will only trigger once per bar when the signal is confirmed, preventing repetitive or "flicker" alerts.

- The alert message will be simple and clear (e.g., "Bullish Hammer (H)", "Bearish Engulfing (BeE)").

How to Use & Backtesting Notes

This indicator is a flexible tool, not just a single strategy. Here are a few ways to think about it:

- The default fast EMA is 9 and Slow is 15. As I always use these, the default settings are tuned for this.

- Try changing the EMAs to 8 and 20, setting the 'Chart Trend Filter' to "Price Position," and only ticking the Hammer. This can work as a great T-wave-style indicator.

- Or, try a classic 9 and 21 EMA combination.

- You can also turn off the 'HTF Trend Filter' and keep only the 'Chart Trend Filter' active, perhaps adding a VWAP to your chart for extra confluence.

Backtesting Results & Expectations

I tested the default settings from Jul 2025 to Oct 2025. This produced a total of 20 signals, resulting in 14 wins, some of which were very large moves.

This indicator is built for quality over quantity. With all trend filters active, it is not going to give you a signal every day. It's designed to find A+ setups. For more frequent signals, you can turn off the trend filters. The built-in volume and "smart money" logic (like liquidity grabs) will still provide a strong, high-quality filter.

I hope you like this update! Please let me know your thoughts after you've had a chance to backtest it. I'm always open to improvement suggestions and will do my best to keep upgrading the tool.

Happy trading!

Nota Keluaran

Rapid Candle Patterns V7.1 - The A+ Reversal Update!Hello, fellow traders!

This is a major upgrade. After building our powerful dual-trend filtering system in V6.0, it's time to add more A+ patterns to our arsenal. V7.1 introduces two classic, high-conviction patterns: The Marubozu (Momentum) and the Morning/Evening Star (Reversal).

But, in line with our "quality over quantity" philosophy, our Morning and Evening Stars are not the basic textbook version. We have built in a three-part quality filter to ensure that only the most powerful and high-probability star patterns are flagged.

What's New in V7.1?

- NEW PATTERN: Marubozu (Momentum) This is a single-candle pattern showing pure, one-sided conviction. A Marubozu has a full body with little to no wicks. A bullish Marubozu shows buyers were in 100% control from open to close. We use this as a trend-following momentum signal. It will only appear if it's aligned with our Dual Trend filter, confirming the strong momentum is on your side.

- NEW PATTERN: High-Quality Morning & Evening Stars This is the star of the update. A standard Morning/Evening Star is a 3-bar reversal, but ours is designed to filter out all the weak, ambiguous ones. For a signal to appear, it must pass this strict 3-point test:

- []1. The Trend Candle: The first candle of the pattern must be a strong, high-momentum candle (a body larger than the recent average) moving in the direction of the local pullback.

- 2. The "Pin Bar" Star: The second candle (the 'star') is not just any small candle. It must be a true pin bar, with a tiny body (e.g., < 10% of its range) and a long, dominant rejection wick (e.g., > 50% of its range).

- 3. The "Conviction" Confirmation: The third candle must prove the reversal has power. It must not only close more than 50% into the body of the first candle, but it must also be a high-quality candle itself, with a strong body and no long, opposing rejection wick.

This strict logic means that when you see a Morning Star (MS) or Evening Star (ES) signal, you know it's a true, high-conviction reversal.

Like all our patterns, these new signals are automatically filtered by both your Chart Trend and HTF Trend settings, ensuring you are only seeing the highest probability setups.

Note: Please change the HTF trend filter accordingly

Nota Keluaran

Sorry we added a separete coviction logic for Marubozu that candle body has to be 1.5 time then last 16 candles. everything eles is identical.

Set up suggestion- 4hr HTF->15min chart or 1hr HTF->5min chart. Please change the look back for harami body and enguphing range to 32-48.

enjoy. this will provide quality signal and then momentum indication to hold the trade further.

Skrip sumber terbuka

Dalam semangat sebenar TradingView, pencipta skrip ini telah menjadikannya sumber terbuka supaya pedagang dapat menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupun anda boleh menggunakannya secara percuma, ingat bahawa menerbitkan semula kod ini adalah tertakluk kepada Peraturan Dalaman kami.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat sebenar TradingView, pencipta skrip ini telah menjadikannya sumber terbuka supaya pedagang dapat menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupun anda boleh menggunakannya secara percuma, ingat bahawa menerbitkan semula kod ini adalah tertakluk kepada Peraturan Dalaman kami.

Penafian

Maklumat dan penerbitan adalah tidak dimaksudkan untuk menjadi, dan tidak membentuk, nasihat untuk kewangan, pelaburan, perdagangan dan jenis-jenis lain atau cadangan yang dibekalkan atau disahkan oleh TradingView. Baca dengan lebih lanjut di Terma Penggunaan.