OPEN-SOURCE SCRIPT

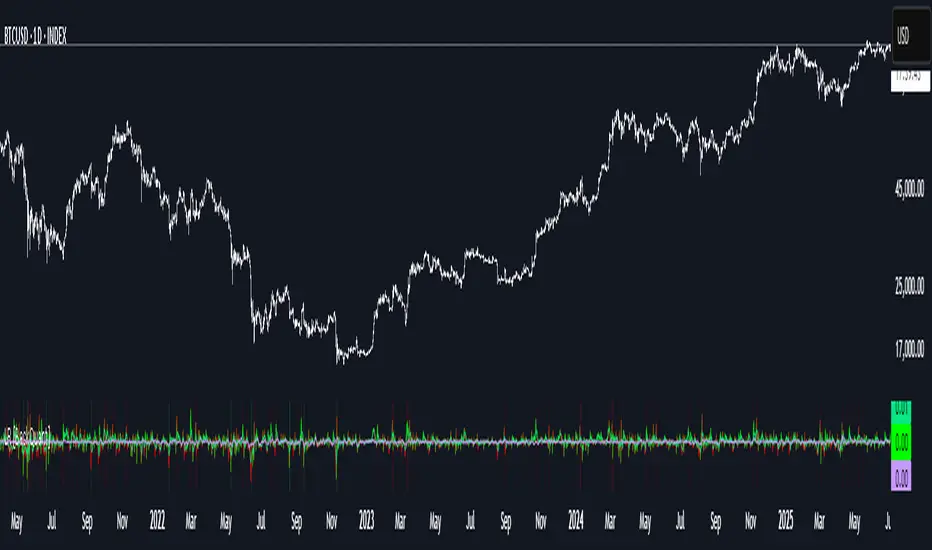

Rolling Log Returns [BackQuant]

Rolling Log Returns [BackQuant]

The Rolling Log Returns [BackQuant] indicator is a versatile tool designed to help traders, quants, and data-driven analysts evaluate the dynamics of price changes using logarithmic return analysis. Widely adopted in quantitative finance, log returns offer several mathematical and statistical advantages over simple returns, making them ideal for backtesting, portfolio optimization, volatility modeling, and risk management.

What Are Log Returns?

In quantitative finance, logarithmic returns are defined as:

ln(Pₜ / Pₜ₋₁)

or for rolling periods:

ln(Pₜ / Pₜ₋ₙ)

where P represents price and n is the rolling lookback window.

Log returns are preferred because:

They are time additive: returns over multiple periods can be summed.

They allow for easier statistical modeling, especially when assuming normally distributed returns.

They behave symmetrically for gains and losses, unlike arithmetic returns.

They normalize percentage changes, making cross-asset or cross-timeframe comparisons more consistent.

Indicator Overview

The Rolling Log Returns [BackQuant] indicator computes log returns either on a standard (1-period) basis or using a rolling lookback period, allowing users to adapt it to short-term trading or long-term trend analysis.

It also supports a comparison series, enabling traders to compare the return structure of the main charted asset to another instrument (e.g., SPY, BTC, etc.).

Core Features

✅ Return Modes:

Normal Log Returns: Measures ln(price / price[1]), ideal for day-to-day return analysis.

Rolling Log Returns: Measures ln(price / price[N]), highlighting price drift over longer horizons.

✅ Comparison Support:

Compare log returns of the primary instrument to another symbol (like an index or ETF).

Useful for relative performance and market regime analysis.

✅ Moving Averages of Returns:

Smooth noisy return series with customizable MA types: SMA, EMA, WMA, RMA, and Linear Regression.

Applicable to both primary and comparison series.

✅ Conditional Coloring:

Returns > 0 are colored green; returns < 0 are red.

Comparison series gets its own unique color scheme.

✅ Extreme Return Detection:

Highlight unusually large price moves using upper/lower thresholds.

Visually flags abnormal volatility events such as earnings surprises or macroeconomic shocks.

Quantitative Use Cases

🔍 Return Distribution Analysis:

Gain insight into the statistical properties of asset returns (e.g., skewness, kurtosis, tail behavior).

📉 Risk Management:

Use historical return outliers to define drawdown expectations, stress tests, or VaR simulations.

🔁 Strategy Backtesting:

Apply rolling log returns to momentum or mean-reversion models where compounding and consistent scaling matter.

📊 Market Regime Detection:

Identify periods of consistent overperformance/underperformance relative to a benchmark asset.

📈 Signal Engineering:

Incorporate return deltas, moving average crossover of returns, or threshold-based triggers into machine learning pipelines or rule-based systems.

Recommended Settings

Use Normal mode for high-frequency trading signals.

Use Rolling mode for swing or trend-following strategies.

Compare vs. a broad market index (e.g., SPY or QQQ) to extract relative strength insights.

Set upper and lower thresholds around ±5% for spotting major volatility days.

Conclusion

The Rolling Log Returns indicator transforms raw price action into a statistically sound return series—equipping traders with a professional-grade lens into market behavior. Whether you're conducting exploratory data analysis, building factor models, or visually scanning for outliers, this indicator integrates seamlessly into a modern quant's toolbox.

The Rolling Log Returns [BackQuant] indicator is a versatile tool designed to help traders, quants, and data-driven analysts evaluate the dynamics of price changes using logarithmic return analysis. Widely adopted in quantitative finance, log returns offer several mathematical and statistical advantages over simple returns, making them ideal for backtesting, portfolio optimization, volatility modeling, and risk management.

What Are Log Returns?

In quantitative finance, logarithmic returns are defined as:

ln(Pₜ / Pₜ₋₁)

or for rolling periods:

ln(Pₜ / Pₜ₋ₙ)

where P represents price and n is the rolling lookback window.

Log returns are preferred because:

They are time additive: returns over multiple periods can be summed.

They allow for easier statistical modeling, especially when assuming normally distributed returns.

They behave symmetrically for gains and losses, unlike arithmetic returns.

They normalize percentage changes, making cross-asset or cross-timeframe comparisons more consistent.

Indicator Overview

The Rolling Log Returns [BackQuant] indicator computes log returns either on a standard (1-period) basis or using a rolling lookback period, allowing users to adapt it to short-term trading or long-term trend analysis.

It also supports a comparison series, enabling traders to compare the return structure of the main charted asset to another instrument (e.g., SPY, BTC, etc.).

Core Features

✅ Return Modes:

Normal Log Returns: Measures ln(price / price[1]), ideal for day-to-day return analysis.

Rolling Log Returns: Measures ln(price / price[N]), highlighting price drift over longer horizons.

✅ Comparison Support:

Compare log returns of the primary instrument to another symbol (like an index or ETF).

Useful for relative performance and market regime analysis.

✅ Moving Averages of Returns:

Smooth noisy return series with customizable MA types: SMA, EMA, WMA, RMA, and Linear Regression.

Applicable to both primary and comparison series.

✅ Conditional Coloring:

Returns > 0 are colored green; returns < 0 are red.

Comparison series gets its own unique color scheme.

✅ Extreme Return Detection:

Highlight unusually large price moves using upper/lower thresholds.

Visually flags abnormal volatility events such as earnings surprises or macroeconomic shocks.

Quantitative Use Cases

🔍 Return Distribution Analysis:

Gain insight into the statistical properties of asset returns (e.g., skewness, kurtosis, tail behavior).

📉 Risk Management:

Use historical return outliers to define drawdown expectations, stress tests, or VaR simulations.

🔁 Strategy Backtesting:

Apply rolling log returns to momentum or mean-reversion models where compounding and consistent scaling matter.

📊 Market Regime Detection:

Identify periods of consistent overperformance/underperformance relative to a benchmark asset.

📈 Signal Engineering:

Incorporate return deltas, moving average crossover of returns, or threshold-based triggers into machine learning pipelines or rule-based systems.

Recommended Settings

Use Normal mode for high-frequency trading signals.

Use Rolling mode for swing or trend-following strategies.

Compare vs. a broad market index (e.g., SPY or QQQ) to extract relative strength insights.

Set upper and lower thresholds around ±5% for spotting major volatility days.

Conclusion

The Rolling Log Returns indicator transforms raw price action into a statistically sound return series—equipping traders with a professional-grade lens into market behavior. Whether you're conducting exploratory data analysis, building factor models, or visually scanning for outliers, this indicator integrates seamlessly into a modern quant's toolbox.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Check out whop.com/signals-suite for Access to Invite Only Scripts!

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Check out whop.com/signals-suite for Access to Invite Only Scripts!

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.