OPEN-SOURCE SCRIPT

Bilateral Filter For Loop [BackQuant]

Bilateral Filter For Loop [BackQuant]

The Bilateral Filter For Loop [BackQuant] is an advanced technical indicator designed to filter out market noise and smooth out price data, thus improving the identification of underlying market trends. It employs a bilateral filter, which is a sophisticated non-linear filter commonly used in image processing and price time series analysis. By considering both spatial and range differences between price points, this filter is highly effective at preserving significant trends while reducing random fluctuations, ultimately making it suitable for dynamic trend-following strategies.

Please take the time to read the following:

Key Features

1. Bilateral Filter Calculation:

The bilateral filter is the core of this indicator and works by applying a weight to each data point based on two factors: spatial distance and price range difference. This dual weighting process allows the filter to preserve important price movements while reducing the impact of less relevant fluctuations. The filter uses two primary parameters:

Spatial Sigma (σ_d): This parameter adjusts the weight applied based on the distance of each price point from the current price. A larger spatial sigma means more smoothing, as further away values will contribute more heavily to the result.

Range Sigma (σ_r): This parameter controls how much weight is applied based on the difference in price values. Larger price differences result in smaller weights, while similar price values result in larger weights, thereby preserving the trend while filtering out noise.

The output of this filter is a smoothed version of the original price series, which eliminates short-term fluctuations, helping traders focus on longer-term trends. The bilateral filter is applied over a rolling window, adjusting the level of smoothing dynamically based on both the distance between values and their relative price movements.

2. For Loop Calculation for Trend Scoring:

A for-loop is used to calculate the trend score based on the filtered price data. The loop compares the current value to previous values within the specified window, scoring the trend as follows:

+1 for upward movement (when the filtered value is greater than the previous value).

-1 for downward movement (when the filtered value is less than the previous value).

The cumulative result of this loop gives a continuous trend score, which serves as a directional indicator for the market's momentum. By summing the scores over the window period, the loop provides an aggregate value that reflects the overall trend strength. This score helps determine whether the market is experiencing a strong uptrend, downtrend, or sideways movement.

3. Long and Short Conditions:

Once the trend score has been calculated, it is compared against predefined threshold levels:

A long signal is generated when the trend score exceeds the upper threshold, indicating that the market is in a strong uptrend.

A short signal is generated when the trend score crosses below the lower threshold, signaling a potential downtrend or trend reversal.

These conditions provide clear signals for potential entry points, and the color-coding helps traders quickly identify market direction:

Long signals are displayed in green.

Short signals are displayed in red.

These signals are designed to provide high-confidence entries for trend-following strategies, helping traders capture profitable movements in the market.

4. Trend Background and Bar Coloring:

The script offers customizable visual settings to enhance the clarity of the trend signals. Traders can choose to:

Color the bars based on the trend direction: Bars are colored green for long signals and red for short signals.

Change the background color to provide additional context: The background will be shaded green for a bullish trend and red for a bearish trend. This visual feedback helps traders to stay aligned with the prevailing market sentiment.

These features offer a quick visual reference for understanding the market's direction, making it easier for traders to identify when to enter or exit positions.

5. Threshold Lines for Visual Feedback:

Threshold lines are plotted on the chart to represent the predefined long and short levels. These lines act as clear markers for when the market reaches a critical threshold, triggering a potential buy (long) or sell (short) signal. By showing these threshold lines on the chart, traders can quickly gauge the strength of the market and assess whether the trend is strong enough to warrant action.

These thresholds can be adjusted based on the trader's preferences, allowing them to fine-tune the indicator for different market conditions or asset behaviors.

6. Customizable Parameters for Flexibility:

The indicator offers several parameters that can be adjusted to suit individual trading preferences:

Window Period (Bilateral Filter): The window size determines how many past price values are used to calculate the bilateral filter. A larger window increases smoothing, while a smaller window results in more responsive, but noisier, data.

Spatial Sigma (σ_d) and Range Sigma (σ_r): These values control how sensitive the filter is to price changes and the distance between data points. Fine-tuning these parameters allows traders to adjust the degree of noise reduction applied to the price series.

Threshold Levels: The upper and lower thresholds determine when the trend score crosses into long or short territory. These levels can be customized to better match the trader's risk tolerance or asset characteristics.

Visual Settings: Traders can customize the appearance of the chart, including the line width of trend signals, bar colors, and background shading, to make the indicator more readable and aligned with their charting style.

7. Alerts for Trend Reversals:

The indicator includes alert conditions for real-time notifications when the market crosses the defined thresholds. Traders can set alerts to be notified when:

The trend score crosses the long threshold, signaling an uptrend.

The trend score crosses the short threshold, signaling a downtrend.

These alerts provide timely information, allowing traders to take immediate action when the market shows a significant change in direction.

Final Thoughts

The Bilateral Filter For Loop [BackQuant] indicator is a robust tool for trend-following traders who wish to reduce market noise and focus on the underlying trend. By applying the bilateral filter and calculating trend scores, this indicator helps traders identify strong uptrends and downtrends, providing reliable entry signals with minimal market noise. The customizable parameters, visual feedback, and alerting system make it a versatile tool for traders seeking to improve their timing and capture profitable market movements.

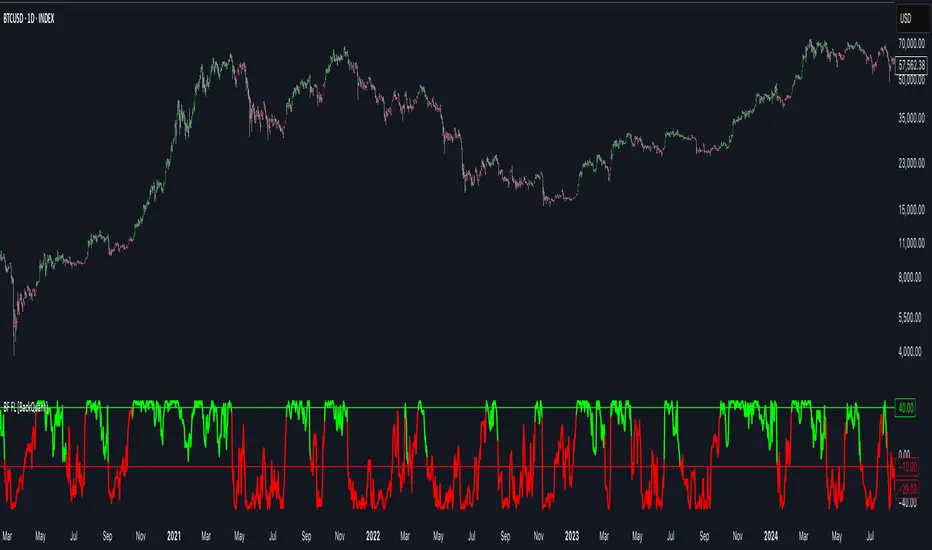

Thus following all of the key points here are some sample backtests on the 1D Chart

Disclaimer: Backtests are based off past results, and are not indicative of the future.

BTCUSD

BTCUSD

ETHUSD

ETHUSD

SOLUSD

SOLUSD

The Bilateral Filter For Loop [BackQuant] is an advanced technical indicator designed to filter out market noise and smooth out price data, thus improving the identification of underlying market trends. It employs a bilateral filter, which is a sophisticated non-linear filter commonly used in image processing and price time series analysis. By considering both spatial and range differences between price points, this filter is highly effective at preserving significant trends while reducing random fluctuations, ultimately making it suitable for dynamic trend-following strategies.

Please take the time to read the following:

Key Features

1. Bilateral Filter Calculation:

The bilateral filter is the core of this indicator and works by applying a weight to each data point based on two factors: spatial distance and price range difference. This dual weighting process allows the filter to preserve important price movements while reducing the impact of less relevant fluctuations. The filter uses two primary parameters:

Spatial Sigma (σ_d): This parameter adjusts the weight applied based on the distance of each price point from the current price. A larger spatial sigma means more smoothing, as further away values will contribute more heavily to the result.

Range Sigma (σ_r): This parameter controls how much weight is applied based on the difference in price values. Larger price differences result in smaller weights, while similar price values result in larger weights, thereby preserving the trend while filtering out noise.

The output of this filter is a smoothed version of the original price series, which eliminates short-term fluctuations, helping traders focus on longer-term trends. The bilateral filter is applied over a rolling window, adjusting the level of smoothing dynamically based on both the distance between values and their relative price movements.

2. For Loop Calculation for Trend Scoring:

A for-loop is used to calculate the trend score based on the filtered price data. The loop compares the current value to previous values within the specified window, scoring the trend as follows:

+1 for upward movement (when the filtered value is greater than the previous value).

-1 for downward movement (when the filtered value is less than the previous value).

The cumulative result of this loop gives a continuous trend score, which serves as a directional indicator for the market's momentum. By summing the scores over the window period, the loop provides an aggregate value that reflects the overall trend strength. This score helps determine whether the market is experiencing a strong uptrend, downtrend, or sideways movement.

3. Long and Short Conditions:

Once the trend score has been calculated, it is compared against predefined threshold levels:

A long signal is generated when the trend score exceeds the upper threshold, indicating that the market is in a strong uptrend.

A short signal is generated when the trend score crosses below the lower threshold, signaling a potential downtrend or trend reversal.

These conditions provide clear signals for potential entry points, and the color-coding helps traders quickly identify market direction:

Long signals are displayed in green.

Short signals are displayed in red.

These signals are designed to provide high-confidence entries for trend-following strategies, helping traders capture profitable movements in the market.

4. Trend Background and Bar Coloring:

The script offers customizable visual settings to enhance the clarity of the trend signals. Traders can choose to:

Color the bars based on the trend direction: Bars are colored green for long signals and red for short signals.

Change the background color to provide additional context: The background will be shaded green for a bullish trend and red for a bearish trend. This visual feedback helps traders to stay aligned with the prevailing market sentiment.

These features offer a quick visual reference for understanding the market's direction, making it easier for traders to identify when to enter or exit positions.

5. Threshold Lines for Visual Feedback:

Threshold lines are plotted on the chart to represent the predefined long and short levels. These lines act as clear markers for when the market reaches a critical threshold, triggering a potential buy (long) or sell (short) signal. By showing these threshold lines on the chart, traders can quickly gauge the strength of the market and assess whether the trend is strong enough to warrant action.

These thresholds can be adjusted based on the trader's preferences, allowing them to fine-tune the indicator for different market conditions or asset behaviors.

6. Customizable Parameters for Flexibility:

The indicator offers several parameters that can be adjusted to suit individual trading preferences:

Window Period (Bilateral Filter): The window size determines how many past price values are used to calculate the bilateral filter. A larger window increases smoothing, while a smaller window results in more responsive, but noisier, data.

Spatial Sigma (σ_d) and Range Sigma (σ_r): These values control how sensitive the filter is to price changes and the distance between data points. Fine-tuning these parameters allows traders to adjust the degree of noise reduction applied to the price series.

Threshold Levels: The upper and lower thresholds determine when the trend score crosses into long or short territory. These levels can be customized to better match the trader's risk tolerance or asset characteristics.

Visual Settings: Traders can customize the appearance of the chart, including the line width of trend signals, bar colors, and background shading, to make the indicator more readable and aligned with their charting style.

7. Alerts for Trend Reversals:

The indicator includes alert conditions for real-time notifications when the market crosses the defined thresholds. Traders can set alerts to be notified when:

The trend score crosses the long threshold, signaling an uptrend.

The trend score crosses the short threshold, signaling a downtrend.

These alerts provide timely information, allowing traders to take immediate action when the market shows a significant change in direction.

Final Thoughts

The Bilateral Filter For Loop [BackQuant] indicator is a robust tool for trend-following traders who wish to reduce market noise and focus on the underlying trend. By applying the bilateral filter and calculating trend scores, this indicator helps traders identify strong uptrends and downtrends, providing reliable entry signals with minimal market noise. The customizable parameters, visual feedback, and alerting system make it a versatile tool for traders seeking to improve their timing and capture profitable market movements.

Thus following all of the key points here are some sample backtests on the 1D Chart

Disclaimer: Backtests are based off past results, and are not indicative of the future.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Check out whop.com/signals-suite for Access to Invite Only Scripts!

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.

Skrip sumber terbuka

Dalam semangat TradingView sebenar, pencipta skrip ini telah menjadikannya sumber terbuka, jadi pedagang boleh menilai dan mengesahkan kefungsiannya. Terima kasih kepada penulis! Walaupuan anda boleh menggunakan secara percuma, ingat bahawa penerbitan semula kod ini tertakluk kepada Peraturan Dalaman.

Check out whop.com/signals-suite for Access to Invite Only Scripts!

Penafian

Maklumat dan penerbitan adalah tidak bertujuan, dan tidak membentuk, nasihat atau cadangan kewangan, pelaburan, dagangan atau jenis lain yang diberikan atau disahkan oleh TradingView. Baca lebih dalam Terma Penggunaan.