PineConnector [Extension] | Fractalyst

The PineConnector Extension is a sophisticated bridge indicator designed to seamlessly connect Quantify trading signals with PineConnector's automated execution system.

This extension transforms manual signal monitoring into fully automated trading by interpreting Quantify's signal outputs and converting them into executable PineConnector commands.

Unlike standalone trading indicators, this extension serves as a communication layer between your signal generation (Quantify indicator) and trade execution (PineConnector), enabling hands-free trading across multiple timeframes and instruments.

How does the signal processing work?

The extension processes four distinct signal types from Quantify indicators:

Signal Values:

1 = Buy/Long signal - Opens bullish positions

-1 = Sell/Short signal - Opens bearish positions

0.5 = Close Long - Closes all long positions

-0.5 = Close Short - Closes all short positions

The script continuously monitors the "Signal Source" input, which should be connected to any Quantify indicator's output. When a signal is detected, the extension automatically generates the corresponding PineConnector command with your configured parameters.

What are the available order types and how do they work?

The extension supports three order execution modes:

Market Orders:

- Execute immediately at current market price

- Highest execution probability

- Subject to slippage during volatile conditions

Limit Orders:

- Execute only when price reaches a more favorable level

- Buy limits placed below current price

- Sell limits placed above current price

- Dynamic pip offset calculated using ATR-based volatility

Stop Orders:

- Execute when price breaks beyond specified levels

- Buy stops placed above current price

- Sell stops placed below current price

- Useful for breakout strategies

Dynamic Pricing Calculation:

The extension calculates optimal entry prices using volatility-adjusted pip offsets:

How does the risk management system work?

Risk Percentage:

The extension uses percentage-based position sizing where you specify the risk per trade (0.1% to 10.0%). This value is passed to PineConnector, which calculates the exact position size based on:

- Account balance

- Stop loss distance

- Instrument specifications

- Broker settings

Stop Loss Integration:

- The "Stop Source" input connects to external stop loss levels from Quantify or other indicators. - This ensures:

- Consistent risk-reward ratios

- Dynamic stop placement based on market structure

- Automatic position sizing calculations

Multi-Asset Compatibility:

The extension automatically detects instrument types and adjusts pip calculations:

Forex: mintick * 10

Crypto: mintick * 10

Other assets: mintick * 1

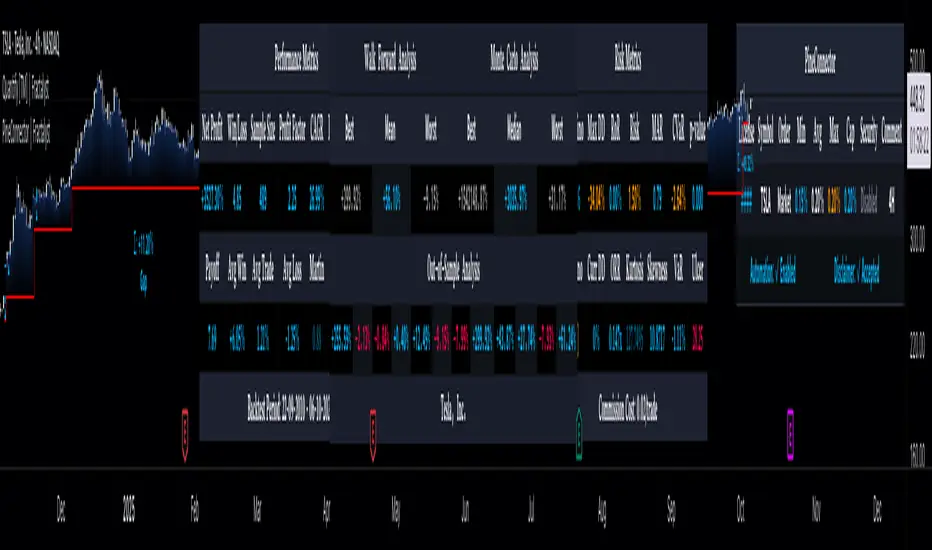

What does the information display table show?

The real-time status table provides essential configuration monitoring:

Status Indicators:

- License: Shows PineConnector license ID status (Blue = Set, Red = Missing)

- Security: Displays secret key status (Blue = Set, Orange = Disabled)

- Comment: Shows trade comment or timeframe if empty

- Symbol: Current trading symbol (manual override or chart symbol)

- Order Type: Active execution mode (Market/Limit/Stop)

- Risk: Risk percentage with color coding (Blue ≤1%, Orange >1%)

- Signal: Connection status (Blue = Connected, Red = Not Set)

- Stop: Stop loss source status (Blue = Connected, Red = Not Set)

Color Coding System:

Blue: Optimal/Connected

Orange: Warning/Moderate risk

Red: Error/Not configured

How do I connect this to my Quantify indicator?

Step-by-Step Connection:

Add the PineConnector Extension to your chart containing Quantify indicator

Configure Signal Source:

In the extension settings, locate "Signal Source"

Click the dropdown and select your Quantify indicator's signal output

The extension will automatically detect custom sources vs. default price data

Configure Stop Source:

Connect "Stop Source" to your Quantify indicator's stop loss output

This enables dynamic position sizing based on stop distance

Verify Connection:

Check the information table for "Signal" and "Stop" status

Blue indicates successful connection

Red indicates default price data (not connected)

Compatible Quantify Indicators:

- Quantify Trading Model

- Any indicator outputting standardized signals (1, -1, 0.5, -0.5)

What PineConnector setup is required?

Prerequisites:

- Active PineConnector License - Required for all functionality

- MetaTrader 4/5 or supported broker platform

- PineConnector EA installed and configured

- TradingView Pro/Pro+/Premium for alert functionality

Configuration Steps:

- License ID: Enter your PineConnector license ID in the extension

- Secret Key: Optional security layer for command verification

- Symbol Mapping: Ensure symbol names match between TradingView and broker

- Alert Setup: Create TradingView alerts using this indicator

- Webhook Configuration: Point alerts to your PineConnector webhook URL

Security Features:

- Optional secret key encryption

- Symbol-specific commands

- Debug mode for testing and validation

What makes this extension unique?

Seamless Integration:

- Unlike manual signal copying, this extension provides:

- Zero-latency signal translation

- Automated parameter passing

- Consistent execution across timeframes

- No human intervention required

Dynamic Adaptability:

Volatility-adjusted pricing for limit/stop orders

Automatic symbol detection and conversion

Multi-asset pip calculations

Intelligent timeframe formatting

Professional Risk Management:

- Percentage-based position sizing

- External stop loss integration

- Multi-order type support

- Real-time status monitoring

Robust Architecture:

- Error-resistant signal processing

- Comprehensive input validation

- Debug and testing capabilities

- Security features for live trading

Installation and Setup Guide

Quick Start:

- Add "PineConnector [Extension] | Fractalyst" to your chart

- Configure your PineConnector license ID

- Connect Signal Source to your Quantify indicator

- Connect Stop Source to your stop loss indicator

- Set your preferred risk percentage

- Choose order type (Market recommended for beginners)

- Create TradingView alert using this indicator

- Ensure PineConnector EA is running on your trading platform

Advanced Configuration:

- Custom symbol mapping for cross-platform trading

- Secret key implementation for enhanced security

- Comment customization for trade tracking

- Debug mode for strategy validation

Legal Disclaimers and Risk Acknowledgments

Trading Risk Disclosure

This PineConnector Extension is provided for informational, educational, and automation purposes only and should not be construed as financial, investment, or trading advice. The extension facilitates automated trading connections but does not guarantee profitable outcomes, successful trade execution, or positive investment returns.

Automated trading systems carry substantial risks including but not limited to total capital loss, system failures, connectivity issues, and adverse market conditions. The extension's performance depends on multiple third-party services including PineConnector, MetaTrader platforms, TradingView infrastructure, and broker execution quality, any of which may experience downtime, technical failures, or service interruptions that could affect trading performance.

System Dependency Acknowledgment

The extension requires continuous operation of multiple interconnected systems: TradingView charts and alerts, PineConnector services and Expert Advisors, MetaTrader platforms, broker connectivity, and stable internet connections. Any interruption or malfunction in these systems may result in missed signals, failed executions, or unexpected trading behavior.

Users acknowledge that neither the seller nor the creator of this extension has control over these third-party services and cannot guarantee their availability, accuracy, or performance. Market conditions, broker execution policies, slippage, and technical factors may significantly affect actual trading results compared to theoretical or backtested performance.

Liability Limitation

By utilizing this extension, users acknowledge and agree that they assume full responsibility and liability for all trading decisions, financial outcomes, and potential losses resulting from the use of this automated trading system. Neither the seller nor the creator shall be liable for any unfavorable outcomes, financial losses, missed opportunities, or damages resulting from the development, use, malfunction, or performance of this extension.

Past performance of connected indicators, strategies, or the extension itself does not guarantee future results. Trading outcomes depend on numerous factors including market conditions, economic events, broker execution quality, network connectivity, and proper system configuration, all of which are beyond the control of the extension creator.

User Responsibility Statement

Users are solely responsible for understanding the risks associated with automated trading, properly configuring all system components, maintaining adequate capitalization and risk management, and regularly monitoring system performance. Users should thoroughly test the extension in demo environments before live deployment and should never risk more capital than they can afford to lose.

This extension is designed to automate signal execution but does not replace the need for proper risk management, market understanding, and trading discipline. Users should maintain active oversight of their automated trading systems and be prepared to intervene manually when necessary.

- Reduced Complexity : Eliminated multiple input.source() declarations

- Better Synchronization : All signal data arrives together, preventing timing mismatches

- Cleaner UI : Fewer input parameters to configure

- Improved Reliability : Single point of connection reduces potential connection issues

- Integration with Quantify new risk engines

PineConnector now receives optimal position sizing directly from Quantify's risk calculations, which are calibrated to keep historical drawdowns around 5%.

Users can still set personal risk caps for tighter control.

First bar now emits a chart-specific verification code that the automation listens for, so only the authentic strategy can trigger trades.

Execution guardrails

Orders stay dormant until the handshake clears, shutting down any spoofed or third-party alerts before they reach the broker.

Clean signal stream

Entry and exit alerts only fire when a fresh trade actually opens or closes, and back-to-back duplicate entries are filtered out.

Added Session First Bar Delay to pause entry signals at the start of each trading session, avoiding volatile market opens.

Why It Matters

Market opens are often chaotic with wider spreads, whipsaw moves, and false signals. This feature lets the market settle before you start trading.

How It Works

When a new session starts (e.g., market open), the script starts a countdown timer:

- ✅ Blocks entry signals during the delay period

- ✅ Allows exit signals anytime (you can still close positions)

- ✅ Resumes normal trading once delay expires

Example: Set 300 seconds (5 min) delay → Market opens at 9:30 AM → Trading starts at 9:35 AM

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi Fractalyst secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

darwinexzero.com/darwin/XRPV/performance

🎯 | Entry Model:

whop.com/fractalyst

📥 | Work with Me:

fractalyst.net

Penafian

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi Fractalyst secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

darwinexzero.com/darwin/XRPV/performance

🎯 | Entry Model:

whop.com/fractalyst

📥 | Work with Me:

fractalyst.net