Jackrabbit.modulus.DCA

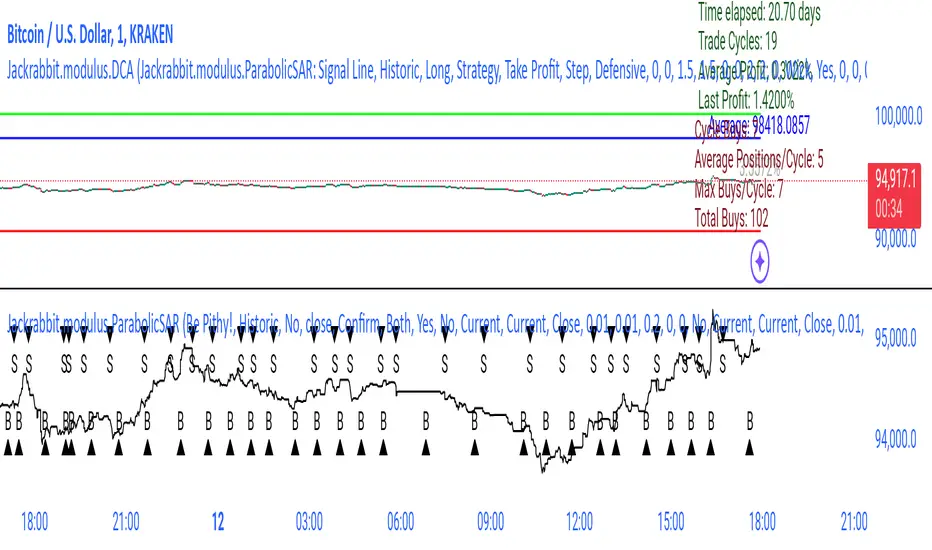

The blue line is the current average price of the asset.

The red line is the deviation boundary. Price action must be below this line for buys to be signaled.

The green line is the take profit. Price action must be above this line for a sell signal to be generated.

Here is a list of the settings:

Buy method: DCA or Strategy. DCA allows the module to decide buys based upon the methodology (step, price). Strategy added to the average on the basis of a buy signal from the strategy, but only when it is below the deviation and is the most organic of dollar cost averaging.

Sell Method. Take profit or Steategy. Take Profit sells the asset as soon as the price action crosses above the take profit line. Strategy sells on the basis of a sell signal, but only if it is above the take profit. Selling never occurs at a loss, with the only exception being the exit point.

Methodolgy: Step or Price. Stepping allows a fixed and uniform averaging ant percise intervals of deviation. Price is a very aggressive approach that will drive the average down on the basis of the difference between the average and the current price action. The price methodology is VERY high risk.

Take Profit, which describes the average profit percent of the combined positions.

Deviation, which describes the percent boundary for which price action must drop before additional assets are purchased.

Sideways Breaker: This algorithm breaks the sideways rut by forcing a purchase after X days, minimum 1 day.

Exit Position: Internal stop loss expressed in the number of buys.

It is important that when you establish your sell signal, ALL positions must be sold to ensure the average profit. If required, use a CLOSE ALL message provided by your platform. Also, any platform specific DCA or Safety Orders will cause losses as this script can not track their value. It is recommended that these features not be used.

The Jackrabbit modulus framework is a plug in play paradigm built to operate through TradingView's indicator on indicatior (IoI) functionality. As such, this script receives a signal line from the previous script in the IoI chain, and evaluates the buy/sell signals appropriate to the current analysis.

This script is by invitation only. To learn more about accessing this script, please see my signature or send me a PM. Thank you.

Price method now tracks last buy price and requires next buy price to be lower than the last. This always ensures price action is dropping during accumulation.

Step method now tracks deviation as a fixed position from the initial price. This ensures that the deviation is always absolute and is more defensive with regards to the budget.

By request, added price aggression. If you do not plan your budget carefully, you will have your entire portfolio wrecked! This is for advanced users ONLY.

Added a new feature, fuzzy deviation.

This allows the best of both worlds by choosing trigger points of either the number of purchases or the percentage of the average from the the price.

DTP is broken down into a lower and upper value. When both are the same, DTP is disabled and the standard TP mechanics function as normal.

When the lower DTP is less then the upper DTP, TP is set to the lowest value and increments according to the maximum buys per cycle. When the upper DTP is less then the lower DTP, the TP starts as the upper valus and is decreased according to the maximum buys per cycle.

DTP will woek on both Step and Price methods.

Dynamic deviation now has an upper and lower percentage that can fluctuate according to the maximum buys per cycle.

Also dynamic opperations now take place within the current cycle, as well as adapting over the life of total cycles.

Take profit and deviations now support fractional numbers.

Shutdown after buys/cycle, This entry shuts down the recipe if the event that buys to cycle exceeds a desired level or the desired accumulation has taken place,

Shutdown after trade cycles, this shuts down the recipe completes the desired number of trade cycles.

Weighted deviation., This weights the deviation based upon the current average price and number of buys per cycle. Allows for a graceful non linear slowing process of accumulation that can dynamically adjust to the current situation.

This method can be activated by setting the initial and final values of deviation or take profit to 0. BOTH numbers must be set for this special feature to activate. Also DCA buying is DISABLED for this process. This feature is expert use only and can cause extremwe losses if not properly used. Careful attention must bew taken with this approach as all the normal safeguards are DISABLED.

Made this module overlay main chart by default.

This evaluation tests the concept that a profit is "good enough" if it is "close enough" to the desired take profit area.

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi RobertD7723 secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

patreon.com/RD3277

Penafian

Skrip jemputan sahaja

Hanya pengguna disahkan oleh penulis boleh mengakses skrip ini. Anda perlu memohon dan mendapatkan kebenaran untuk menggunakannya. Keizinan selalunya diberikan selepas pembayaran. Untuk lebih butiran, ikuti arahan penulis di bawah atau hubungi RobertD7723 secara terus.

TradingView TIDAK menyarankan pembayaran atau penggunaan skrip kecuali anda mempercayai sepenuhnya penulis dan memahami bagaimana ia berfungsi. Anda juga boleh menjumpai alternatif sumber terbuka dan percuma yang lain di dalam skrip komuniti kami.

Arahan penulis

patreon.com/RD3277