Directional Volume Cloud MTFThe Directional Volume Cloud MTF transforms raw volume into a visually intuitive cloud histogram that highlights directional bias and exhaustion zones.

🔍 Core Logic

- Volume bias is calculated using candle direction (bullish/bearish) and smoothed via EMA.

- Bias strength is normalized against average volume to produce a ratio from -1 to +1.

- Color and opacity dynamically reflect bias direction and strength — pale clouds indicate weak volume, while vivid clouds signal strong conviction.

Features

- Customizable bullish/bearish colors

- Dynamic opacity based on volume strength

- Declining volume signals for potential reversals

- Multi-timeframe bias overlay (e.g., daily bias on intraday chart)

📈 Use Cases

- Spot volume exhaustion before reversals

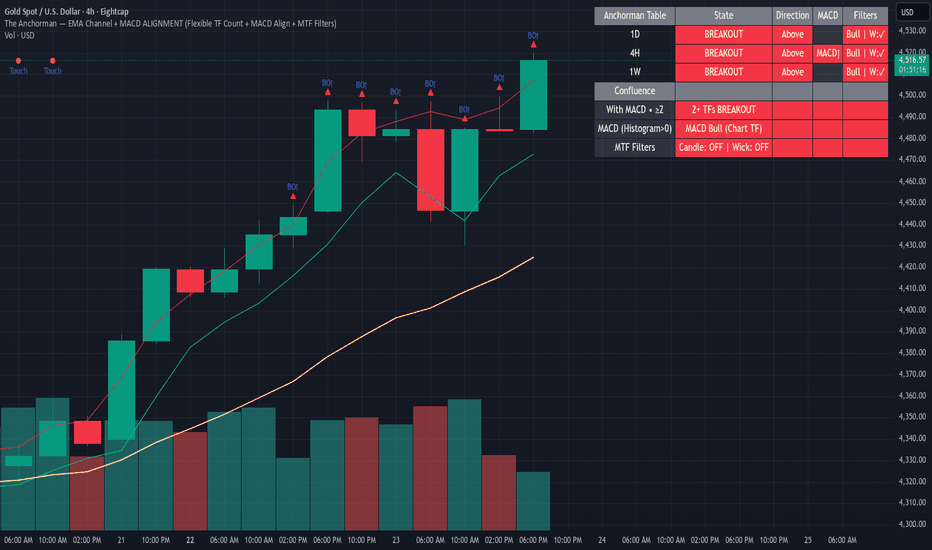

- Confirm breakout strength with bias intensity

- Compare short-term vs long-term volume pressure

Whether you're scalping intraday moves or validating swing setups, this cloud-based volume heatmap offers a clean, modular way to visualize market conviction.

Penunjuk Pine Script®